Veteran analyst sends surprising message on stocks, bonds, and gold

A big opportunity may be near, but it's not what you think.

The stock market rally has been impressive.

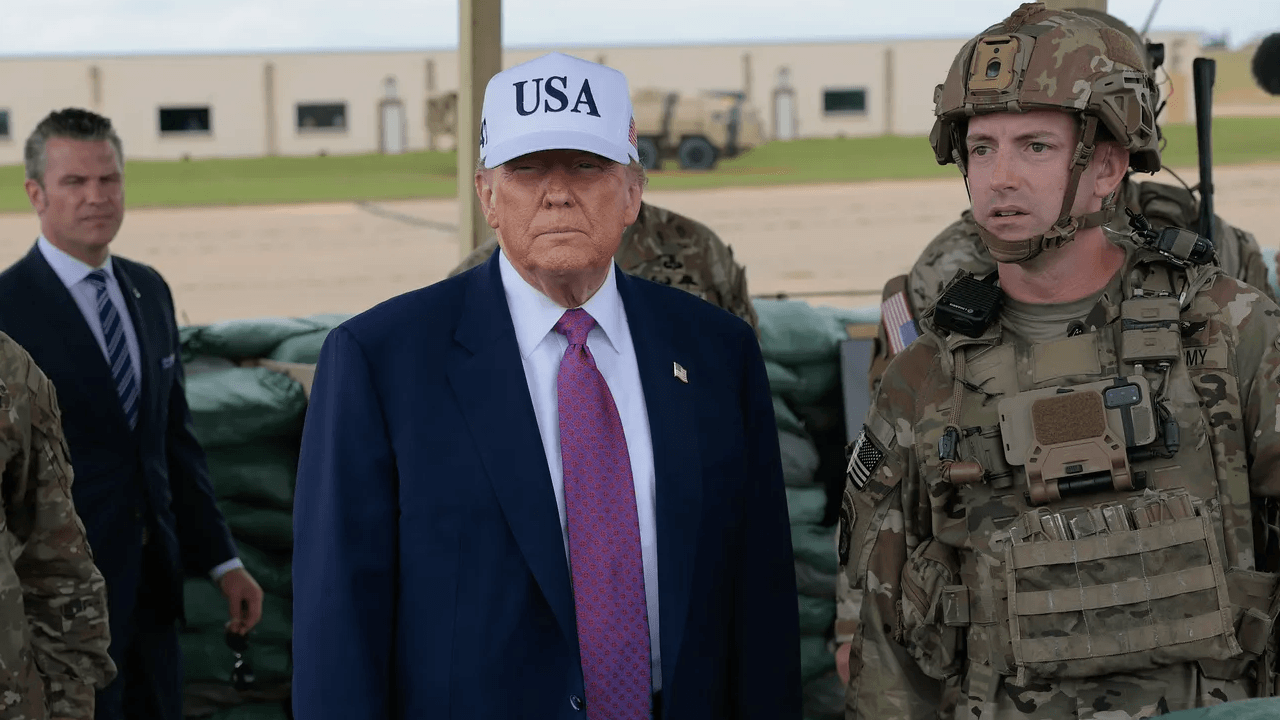

Since President Donald Trump paused most reciprocal tariffs on April 9, only days after announcing them, stocks have soared. The S&P 500 has gained about 20%, while the tech-stock heavy Nasdaq Composite is up 27%.

Those returns in such a short span significantly outpace the average 10% annual return for stocks since 1928.

Stocks haven't been the only winner. Gold has also notched impressive returns this year. The yellow metal has rallied 30% in 2025 as investors have sought to insulate risk amid growing economic concerns surrounding debt and the impact of tariffs on inflation.

Related: Legendary fund manager sends blunt 3-word message on economy

The one big disappointment this year: Treasury bonds. They've tumbled, sending bond yields soaring, as global investors have soured on financing America's insatiable appetite for spending.

The market action has captured the attention of many, including veteran commodities and futures analyst Carley Garner. Garner has been professionally navigating these markets for twenty years, and her track record includes accurately predicting the stock rally in 2023 and last year's decline in oil prices.

Garner updated her outlook on stocks, gold, and bonds, and her takeaway may surprise you.

Stocks, gold climb 'wall of worry' as Treasury bonds tumble

Stocks' rally since the lows in early April likely surprised many, given significant economic risks remain.

