Trump court loss gives investors something to cheer about

This time the trade wasn't 'TACO' (Trump Always Chickens Out) but 'CAST' (Courts Also Stop Trump).

- Investors cheered the decision by the U.S. Court of International Trade in New York to block large swathes of U.S. President Donald Trump’s tariff program. Markets rose around the globe, but especially in the U.S. as Nvidia’s hot earnings helped lift spirits.

This time it wasn’t U.S. President Donald Trump who backed off his tariff threats. It was three federal judges in New York who forced him to.

Investors celebrated yesterday evening’s decision from the U.S. Court of International Trade to invalidate Trump’s ‘Liberation Day’ tariffs by bidding up U.S. assets in a way not seen since… well, Tuesday, after Trump backed off his threat of a 50% tariff on EU goods.

Markets rose around the globe Thursday morning, but especially in the U.S.

In Asia, Japan’s Nikkei jumped 1.9%, while Hong Kong’s Hang Seng rose 1.4%, and the Shanghai exchange was up 0.7%.

Europe’s Stoxx 600 got in on the action too, albeit more calmly, with a 0.2% rise in early trading.

U.S. futures soared, however. S&P 500 futures rose 1.2% in pre-market trading, while Dow futures rose a more modest 0.6%. Nasdaq futures led the way, rising 1.7% with a little help from Nvidia, which jumped over 6% pre-market—and sparked a chips rally— after its better-than-expected earnings report Wednesday evening.

It’s quite possible that this rally will be as short-lived as Tuesday’s ‘TACO‘ (Trump Always Chickens Out) runup, Wall Street warns. The Trump administration has already appealed the court’s decision, and it had plenty of other levers to use to put more tariffs in place.

And, UBS’s global chief economist Paul Donovan warns, the damage may already be done.

“For now, the court ruling lifts a significant tax burden from U.S. consumers and companies,” he said Thursday morning in a note seen by Fortune. “However, the main outcome is uncertainty. The decision will be appealed; the Supreme Court may again prefer Trump to precedent.

“Trump may use other legislation to reimpose taxes. Existing trade negotiations (and the UK’s non-binding trade agreement) are questioned—why talk seriously if the U.S. stance is unclear? Perhaps most important, why would companies invest or hire in the U.S. when taxes on their supply chains and on their customers’ spending power remain unclear?”

Here’s a snapshot of today’s action prior to the opening bell in New York:

- The S&P 500 fell 0.6% Wednesday. The index is up 0.1% YTD.

- S&P futures were trading up 1.5% this morning.

- The Stoxx Europe 600 was up 0.3% in early trading.

- Asia was up: Japan was up 1.9%. Hong Kong rose 1.4%. Shanghai was up 0.7%, and India’s Nifty 50 rose 0.3%.

- Nvidia boomed pre-market after it’s better-than-expected earnings report Wednesday evening. Nvidia rose over 6% before the opening bell, sparking a chips rally.

