This Is the Cardinal Sin Warren Buffett Says Investors Should Avoid

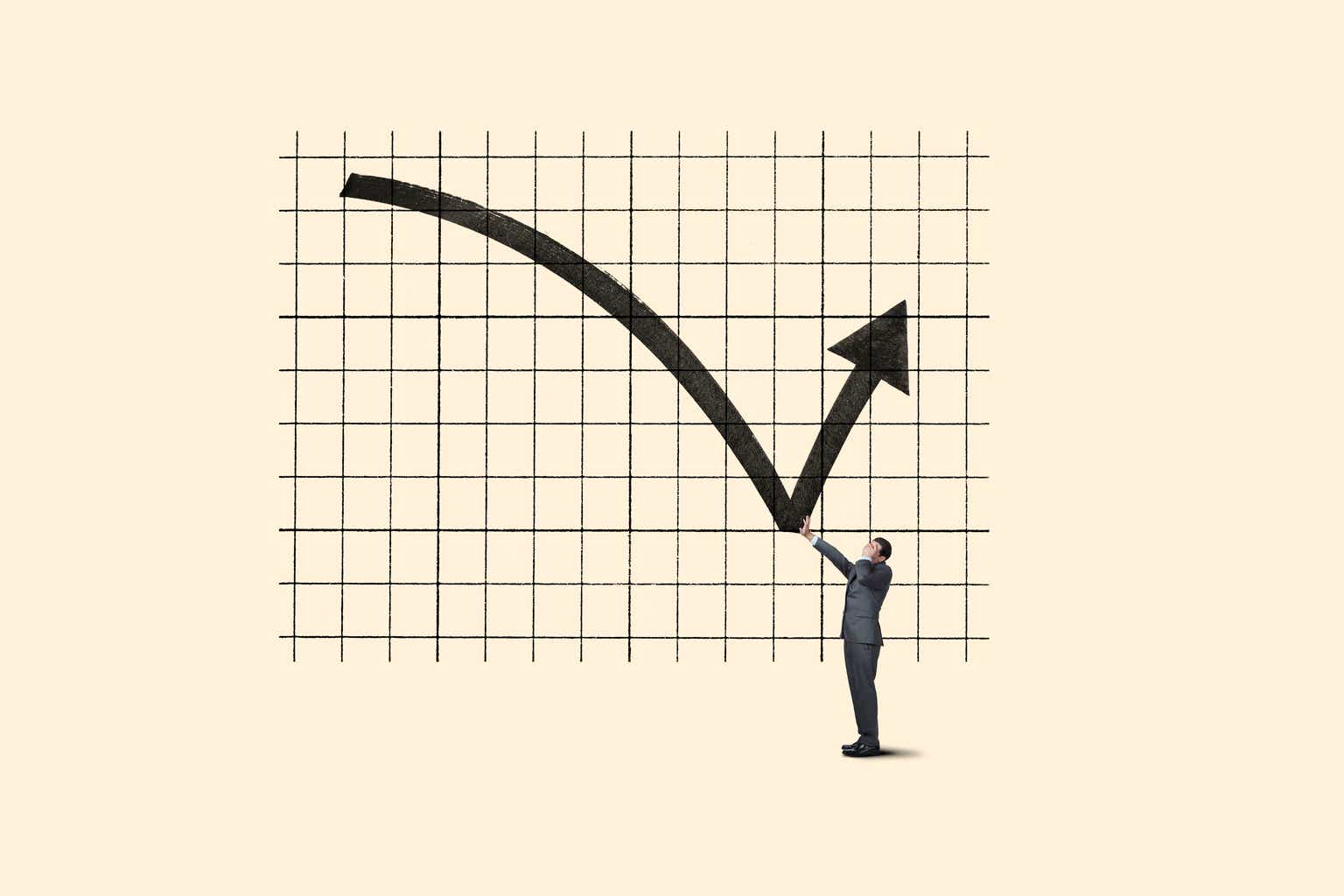

If you're picking individual stocks, it's inevitable that you are going to pick some poorly performing investments. Not all your stocks are going to be winners. Things can happen unexpectedly that impact a stock, whether it's the business's own doing or broader macroeconomic conditions. This year, for instance, many stocks are struggling due to tariffs, which are out of their control.Billionaire investor Warren Buffett believes there's one particularly bad, "cardinal sin" that investors should avoid. Doing this is not only a waste of time but also a waste of money. This is a lesson he learned from the late Charlie Munger.There's nothing more discouraging for investors than to lose money on a stock that they thought had plenty of upside and room to grow. Continue reading

If you're picking individual stocks, it's inevitable that you are going to pick some poorly performing investments. Not all your stocks are going to be winners. Things can happen unexpectedly that impact a stock, whether it's the business's own doing or broader macroeconomic conditions. This year, for instance, many stocks are struggling due to tariffs, which are out of their control.

Billionaire investor Warren Buffett believes there's one particularly bad, "cardinal sin" that investors should avoid. Doing this is not only a waste of time but also a waste of money. This is a lesson he learned from the late Charlie Munger.

There's nothing more discouraging for investors than to lose money on a stock that they thought had plenty of upside and room to grow.