This is What You Should Have Saved by 65

If you’re nearing the age of 65, you’re about to hit a major life milestone. Congratulate yourself for endearing all the challenges over the years (and hopefully some wonderful moments, too). By our mid-60s, many of us are preparing to retire. Knowing how much money you should have in the bank before your golden years […] The post This is What You Should Have Saved by 65 appeared first on 24/7 Wall St..

If you’re nearing the age of 65, you’re about to hit a major life milestone. Congratulate yourself for endearing all the challenges over the years (and hopefully some wonderful moments, too). By our mid-60s, many of us are preparing to retire. Knowing how much money you should have in the bank before your golden years is critical for future financial peace of mind. Everyone’s situation is different, but general savings benchmarks provide a guideline.

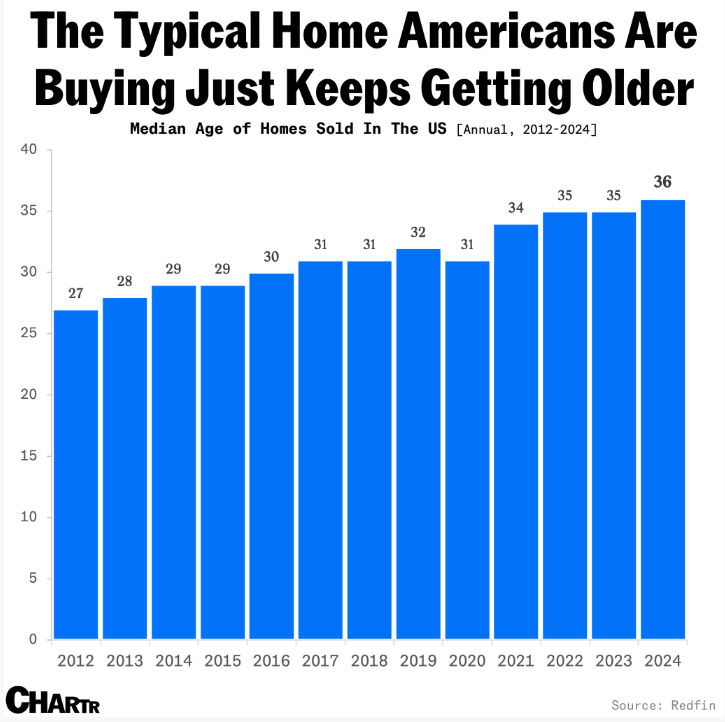

A great deal of wealth lies in home equity, leading people to rely on this investment for their retirement. But we have to remember that our home, while valuable in its own way, will not help you with expenses day-to-day. To retire in a comfortable manner, it’s important to have accessible money in the form of savings accounts, 401(k)s, and the like.

24/7 Wall St put together this slideshow to provide a general overview of savings, including how much you should reasonably have set aside and ways to help plan for your future. Check out these steps to see how they can help.

How Much Should You Gave Saved by 65?

- As retirement nears, knowing your savings target is essential.

- Financial benchmarks based on income help you plan effectively.

- For many, home equity is valuable but not easily accessible.

Home Equity Isn’t Enough

- Home equity is often a big part of net worth, but it’s not liquid.

- Liquid savings offer flexibility for everyday and emergency costs.

- Don’t rely solely on your house for retirement security.

Savings Benchmarks at 65

- Edward Jones says a 65-year-old earning $100K should aim for $1.05M–$1.21M.

- For $200K earners, the target rises to $2.77M–$3.17M.

- These figures assume retirement at 65 and living to 92.