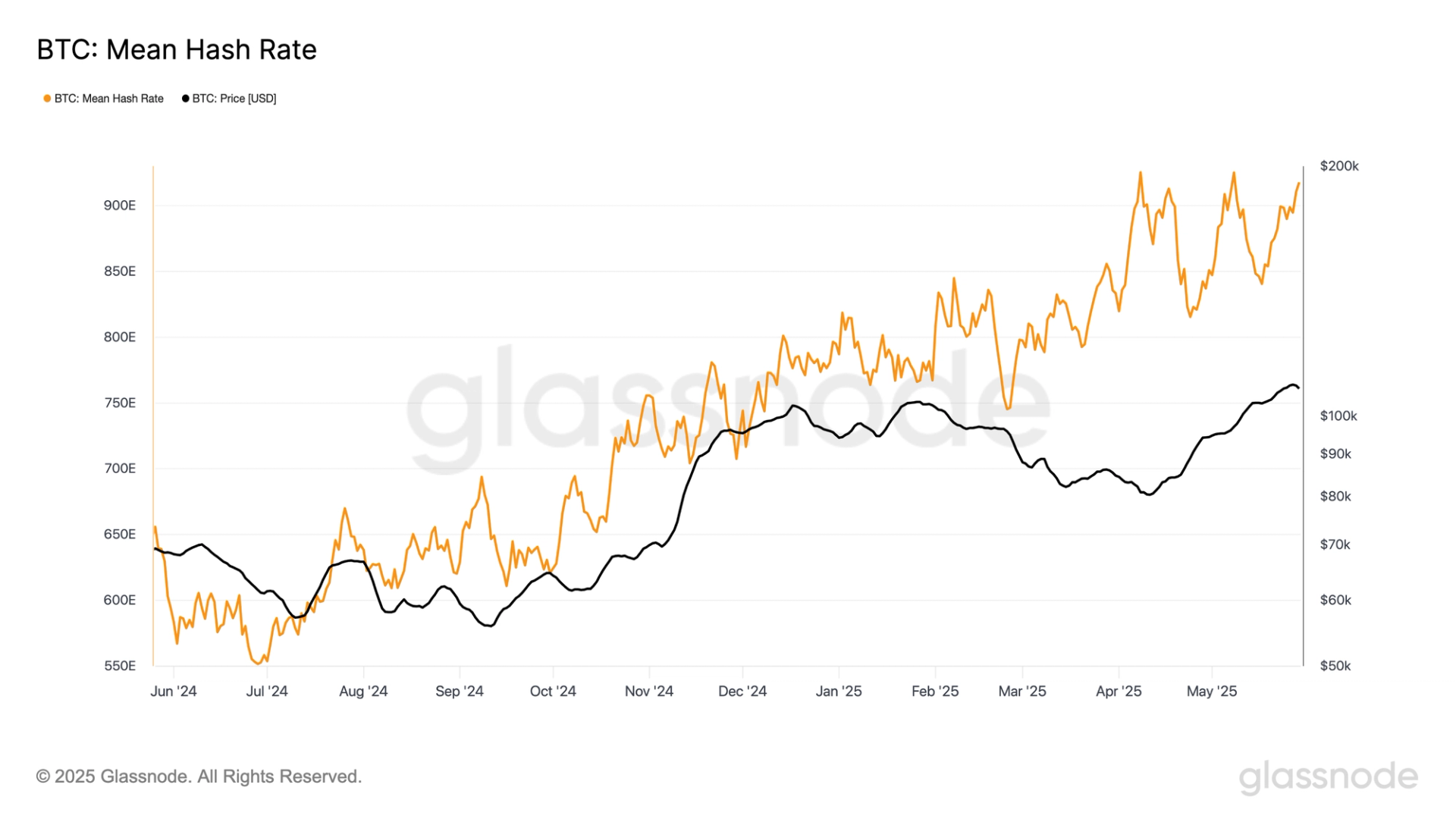

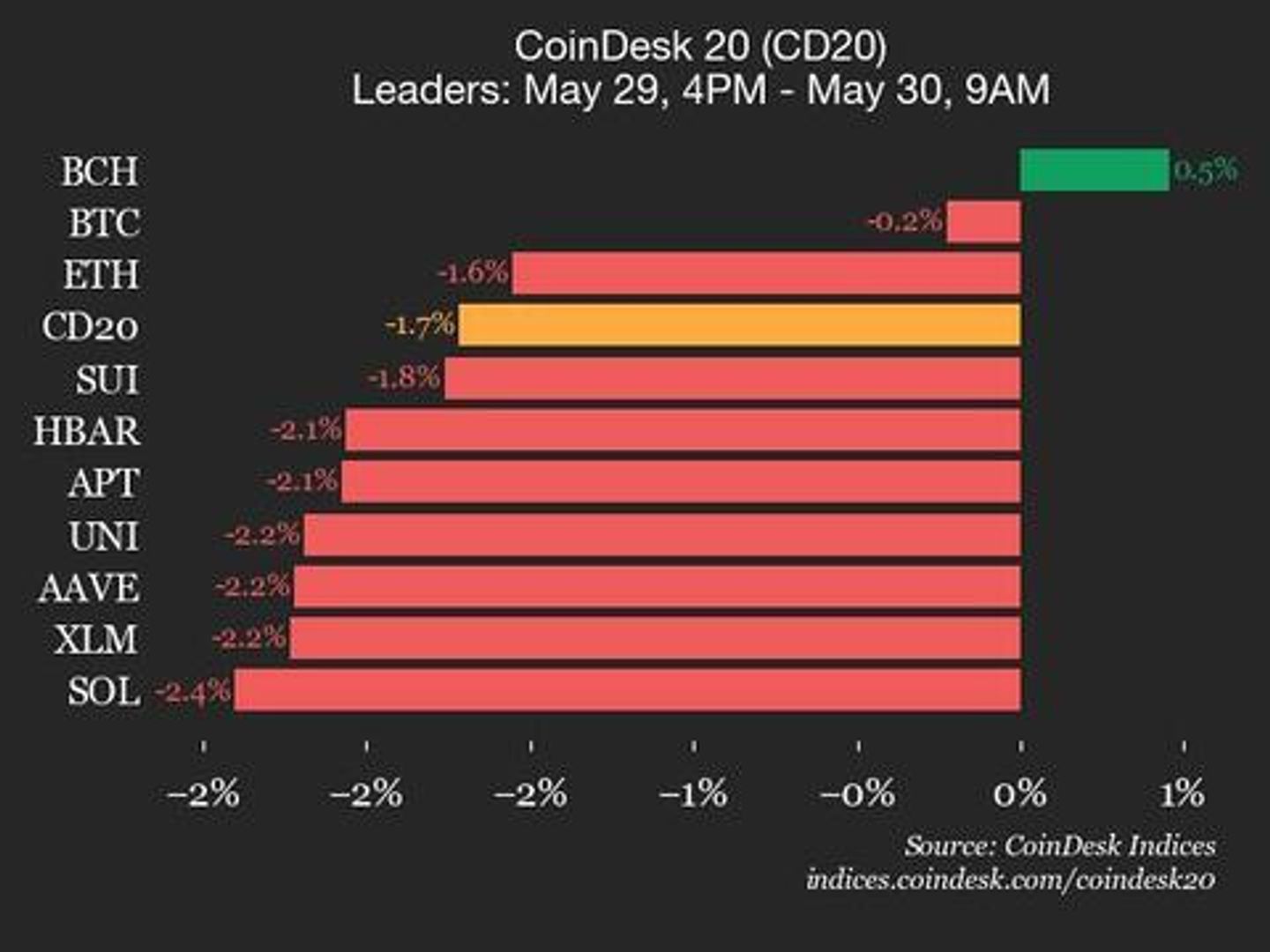

- Bitcoin was sitting up at $108,700 this morning.

This story was originally featured on Fortune.com