While inflation has retreated below 3% from over 8% in 2022, price increases over the past years have cash-strapped consumers, causing them to shift spending from discretionary purchases to essentials.

Related: Bank of America unveils surprising Fed interest rate forecast for 2026

The problem has been compounded by an uptick in unemployment, which has increased to 4.2% from 3.4% in 2023, partly due to higher interest rates designed to crimp inflation.

According to Challenger, Gray, & Christmas, U.S. companies have laid off 696,309 workers this year through May, up 80% from one year ago.

The situation isn't likely to get much better for workers. While Trump paused many reciprocal tariffs in April, key tariffs remain, including a 25% tariff on Canada and Mexico and autos, a 10% tariff on all imports, and 30% tariff on China (total tariffs on China, including those put in place during President Trump's first term exceed 50%).

The remaining tariffs, and potential for more after the 90-day pause expires, could fuel inflation later this year, particularly in retail, which sources everything from clothing to electronics from overseas.

The risk of inflation alongside job losses suggests America could go headlong into a period of stagflation or recession.

Despite those risks, the S&P 500 and Nasdaq Composite have notched remarkable gains. Investors who quickly sold amid tariff announcements earlier this year have been left behind, and as a result, they're buying every dip to regain their exposure.

One major exception? Warren Buffett.

The Oracle of Omaha has increased Berkshire Hathaway's cash position, choosing to collect guaranteed fixed income from T-bills rather than leap back into the stock market amid the uncertainty.

Exiting the first quarter, Warren Buffett's cash stockpile eclipsed $347 billion, a record, and more than double the levels exiting 2023.

Long-time analyst turns attention to beat-up bonds, away from stocks, gold

The rallies in stocks and gold may continue, but like Buffett, Carley Garner doesn't see the risk-to-reward as overly compelling in stocks. She's also become bearish on gold relative to bonds, given that gold has moved significantly higher and, unlike bonds, doesn't pay dividends.

"While I believe the S&P 500 can easily reach 6300 to 6400, the downside risk might be outsized relative to the potential reward," wrote Garner on TheStreet Pro. "Since 1928, the S&P 500 has returned an average annual rate of 10%; however, in recent years, the average return has been abnormally high, at approximately 14%. There is a good chance that, like the dot-com era, we have pulled forward gains and could be on the verge of a “returnless” market in the coming years."

Garner points to a key measure favored by Warren Buffett regarding stock market valuation as evidence that stocks are over their skis.

More Experts:

- Fed official sends strong message about interest-rate cuts

- Billionaire fund manager sends surprising message on trade deficit

- Hedge-fund manager sees U.S. becoming Greece

"The Warren Buffett Indicator measures the total stock market value vs. the GDP," wrote Garner. "Since 1950, the stock market has only been this overstretched a few other times. Not surprisingly, the dot-com bubble was one of those times. Historically, this indicator has not been the time to hit the gas on risk assets. It has been the opposite."

The arguable overvaluation of stocks could mean the risk of a reckoning is high enough to concentrate on other assets. However, gold may not be the best bet, given it's already made a big move higher.

Instead, it's Treasury bonds that Garner believes offer the best chance for upside.

"There is only one [of these assets] near a two-decade low in valuation: Treasuries," writes Garner. "Except for some forms of real estate, it is the only asset that yields an attractive income stream. Lastly, Treasuries are the least risky asset class in the world but the market is treating the securities as anything but."

Garner points out that people were flocking to own bonds with paltry yields only five years ago. Now, they're shunning yields near 4.5%.

Many are hesitant to own bonds despite the high yields, fearing that bonds will continue to drop, sending yields even higher, as the US debt load rises.

While it's true that lower bond values could mean short-term losses, Garner views the risk of a US default as unlikely, suggesting that those holding Treasuries to maturity will be fine, and pocket healthy income along the way.

"Historically, there have been two other instances in history when stocks were as overvalued as they are now relative to bonds. Or, alternatively, bonds were this undervalued relative to stocks," wrote Garner. "Such opportunities have only arisen once every two decades, and they have proven to be significant inflection points in both stocks (the beginning of prolonged underperformance) and bonds (the start of a period of capital gains to enhance interest earned). This metric has been similarly favoring bonds since the initial collapse in 2023, so instant satisfaction shouldn’t be expected, but patience will likely pay off."

Related: Veteran fund manager issues dire stock market warning