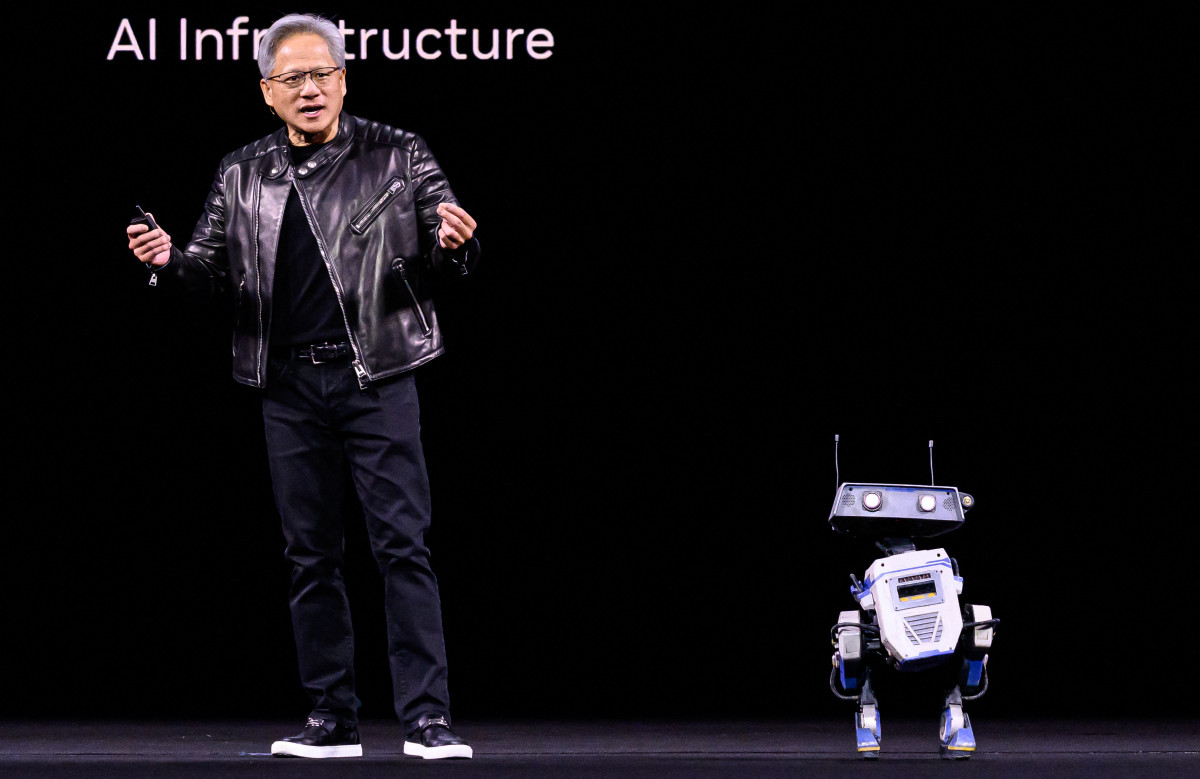

The Nvidia story Wall Street isn’t talking about

Nvidia posted strong first quarter results but investors might be missing a critical part of the story.

Nvidia (NVDA) posted better than expected first quarter earnings with massive growth in its data center business. Angelo Zino, senior vice president at CFRA Research joined TheStreet to break down what’s driving the results, how China’s tech crackdown is weighing on the company and whether this momentum can last.

Related: Analyst resets Nvidia-backed AI stock price target after 200% surge

Full Video Transcript Below:

ANGELO ZINO: So the biggest takeaways from NVIDIA and our outlook on the stock, I'd say the biggest takeaway for NVIDIA on the April quarter has to be on the guidance side. And specifically as far as China is concerned, clearly the guidance was slightly below expectations, but more importantly is the fact that they did allude to the fact that there was an $8 billion, essentially missed revenue opportunity tied to China. And listen, that's unfortunate in nature, but a couple of positives in the sense that it helps de-risk the stock. The other thing I will say is the expectation going for the July quarter from most analysts was about a $4 to $5 billion hit from China. The fact that it was, in fact, 8 billion actually tells you that the rest of the world or the rest of NVIDIA's business is actually running stronger than expected. And I would actually say, that largely has to do with the fact that Blackwell is gaining more momentum than we originally expected, not only from the hyperscalers like the Microsofts and the Amazons and metas of the world, but also some of those tier 2 and three players, like the core weaves that are also increasing CapEx.

So NVIDIA is 73% growth in the data center business. Do we think it's sustainable. I would say unlikely. Going to be sustainable. In fact, we've seen growth rates decelerate here in recent quarters within the data center business. And, clearly just the law of numbers is going to cause growth rates to continue to decelerate here over the next couple of quarters. I mean, we've seen essentially triple digit growth rates, for essentially a 6, 7/4 period of time back in 23, 2024. We're now kind of decelerating towards growth rates that are probably going to be 50% or so here over the next two quarters and further decelerate as you go into 2026 and 2027, I would say expect a run rate to get closer to as far as data centers is concerned, maybe 20% is something that's more sustainable in nature as we look out maybe 6, 7/4 down the road from that. But nonetheless, I mean, you start thinking about where the multiples are. And we think this is still a compelling opportunity.