These Are the Countries Where China Is Quietly Pouring Billions of Dollars

24/7 Wall St. Insights In the last 10 years, no country has invested more around the world than China. Chinese overseas investment induces economic dependency in poorer recipient nations and bolsters China’s presence in strategic areas. In recent years, China has increasingly invested in smaller nations in key geopolitical regions like Africa, South Asia, and […] The post These Are the Countries Where China Is Quietly Pouring Billions of Dollars appeared first on 24/7 Wall St..

24/7 Wall St. Insights

- In the last 10 years, no country has invested more around the world than China.

- Chinese overseas investment induces economic dependency in poorer recipient nations and bolsters China’s presence in strategic areas.

- In recent years, China has increasingly invested in smaller nations in key geopolitical regions like Africa, South Asia, and Latin America.

- Also: Discover the next Nvidia

Since launching its Belt and Road Initiative in 2013, China has poured more than $950 million into infrastructure and development projects across over 140 countries. Heavy investment in resource-rich nations has bolstered China’s energy infrastructure and significantly expanded its global reach. China’s overseas investments surpass those of the United States by nearly tenfold, creating a wide disparity in the spread of economic influence around the world.

In recent years, China has upped its investment in smaller countries in key geopolitical areas. In what critics term debt-trap diplomacy, Chinese loans can induce economic dependency in poorer recipient nations that struggle to repay debts. Some projects – like controversial investments in ports in Sri Lanka, Equatorial Guinea, and Pakistan – are raising concerns that China is using civilian investment to lay the groundwork for what may later become Chinese naval bases. A closer look at the data reveals the countries where China is upping its investment the most.

To determine the countries where China is upping their investment, 24/7 Wall St. reviewed data on development projects financed by China in foreign countries from AidData, a research lab at the College of William & Mary. Countries were ranked based on the difference between the total, inflation-adjusted value of development projects funded by the Chinese government and state-owned institutions during the 17-year period from 2000-2016 and the five-year period from 2018-2021. Countries with the greatest difference in investment from the 2000-2016 baseline and the 2018-2021 recent period were ranked highest.

Financial values were converted from original currencies to constant 2021 U.S. dollars and aggregated according to AidData recommendations. Supplemental data on primary investment sector and the largest project by amount invested were calculated from the AidData dataset. Investment per capita was calculated using population averages from 2000 to 2021 from the World Bank.

25. Bulgaria

- Chinese investment, 2017-2021: $752.4 million (+$128.8 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $107.82 per resident

- Primary sector of investment: Business And Other Services (40.3% of spending)

- Largest project: China Development Bank signs a €1.5 billion EUR financial cooperation framework agreement with Bulgarian Development Bank (2018)

24. Sao Tome and Principe

- Chinese investment, 2017-2021: $130.7 million (+$130.7 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $607.51 per resident

- Primary sector of investment: Unallocated/Unspecified (58.2% of spending)

- Largest project: Chinese Government pledges $146 million for infrastructure projects (2017)

23. Benin

- Chinese investment, 2017-2021: $1.4 billion (+$134.1 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $110.30 per resident

- Primary sector of investment: Industry, Mining, Construction (34.4% of spending)

- Largest project: CPFHK provides $840 million loan for Benin Section of Niger-Benin Oil Pipeline Construction Project (2021)

22. Kiribati

- Chinese investment, 2017-2021: $161.4 million (+$161.4 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $1,297.29 per resident

- Primary sector of investment: Agriculture, Forestry, Fishing (73.0% of spending)

- Largest project: China Eximbank provides loan for Tuna Fishing Project (2019)

21. Madagascar

- Chinese investment, 2017-2021: $552.4 million (+$198.6 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $20.06 per resident

- Primary sector of investment: Transport And Storage (53.5% of spending)

- Largest project: China Eximbank pledges MGA 676 billion loan for 86MW Ranomafana Hydropower Plant Construction Project (2018)

20. Lebanon

- Chinese investment, 2017-2021: $369.4 million (+$249.0 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $63.47 per resident

- Primary sector of investment: Transport And Storage (59.2% of spending)

- Largest project: Middle East Airlines enters into sale and leaseback agreement with BOC Aviation for 5-10 Airbus A321neo aircraft (2019)

19. El Salvador

- Chinese investment, 2017-2021: $287.3 million (+$264.9 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $45.71 per resident

- Primary sector of investment: Water Supply And Sanitation (26.8% of spending)

- Largest project: China signs ETCA with El Salvador to provide $500 million for various projects (2019)

18. Bosnia and Herzegovina

- Chinese investment, 2017-2021: $1.3 billion (+$378.9 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $379.35 per resident

- Primary sector of investment: Energy (87.0% of spending)

