Wall Street Expert Says Palantir Could Be $1 Trillion Company in 2-3 Years—Is He Right?

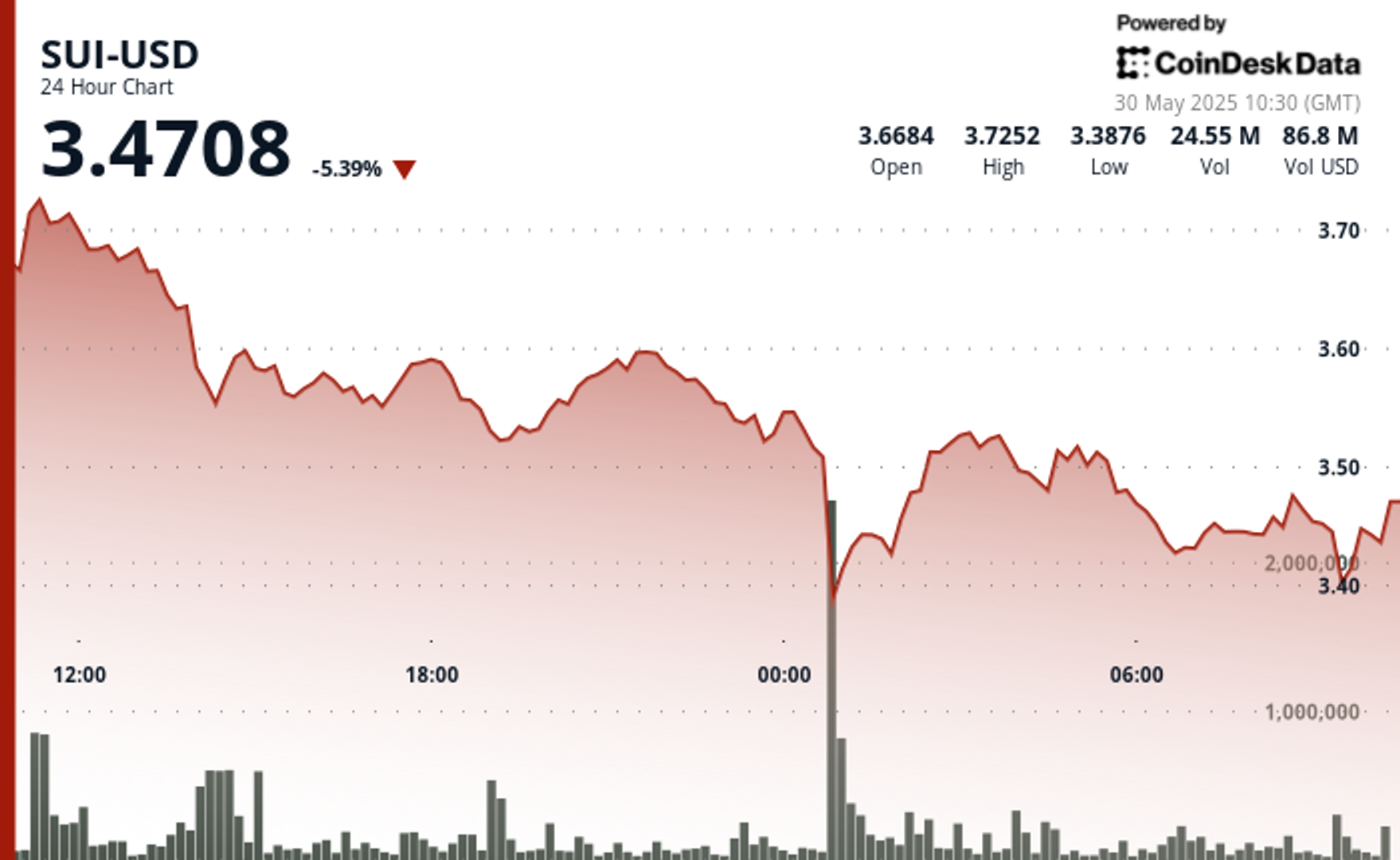

Shares of Palantir (NASDAQ:PLTR) have been remarkably resilient amid the treacherous past few months for the tech sector. With the stock recently coming off a fresh new all-time high, investors may be wondering if the $292 billion big data company has the legs to deliver further multi-bagger gains for investors. Undoubtedly, Palantir is a bit […] The post Wall Street Expert Says Palantir Could Be $1 Trillion Company in 2-3 Years—Is He Right? appeared first on 24/7 Wall St..

