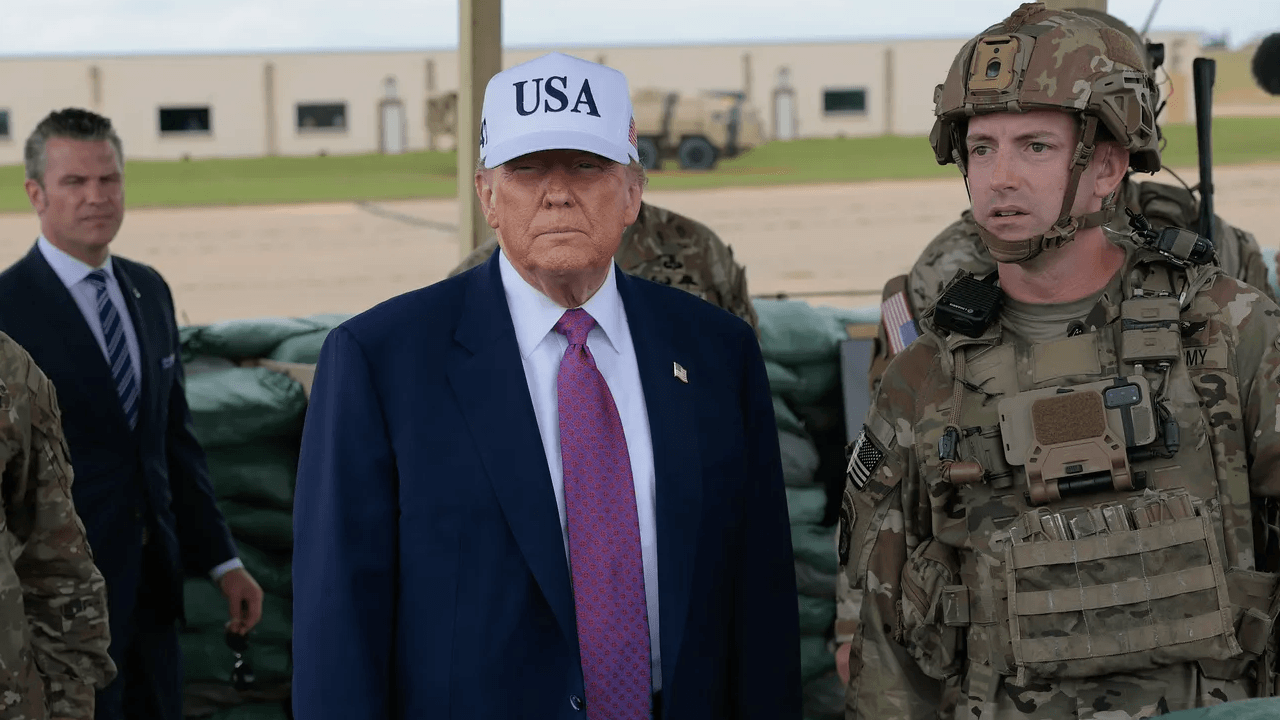

Trump's Bill Would End EV Subsidies: Could This Kill Tesla?

Billionaire Elon Musk is fighting to make sure federal tax incentives for electric vehicles (EVs) -- a key subsidy that makes buying EVs more affordable -- remain in place. President Donald Trump's new bill seeks to eliminate these tax incentives, which would otherwise be in place until 2032. Musk's company Tesla (NASDAQ: TSLA) has already seen sales struggle to grow across many key geographies. Deliveries last quarter fell by 32% quarter over quarter, and by 13% year over year. Could the elimination of EV tax credits be a lethal blow to the struggling automaker? You might be surprised by the answer. When it comes to potential regulation "killing" an operating business like Tesla, the first thing investors must consider is the effect on sales growth. Already, demand growth has been stagnating for Tesla. And while the company has teased new potential revenue sources like its robotaxi venture, there aren't many high-visibility milestones ahead that will meaningfully boost revenue over the next year or two. Analysts expect the company to refresh its existing lineup, but details are scarce on releasing any brand new models in 2025 or 2026. Even if a new model is released, it's unlikely that production will scale meaningfully over the next 12 to 24 months. Continue reading

Billionaire Elon Musk is fighting to make sure federal tax incentives for electric vehicles (EVs) -- a key subsidy that makes buying EVs more affordable -- remain in place. President Donald Trump's new bill seeks to eliminate these tax incentives, which would otherwise be in place until 2032.

Musk's company Tesla (NASDAQ: TSLA) has already seen sales struggle to grow across many key geographies. Deliveries last quarter fell by 32% quarter over quarter, and by 13% year over year. Could the elimination of EV tax credits be a lethal blow to the struggling automaker? You might be surprised by the answer.

When it comes to potential regulation "killing" an operating business like Tesla, the first thing investors must consider is the effect on sales growth. Already, demand growth has been stagnating for Tesla. And while the company has teased new potential revenue sources like its robotaxi venture, there aren't many high-visibility milestones ahead that will meaningfully boost revenue over the next year or two. Analysts expect the company to refresh its existing lineup, but details are scarce on releasing any brand new models in 2025 or 2026. Even if a new model is released, it's unlikely that production will scale meaningfully over the next 12 to 24 months.