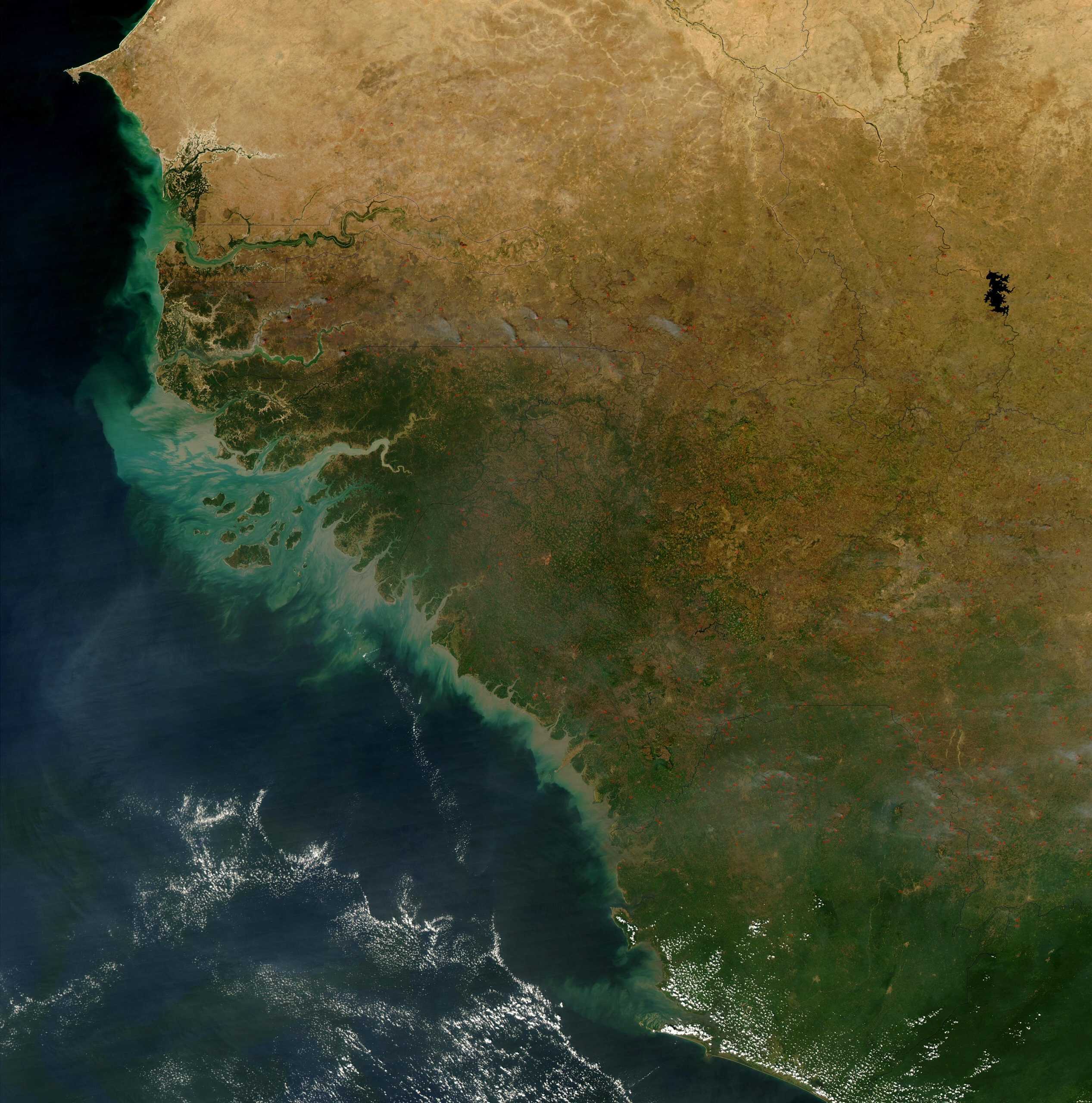

These Are The Key Strategic Areas Where China Is Building Overseas Ports

24/7 Wall St. Insights Chinese overseas investment outranks the U.S. by a factor of 10. Since 2000, China has funded the construction or expansion of at least 78 ports in 46 countries. While the Belt and Road Initiative is commercial in nature, critics worry China is laying the groundwork for future naval bases. Also: Discover […] The post These Are The Key Strategic Areas Where China Is Building Overseas Ports appeared first on 24/7 Wall St..

24/7 Wall St. Insights

- Chinese overseas investment outranks the U.S. by a factor of 10.

- Since 2000, China has funded the construction or expansion of at least 78 ports in 46 countries.

- While the Belt and Road Initiative is commercial in nature, critics worry China is laying the groundwork for future naval bases.

- Also: Discover the next Nvidia

Over the past 10 years, no country has invested more in the rest of the world than China. Since commencing its Belt and Road Initiative in 2013, China has invested over $950 billion in infrastructure and other development projects over 140 countries, building roads and railways, cultivating energy supplies, and expanding its influence across the globe.

International ports are one of the largest and most controversial sectors of Chinese overseas spending. Over the last decade, China has invested more than $30 billion in overseas port development, allowing China to gain a critical foothold in key geopolitical hotspots. While the investments have spurred economic development in host countries and improved infrastructure around the world, they have also raised concerns about sovereignty and debt sustainability. Critics argue that many of the more vulnerable recipient countries risk falling into debt traps that may force them to cede strategic assets to China in order to repay loans, bolstering the Red Dragon’s global naval power. A closer look at the data reveals the key ports where overseas investment is allowing China to gain a strategic military foothold.

To determine the key strategic areas where China is building overseas ports, 24/7 Wall St. reviewed data on development projects financed by China in foreign countries from AidData, a research lab at the College of William & Mary. Ports were ranked based on the total, inflation-adjusted value of development projects funded by the Chinese government and state-owned institutions from 2000 to 2021.

Financial values were converted from original currencies to constant 2021 U.S. dollars and aggregated according to AidData recommendations. Supplemental data on primary investment sector and the largest project by amount invested were calculated from the AidData dataset. Investment per capita was calculated using population averages from 2000 to 2021 from the World Bank.

20. Beira Fishing Port (Mozambique)

- Funding commitment, 2000 to 2021: $45.4 billion

Beira’s upgrades were supported through Chinese development loans. While modest in scale, the port helps extend China’s presence along the Indian Ocean coast. It serves more of a commercial than strategic role

19. Port of Santiago de Cuba (Cuba)

- Funding commitment, 2000 to 2021: $45.4 billion

China funded refurbishments to Santiago’s port, where the PLAN has made past visits. Cuba’s political alignment with China and regional proximity to the U.S. make it a symbolic investment. Its military utility remains speculative.

18. Nouadhibou Fishing Port (Mauritania)

- Funding commitment, 2000 to 2021: $45.4 billion

Three loans supported Nouadhibou’s construction, spearheaded by a Chinese military-affiliated fishing company. Though small, the port illustrates China’s wide strategic interests in maritime fisheries. The quay size limits potential for naval use.

17. Port of Nacala (Mozambique)

- Funding commitment, 2000 to 2021: $45.4 billion

Chinese-funded expansion has transformed Nacala into a deepwater port. Mozambique is broadly aligned with China diplomatically. Still, its port remains more commercial than strategic at present.

16. Port of Sudan (Sudan)

- Funding commitment, 2000 to 2021: $45.4 billion

Located along the Red Sea, the Port of Sudan has attracted both commercial and geopolitical interest from China. China’s investment facilitates access to a vital maritime corridor. However, political instability in Sudan adds uncertainty.

15. Port of Colombo (Sri Lanka)

- Funding commitment, 2000 to 2021: $45.4 billion

Colombo complements Chinese control over nearby Hambantota. While not a basing candidate itself, it boosts China’s logistics capacity in South Asia. The port enhances China’s footprint in Indian Ocean trade routes.

14. José Petroterminal (Venezuela)

- Funding commitment, 2000 to 2021: $45.4 billion

China Eximbank funded this key oil export terminal as part of its broader leverage over Venezuelan infrastructure. The port is the largest China-only investment in Latin America. Venezuela’s deep financial dependence on China could provide Beijing strategic leverage.

13. Port of Tema (Ghana)

- Funding commitment, 2000 to 2021: $45.4 billion

Tema is part of a competitive triad of West African ports with heavy Chinese financing. The project included large-scale dredging and berth construction, supported by Chinese and non-Chinese banks. Despite the investment, Ghana’s U.S. ties likely limit Chinese naval ambitions.

12. Doraleh Multipurpose Port and Damerjog Livestock Port* (Djibouti)

- Funding commitment, 2000 to 2021: $45.4 billion

China financed both ports with loans totaling $466M, and constructed its first overseas naval base adjacent to Doraleh. Djibouti remains a model for China’s co-located commercial and military infrastructure strategy. The ports also serve the Chinese-built Addis Ababa–Djibouti railway.

11. Autonomous Port of Nouakchott (Mauritania)

- Funding commitment, 2000 to 2021: $45.4 billion

Funded by China in two phases, Nouakchott’s port was completed in 2016. Though not currently a strong military candidate, the port underscores China’s quiet, long-term presence in West Africa. Its development predates the Belt and Road Initiative.

10. Gwadar Port (Pakistan)

- Funding commitment, 2000 to 2021: $45.4 billion

As a flagship Belt and Road project, Gwadar is emblematic of the China–Pakistan alliance. The port is strategically located near the Strait of Hormuz. Its dual-use potential for commercial and military applications has long been speculated.

9. Port of Bata (Equatorial Guinea)

- Funding commitment, 2000 to 2021: $45.4 billion

Bata has attracted interest as a potential future Chinese naval base, with U.S. officials reportedly raising alarms. Its authoritarian regime and deep Chinese investment make it a plausible site. The port’s location on the Atlantic further adds to its strategic value.

8. Lekki Deep Sea Port (Nigeria)

- Funding commitment, 2000 to 2021: $45.4 billion

China’s investment in Lekki was made through a public-private partnership and backed by the China Development Bank. It became operational in 2022 and is Nigeria’s first deep-sea port. While strategically relevant, Nigeria’s strong U.S. ties make it less likely as a Chinese military base.

7. Queen Elizabeth II Quay, Freetown (Sierra Leone)

- Funding commitment, 2000 to 2021: $45.4 billion

Built by a Chinese consortium, the Freetown port project is closely tied to Sierra Leone’s China-friendly political party. The IMF flagged risks tied to the project’s sovereign loan guarantees. Allegations of corruption and political favoritism have surrounded the investment.

6. Autonomous Port of Abidjan (Côte d’Ivoire)

- Funding commitment, 2000 to 2021: $45.4 billion

Completed in phases through 2022, Abidjan’s expansion included terminals and jetties funded by China Eximbank. The port has suffered financial issues, raising repayment concerns. It represents a significant Chinese stake in West Africa’s shipping infrastructure.

5. Port of Ashdod (Israel)

- Funding commitment, 2000 to 2021: $45.4 billion

Despite the scale of investment, Ashdod’s future as a Chinese naval site is doubtful given Israel’s ties to NATO. China’s role has been largely commercial. The project is part of a broader Chinese effort to secure Mediterranean logistics routes.

4. Port of Caio (Angola)

- Funding commitment, 2000 to 2021: $45.4 billion

Caio’s phased development includes a large docking basin and infrastructure for naval-capable vessels. China’s investment in this remote Angolan exclave highlights its interest in secure, controllable port locations. The port enhances access to Angola’s natural resources and reflects Beijing’s strategy of developing off-grid maritime assets.

3. Bayport Terminal at Haifa Port (Israel)

- Funding commitment, 2000 to 2021: $45.4 billion

Though China built and partially operates Haifa port, its use as a naval base is unlikely due to Israel’s strong Western alliances. Shanghai International Port Group began operations in 2021. The port marks one of China’s few major investments in a high-income, NATO-aligned country.

2. Autonomous Port of Kribi (Cameroon)

- Funding commitment, 2000 to 2021: $45.4 billion

China financed Kribi through multiple loans totaling over $1 billion, including a $604M credit completed in 2018. The port is deep enough to accommodate large warships and is strategically located on Africa’s Atlantic coast. Cameroon’s geopolitical alignment and long-standing political stability strengthen China’s foothold here.

1. Hambantota International Port (Sri Lanka)

- Funding commitment, 2000 to 2021: $45.4 billion

China’s largest port investment globally, Hambantota was leased to China Merchants Port Holdings in 2017 after Sri Lanka struggled with debt repayments. Its strategic location along Indian Ocean shipping lanes makes it a potential future Chinese naval base. The deal has raised international concerns about debt-trap diplomacy.

The post These Are The Key Strategic Areas Where China Is Building Overseas Ports appeared first on 24/7 Wall St..