Key Points

-

Dan Ives of Wedbush has been right with Palantir so far. Could he be right about the road ahead?

-

A $1 trillion market cap would entail a more than tripling in two to three years.

-

Palantir stock is gaining speed again, now up over 45% in just three months.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Shares of Palantir (NASDAQ:PLTR) have been remarkably resilient amid the treacherous past few months for the tech sector. With the stock recently coming off a fresh new all-time high, investors may be wondering if the $292 billion big data company has the legs to deliver further multi-bagger gains for investors. Undoubtedly, Palantir is a bit of a meme stock of sorts, with many Redditors chasing the name solely because of its blistering momentum.

And while there are sure to be painful corrections (more like crashes) every so often, it’s tough to bet against what Wedbush Securities analyst Dan Ives once referred to as the “Messi of AI.” Indeed, Ives has been the man on Wall Street to listen to, even as doubters raised concerns over PLTR stock’s lofty valuation.

Ever since debuting on the public markets, Palantir has always been an incredibly expensive stock. And while it’s one of the priciest names in the large-cap tech universe today, I’m starting to think that there are enough AI opportunities on the horizon that could justify the seemingly absurd multiple on shares.

In any case, Dan Ives previously stated his belief that Palantir would eventually become a $1 trillion company in two to three years’ time. At the time, such a statement seemed absurd, especially as tech stocks sagged following the infamous Liberation Day tariff unveiling. Given the pace of gains and the near-$300 billion market cap, it’ll only take just north of a tripling for Palantir to join the $1 trillion market cap club, a realistic figure for the next three years or so, at least for the likes of Palantir.

Is Dan Ives’ bold Palantir long-term target realistic?

Just a few weeks ago, it seemed out of reach, especially as CEO Alex Karp sold off a chunk of his shares. Nowadays, it feels like it’s just a matter of time before Palantir joins the likes of Nvidia (NASDAQ:NVDA) and Microsoft (NASDAQ:MSFT) as AI leaders atop the U.S. market. Though I do think many are underestimating the longer-term potential of AI, investors should be cautious when it comes to chasing down hot stocks without putting in more than one’s fair share of due diligence. And while I deeply respect Dan Ives and his firm, I’m not so sure the AI buzz can have the same uplifting effect moving forward.

While the growth trajectory of the AI-driven analytics top dog is undeniably impressive, the valuation is a bit tough to get behind at over $120 per share. At the time of this writing, PLTR stock trades at just shy of 100 times price-to-sales (P/S) and more than 220 times forward price-to-earnings (P/E).

Arguably, the stock could get cut in half twice and still be pretty expensive. Either way, Dan Ives thinks the right drivers are in place to power PLTR to further gains in 2025, with a $140 price target on the name, entailing a modest gain of around 13%.

Palantir’s “unique software approach” could lead to continued gains

Ives and his team cite the company’s “unique AI software approach” as a catalyst as governments aim to “increase efficiency with more software.” I couldn’t agree more. The number of use cases is rapidly expanding. And with that, Palantir will have the means to level up its growth, even as the government trims away at spending.

Arguably, the Trump administration should be doubling down on its business with Palantir and other AI contractors if it’s looking to leverage AI to enhance efficiencies. Time will tell if Palantir will get involved with Trump’s proposed “Golden Dome” missile defense system. If Palantir inks a contract, perhaps another driver could help rocket PLTR to even greater heights. Furthermore, I’d look for non-government contact wins to start generating investor enthusiasm. The company’s recent partnership with Fannie Mae for work on AI to “proactively” identify mortgage fraud, I believe, is a big deal.

All considered, Palantir is one of the most exciting names in AI software. But with a valuation that’s becoming tough to get behind, I’d much rather wait for a near-term pullback before jumping in. As for Palantir hitting the $1 trillion milestone in two to three years, I wouldn’t bet against such a thing from happening if the right cards fall into place. At the same time, expect a choppy road to the milestone and amplified damage if we’re dealt another tech-focused market sell-off.

The post Wall Street Expert Says Palantir Could Be $1 Trillion Company in 2-3 Years—Is He Right? appeared first on 24/7 Wall St..