Veteran fund manager offers blunt take after Nvidia stock drop

Here's what could happen to Nvidia shares next.

The artificial intelligence spending frenzy has catapulted Nvidia's share price and turned Nvidia into a household name akin to Google and Apple.

There's been a tsunami of interest in AI research and development following the highly successful launch of OpenAI's ChatGPT in 2022, and, as a result, demand for Nvidia's high-end semiconductors, which are better suited to handling the heavy workloads associated with training and operating AI programs than CPUs traditionally found in networks, has ballooned.

Investors have profited handsomely from the revenue and profit growth. Nvidia's stock price has gained a remarkable 660%, including a 171% return in 2024, since 2022.

Related: AI CEO issues grave warning about the future of Nvidia

Those returns have been game-changing for many, but it's been much rockier in 2025. Shares are down 25% since their peak on January 6 on worries demand for its next generation graphics chips are peaking.

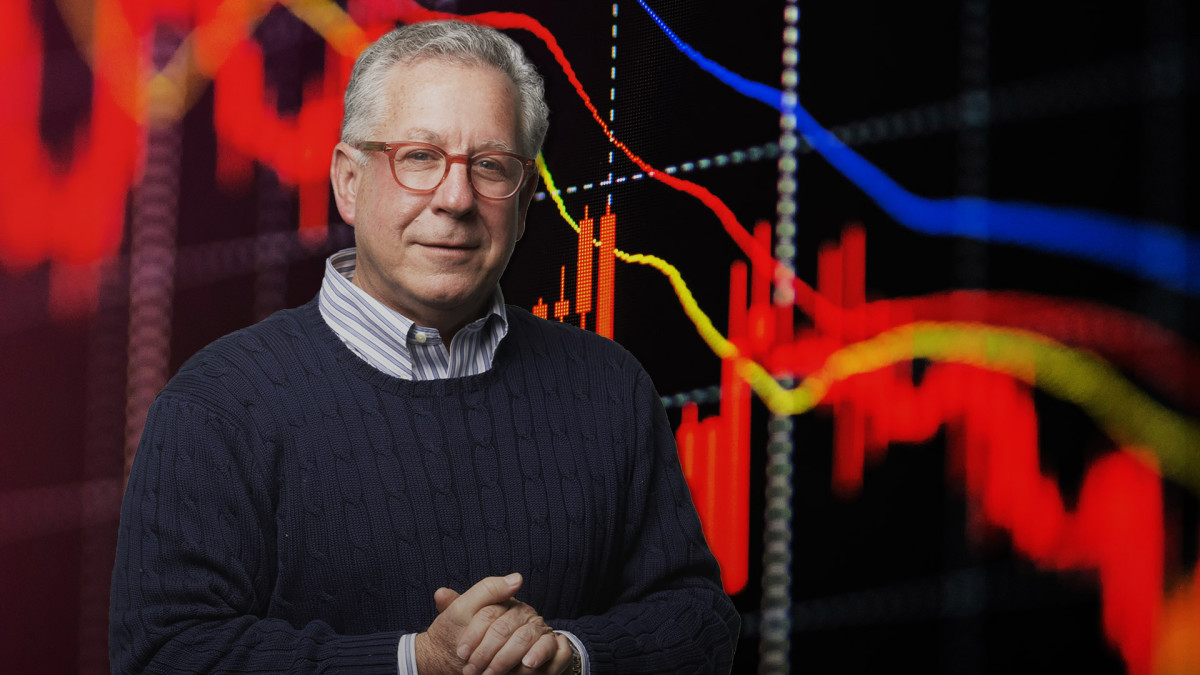

Nvidia's drop has surprised a lot of investors, but long-time Wall Street hedge fund manager Doug Kass isn't among them.

In December, Kass predicted Nvidia's rally would "abruptly end" in 2025 as "it grows clear that double and tripling ordering buoyed the company's past reported top and bottom lines."

Kass's prescient prediction stems from experiencing more than his share of good and bad markets over a 50-year career, including as research director for Leon Cooperman's Omega Advisors.