Why These Numbers Matter

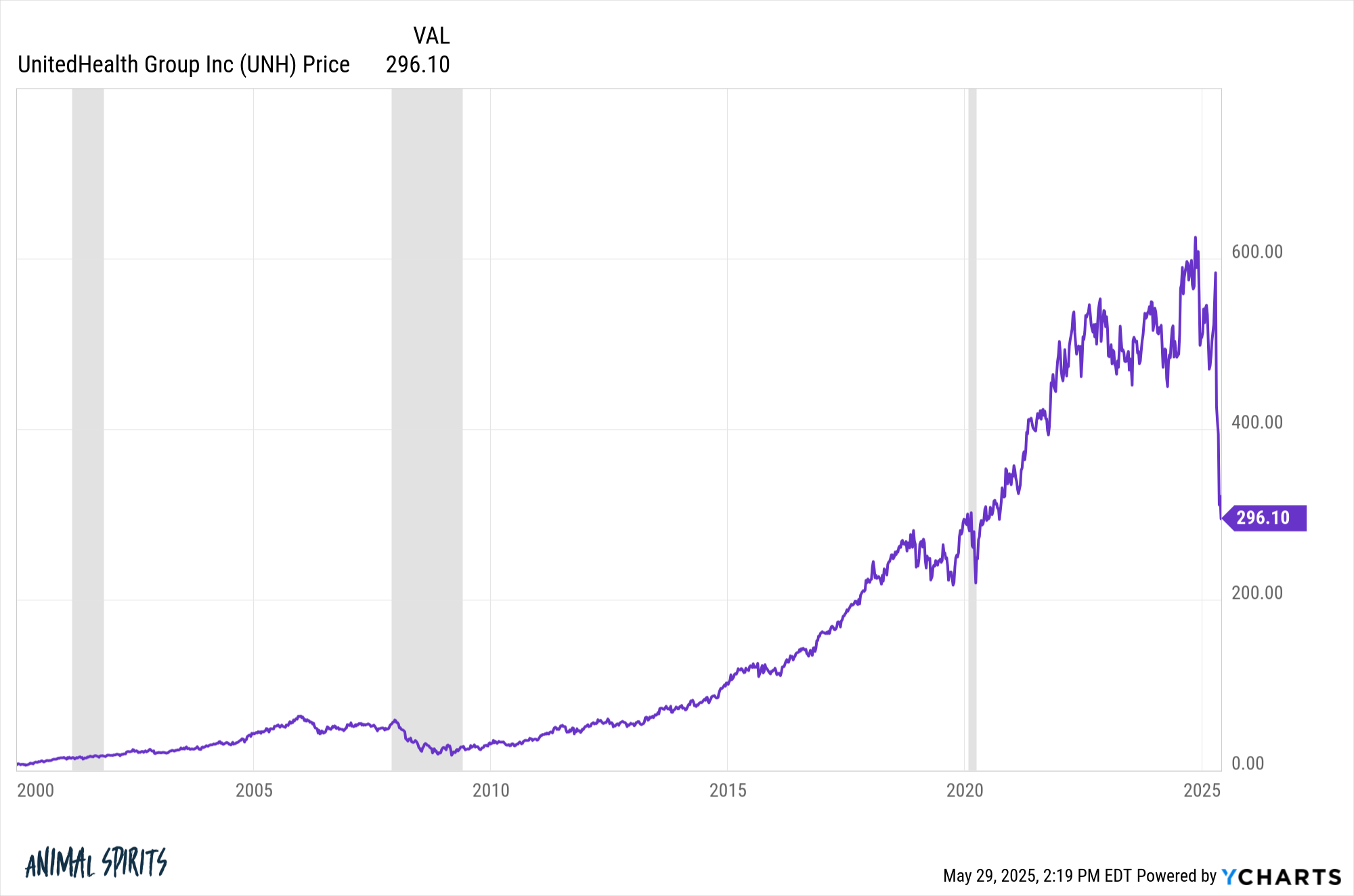

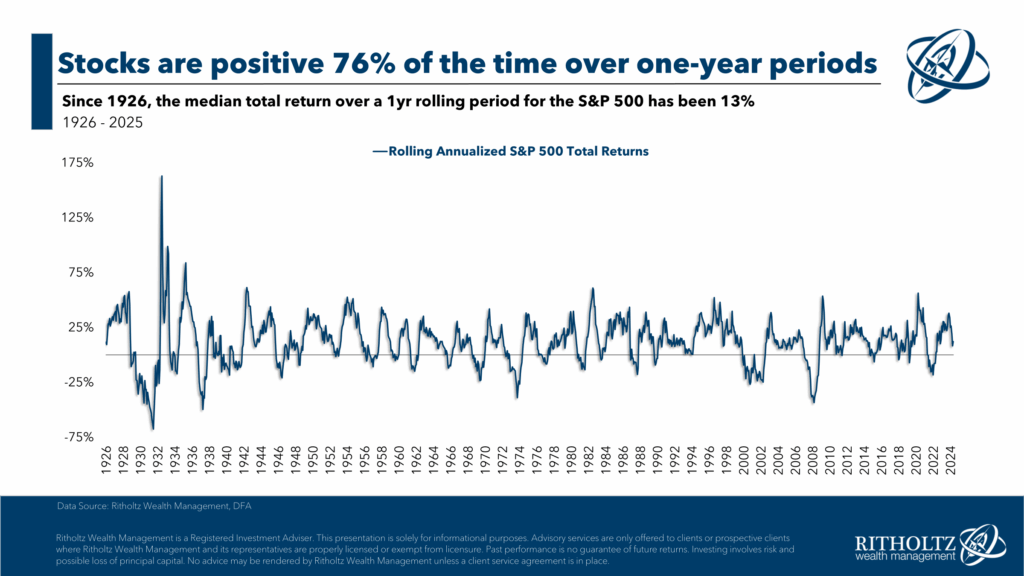

- Retirement savings must account for inflation, healthcare, and market changes.

- Planning with these variables in mind helps preserve your lifestyle.

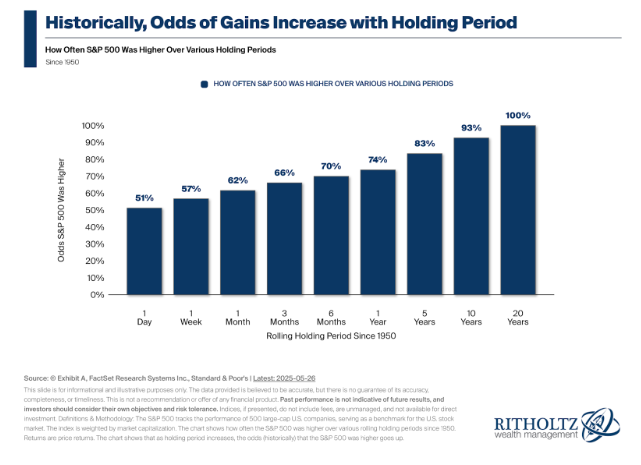

- Strategic investments are key to long-term success.

Falling Behind? Here’s What to Do

- Use catch-up contributions: $7,500 extra in 401(k)s, $1,000 in IRAs after age 50.

- Reduce discretionary spending to boost savings.

- Consider working longer or delaying Social Security for higher benefits.

How Delaying Retirement Helps

- Each year you delay Social Security past full retirement age boosts benefits 8%.

- Working longer means more savings and fewer retirement years to fund.

- It can significantly reduce financial pressure.

If You’re Ahead of the Curve

- Keep investing strategically across diversified assets.

- Consider Roth conversions to reduce future tax burdens.

- Look into HSAs and tax-efficient accounts for added flexibility.

Long-Term Wealth Strategies

- Update estate plans and consider long-term care insurance.

- Protect your wealth for future generations.

- Advanced planning can preserve both money and peace of mind.

Work with a Financial Advisor

- Whether you’re ahead or behind, professional advice pays off.

- Advisors help tailor strategies to your specific goals.

- Avoid guesswork and gain financial confidence.

Take the Retirement Ready Quiz

- SmartAsset’s free quiz matches you with financial advisors in minutes.

- Over 50,000 people per month use it to plan their future.

- Start now and build a path to a secure retirement.

The post This is What You Should Have Saved by 65 appeared first on 24/7 Wall St..