- Largest project: China Eximbank provides EUR 613.99 million buyer’s credit loan for 450MW Tuzla Thermal Power Plant Unit 7 Project (2017)

17. Eritrea

- Chinese investment, 2017-2021: $1.8 billion (+$515.4 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $503.39 per resident

- Primary sector of investment: Industry, Mining, Construction (81.8% of spending)

- Largest project: China Construction Bank provides $870 million loan for Zijin Mining to acquire 55% ownership stake in Bisha Mine (2018)

16. Colombia

- Chinese investment, 2017-2021: $1.2 billion (+$760.6 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $23.89 per resident

- Primary sector of investment: Transport And Storage (61.9% of spending)

- Largest project: CDB provides $267.7 million loan (Tranche A) for Autopista al Mar 2 Project (2019)

15. Cote d’Ivoire

- Chinese investment, 2017-2021: $4.1 billion (+$870.5 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $156.84 per resident

- Primary sector of investment: Transport And Storage (36.2% of spending)

- Largest project: ICBC provides CFA 254.1 billion loan for Ferkessédougou Dry Port Construction Project (2020)

14. Sierra Leone

- Chinese investment, 2017-2021: $3.0 billion (+$967.2 million from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $369.54 per resident

- Primary sector of investment: Industry, Mining, Construction (68.4% of spending)

- Largest project: China Development Bank provides $2 billion loan for Phase 2 of the Tonkolili Iron Mine Project (2021)

13. Guinea

- Chinese investment, 2017-2021: $3.2 billion (+$1.1 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $249.89 per resident

- Primary sector of investment: Energy (50.7% of spending)

- Largest project: Chinese Government signs $20 billion resource-backed loan framework agreement (2017)

12. Jordan

- Chinese investment, 2017-2021: $1.9 billion (+$1.6 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $174.21 per resident

- Primary sector of investment: Energy (89.7% of spending)

- Largest project: ICBC contributes $594 million to syndicated buyer’s credit loan for 554MW Attarat Oil Shale Fired Power Plant Project (2017)

11. Brunei Darussalam

- Chinese investment, 2017-2021: $1.9 billion (+$1.7 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $4,398.87 per resident

- Primary sector of investment: Industry, Mining, Construction (90.0% of spending)

- Largest project: China Development Bank contributes $570 million to $1.75 billion syndicated loan for Phase 1 of Hengyi Pulau Muara Besar (PMB) Oil Refinery and Petrochemical Complex Construction Project (2018)

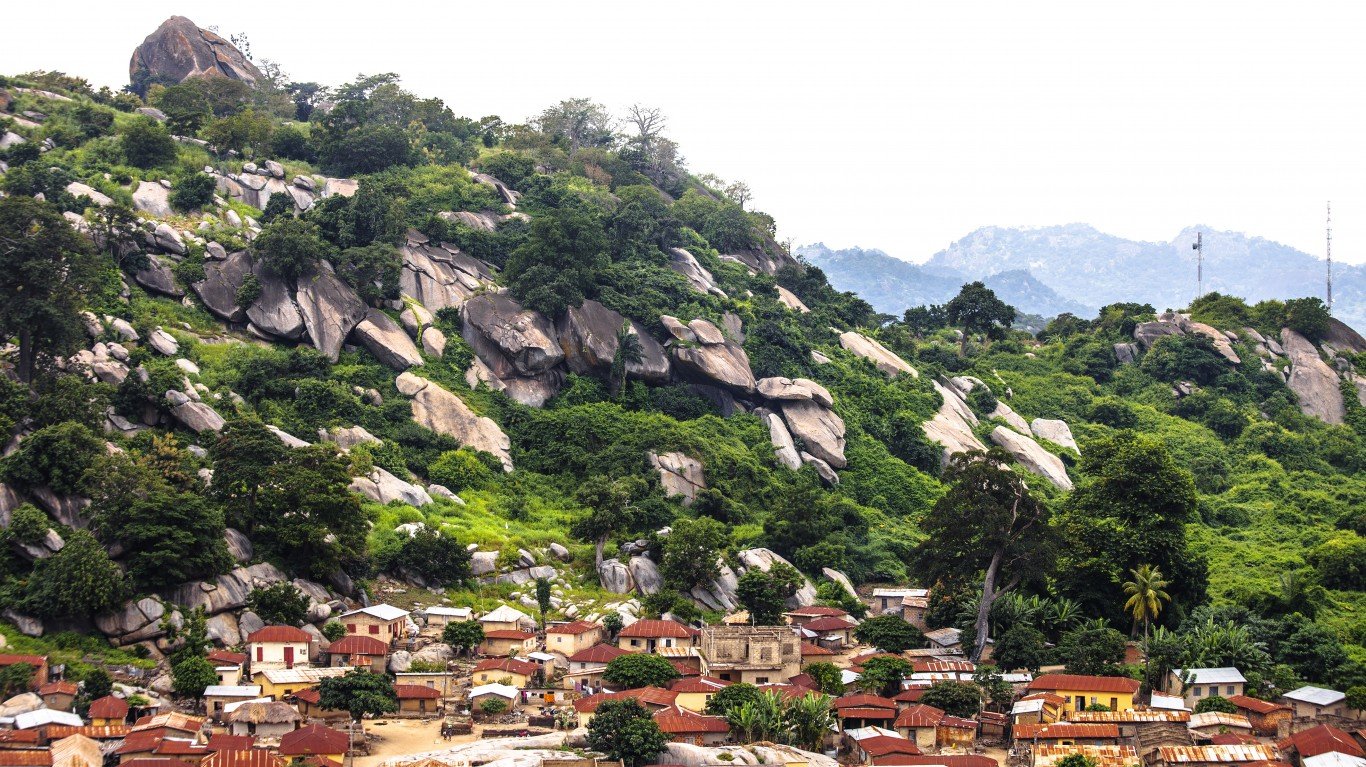

10. Nigeria

- Chinese investment, 2017-2021: $8.6 billion (+$2.1 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $42.25 per resident

- Primary sector of investment: Transport And Storage (34.4% of spending)

- Largest project: China Eximbank pledges to fund $6.7 billion for Nigerian Railway Modernization Phase IV (from Ibadan to Kaduna) (2018)

9. South Africa

- Chinese investment, 2017-2021: $11.8 billion (+$2.2 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $202.59 per resident

- Primary sector of investment: Energy (33.6% of spending)

- Largest project: China Development Bank provides $2.5 billion loan for 4800MW Kusile Coal-Fired Power Plant Construction Project (2018)

8. Oman

- Chinese investment, 2017-2021: $4.9 billion (+$2.7 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $1,075.41 per resident

- Primary sector of investment: General Budget Support (73.9% of spending)

- Largest project: CDB, BoC, ICBC, and Bank of Communications contribute $3.2 billion to syndicated bullet loan to address Oman’s fiscal deficit (2017)

7. Chile

- Chinese investment, 2017-2021: $5.3 billion (+$3.9 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $278.16 per resident

- Primary sector of investment: Industry, Mining, Construction (66.2% of spending)

- Largest project: China CITIC Bank provides $1.3 billion loan for Tianqi Lithium Corporation to acquire 23.77% ownership stake in Sociedad Quimica y Minera de Chile S.A. (2018)

6. Malaysia

- Chinese investment, 2017-2021: $12.3 billion (+$7.6 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $375.75 per resident

- Primary sector of investment: Transport And Storage (36.3% of spending)

- Largest project: China Eximbank provides RM 39.1 billion preferential buyer’s credit for Phase 1 of East Coast Rail Link (ECRL) Construction Project (2018)

5. Bangladesh

- Chinese investment, 2017-2021: $14.5 billion (+$8.1 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $87.35 per resident

- Primary sector of investment: Energy (49.7% of spending)

- Largest project: China Eximbank provides $2.67 billion preferential buyer’s credit for Padma Bridge Rail Link Project (2018)

4. Turkey

- Chinese investment, 2017-2021: $19.7 billion (+$11.1 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $236.05 per resident

- Primary sector of investment: Banking And Financial Services (36.4% of spending)

- Largest project: TCMB makes RMB 35 billion drawdown under currency swap agreement with PBOC in June 2021 (2021)

3. Pakistan

- Chinese investment, 2017-2021: $58.9 billion (+$14.9 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $263.20 per resident

- Primary sector of investment: General Budget Support (31.1% of spending)

- Largest project: SBP makes RMB 30 billion drawdown under currency swap agreement with PBOC in Fiscal Year 2021 (2020)

2. Egypt

- Chinese investment, 2017-2021: $23.9 billion (+$20.9 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $226.79 per resident

- Primary sector of investment: Banking And Financial Services (61.1% of spending)

- Largest project: China Development Bank pledges USD $3.7 billion loan to the Egyptian Electric Holding Company for construction of the Hamrawein coal-powered power plant (2019)

1. Argentina

- Chinese investment, 2017-2021: $100.4 billion (+$62.0 billion from 2000-2016 baseline)

- Chinese investment per capita, 2017-2021: $2,233.37 per resident

- Primary sector of investment: Banking And Financial Services (88.9% of spending)

- Largest project: BCRA makes RMB 130 billion drawdown under currency swap agreement with PBOC in 2018 (2018)

The post These Are the Countries Where China Is Quietly Pouring Billions of Dollars appeared first on 24/7 Wall St..