He's seem plenty of great stocks come and go over the years, making his latest words on Nvidia's stock worth considering. TheStreet

Nvidia benefits from massive AI-driven demand

Artificial intelligence isn't a new concept. The prospect of computers thinking for themselves has been the subject of conversation since mathematician and computer scientist Alan Turing researched designing AI computers and the Rand Corporation created the first AI program in 1950s.

Related: Fund manager who correctly predicted stocks rally delivers blunt 8-word update

Many science fiction books and movies, from Isaac Asimov's iRobot to The Terminator and others, have explored AIs risks and benefits over the past 70 years.

However, only recently has AI's impact on people and business gone mainstream thanks to ChatGPT and the success of competing large language models, including Alphabet's Gemini.

Banks like JP Morgan Chase are using AI to hedge risks, drugmakers are examining its use in developing medicines, retailers are evaluating whether it can curb theft and improve supply chains, and militaries are exploring AI's use on the battlefield.

Every day, millions of Americans are turning to AI chatbots to answer questions and succinctly explain topics, and increasingly, businesses are deploying agentic AI programs to complement or replace workers.

To tap into increasing use, big technology companies are plowing incredible sums into IT budgets. For instance, Microsoft, Google, and Amazon capital expenditures were $192 million last year, up from $117 billion in 2023.

A lot of those extra dollars went to Nvidia to access its software and graphic processing units, or GPUs. Sales of H100, H200, and the latest Blackwell AI chips have catapulted annual revenue to over $130 billion (up 114% year-over-year) from $27 billion in 2023. Meanwhile, net income has increased to nearly $73 billion from less than $5 billion in 2023.

Nvidia encounters speed bumps in 2025

Nvidia markets its AI chips globally, but a key market, China, has shrunk following strict export regulations designed to limit the sale of next-gen technology from U.S. companies to potential rivals overseas.

China represents about 10% Nvidia's data center sales, and according to CEO Jensen Huang, that's "about half of what it was before the export control."

Nvidia is also facing competition, including from Advanced Micro Devices and specially designed chips made by Broadcom and others.

More Nvidia:

- Nvidia stock: The AI tailwind could just be getting started

- Nvidia stakes out aggressive future, despite investor unease

- AI bet from tech upstart could be a major blow to Nvidia

In 2024, AMD's data center segment sales totaled a record $12.6 billion, prompting CEO Lisa Su to say, "Looking into 2025, we see clear opportunities for continued growth based on the strength of our product portfolio and growing demand for high-performance and adaptive computing.”

Su has predicted the AI-GPU market will grow by an average of 73% annually to $400 billion through 2027.

Another concern is that Nvidia demand is inflated by companies over-ordering in hopes of getting allocated hard-to-get chips.

And worry is mounting that overbuilding capacity will become increasingly evident following the launch last month of DeepSeek, a Chinese ChatGPT rival that was reportedly developed using older chips for just $6 million.

If those concerns weren't enough, Nvidia's profit margin has recently been pressured by ramping capacity of its latest Blackwell chips. In the fourth-quarter, gross margin shrunk to 73% from 76% a year earlier.

Veteran fund manager offers blunt warning

Kass considers himself a "contrarian with a calculator." He's most comfortable buying stocks when others are selling.

Despite Nvidia's poor performance this year, he still thinks there may be more pain to come.

"People are buying four times more infrastructure than they need. The better the GPU, the higher the failure rates and this fragility causes significant cluster under-performance with high cost," wrote Kass in his TheStreet Pro diary.

Kass's research suggests Nvidia's solution to failure rates is buying more to compensate, a strategy that certainly doesn't sound overly sound.

"This stuff is incredibly expensive and not working right (obviously) and NVDA is just resorting to – “BUY MORE OF WHAT AIN'T WORKING!” There is massive negative return on investment to the current architecture; how does spending more money solve that problem?," said Kass.

If Kass is correct that hyperscalers like Amazon and Microsoft have been investing too greedily in AI capacity, then it wouldn't be shocking if there's a major reset in IT budgets, and that wouldn't be good news for Nvidia.

Adding to that concern are recent reports that Microsoft, one of the largest hyperscalers, is reining in some of its data center projects. According to TD Cowen, Microsoft has cancelled or deferred data center leases on capacity concerns.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast