The Cost of Homeownership Now Outpaces Median Incomes in Every State

According to Investopedia, on average, U.S. households need a minimum of $118,530 yearly income to be able to afford an average house. Yet, the median household income according to the U.S. Census Bureau from 2019 to 2023 was $78,538. This is a discrepancy of nearly $40,000. Currently, mortgage rates have risen above pre-pandemic levels, making […] The post The Cost of Homeownership Now Outpaces Median Incomes in Every State appeared first on 24/7 Wall St..

According to Investopedia, on average, U.S. households need a minimum of $118,530 yearly income to be able to afford an average house. Yet, the median household income according to the U.S. Census Bureau from 2019 to 2023 was $78,538. This is a discrepancy of nearly $40,000. Currently, mortgage rates have risen above pre-pandemic levels, making securing a home loan costly. Industry experts told CBS News that they expect rates to drop somewhat in 2025, but the rate is not likely to go below pre-pandemic levels, at least for now.

Not only are mortgage rates higher than they were a few years ago, but home prices have risen 30% in the past five years. Inventory is still a challenge for home buyers with buyer demand high and inventory low. And even though mortgage rates may come down, housing prices overall will likely continue increasing. All of this makes the American dream of home ownership seem more unattainable than ever before. In 1981, the average age for a first-time homebuyer was 29 years old. In 2024, it was 38.

24/7 Wall St. calculated the income needed to comfortably afford a typical home in each state by using data from a range of sources. In our assessment, we considered home prices, mortgage rates, property taxes, and insurance premiums. We followed the conventional advice to pay no more than 28% of income to housing costs. Also note, the numbers are estimates only and don’t include the savings necessary to afford a down payment. We have also included the median income for each state with data from the U.S. Census Bureau from 2019 to 2023. Notably, in every state in the country, the median income is below the the income needed to comfortably afford a typical home.

(This article was updated on March 27, 2025, to reflect recent economic news on the housing market and mortgage rates.)

Why It Matters Now

Recent news has predicted that mortgage rates are likely to drop slightly in 2025, but won’t be as affordable as before the pandemic. In recent years, limited supply and rising demand have fueled a surge in home prices. Rising housing costs have led to an affordability crisis, as the number of Americans spending over 30% of their income on housing has grown by the millions in recent years. Now, with home prices and mortgage rates near historic highs, home buyers need to budget carefully — and in some parts of the country, homeownership is accessible for a much broader range of incomes than in others.

This is how much you need to make to buy a home in each state:

Alabama

- Minimum annual income needed to afford a typical home: $88,278 (12th lowest of 50 states)

- Median household income (2019-2023): $62,027

- Est. monthly expenses for a typical home: $2,060 (12th lowest of 50 states)

- Median home list price in October 2024: $329,200 (15th lowest of 50 states)

- Avg. annual homeowners insurance premium: $235 (13th highest of 50 states)

- Est. annual property tax payments: $1,182 (the lowest of 50 states)

- Effective property tax rate: 0.4% (2nd lowest of 50 states)

Alaska

- Minimum annual income needed to afford a typical home: $115,232 (25th highest of 50 states)

- Median household income (2019-2023): $89,336

- Est. monthly expenses for a typical home: $2,689 (25th highest of 50 states)

- Median home list price in October 2024: $425,000 (24th highest of 50 states)

- Avg. annual homeowners insurance premium: $82 (5th lowest of 50 states)

- Est. annual property tax payments: $4,536 (14th highest of 50 states)

- Effective property tax rate: 1.1% (16th highest of 50 states)

Arizona

- Minimum annual income needed to afford a typical home: $127,087 (17th highest of 50 states)

- Median household income (2019-2023): $76,872

- Est. monthly expenses for a typical home: $2,965 (17th highest of 50 states)

- Median home list price in October 2024: $495,000 (16th highest of 50 states)

- Avg. annual homeowners insurance premium: $186 (21st highest of 50 states)

- Est. annual property tax payments: $2,203 (11th lowest of 50 states)

- Effective property tax rate: 0.4% (4th lowest of 50 states)

Arkansas

- Minimum annual income needed to afford a typical home: $82,984 (5th lowest of 50 states)

- Median household income (2019-2023): $58,773

- Est. monthly expenses for a typical home: $1,936 (5th lowest of 50 states)

- Median home list price in October 2024: $296,854 (10th lowest of 50 states)

- Avg. annual homeowners insurance premium: $248 (10th highest of 50 states)

- Est. annual property tax payments: $1,579 (4th lowest of 50 states)

- Effective property tax rate: 0.5% (12th lowest of 50 states)

California

- Minimum annual income needed to afford a typical home: $194,364 (2nd highest of 50 states)

- Median household income (2019-2023): $96,334

- Est. monthly expenses for a typical home: $4,535 (2nd highest of 50 states)

- Median home list price in October 2024: $759,500 (3rd highest of 50 states)

- Avg. annual homeowners insurance premium: $123 (18th lowest of 50 states)

- Est. annual property tax payments: $5,152 (11th highest of 50 states)

- Effective property tax rate: 0.7% (17th lowest of 50 states)

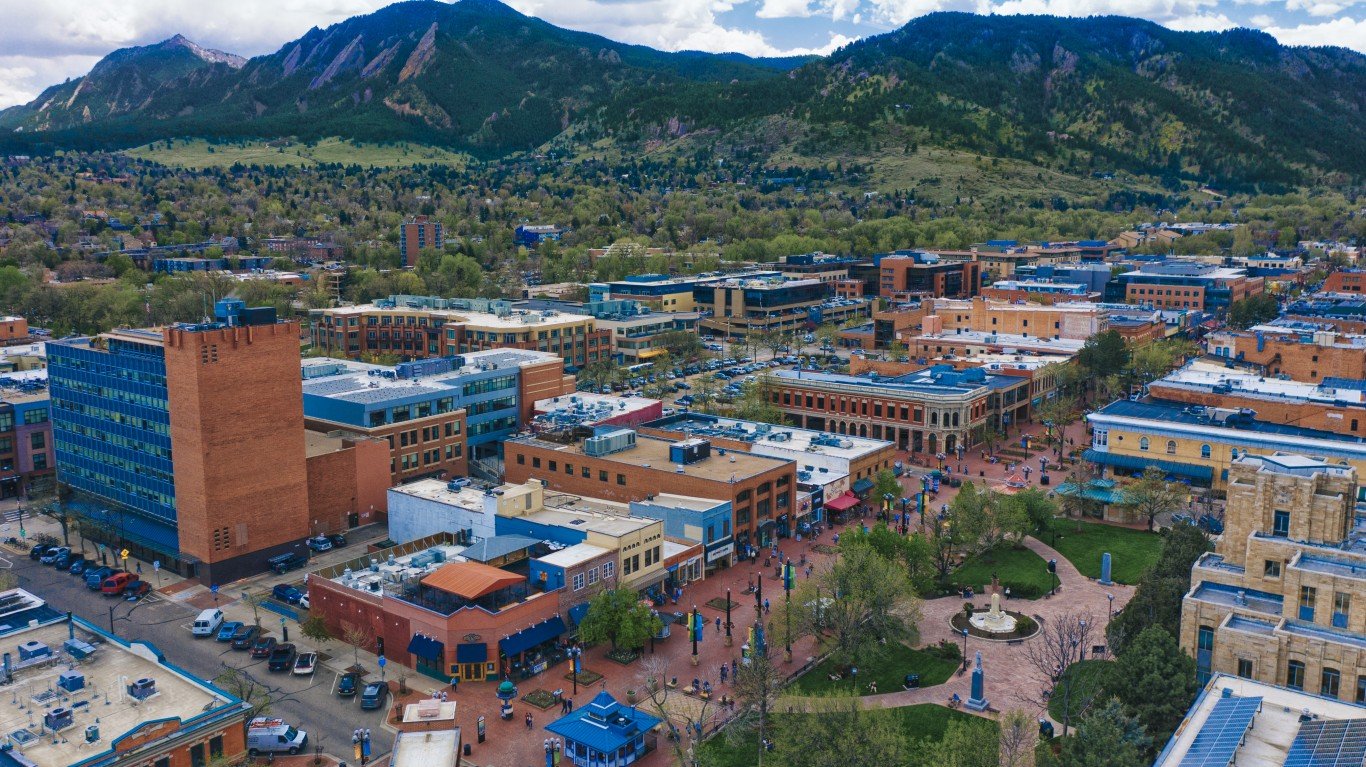

Colorado

- Minimum annual income needed to afford a typical home: $154,869 (10th highest of 50 states)

- Median household income (2019-2023): $92,470

- Est. monthly expenses for a typical home: $3,614 (10th highest of 50 states)

- Median home list price in October 2024: $595,000 (8th highest of 50 states)

- Avg. annual homeowners insurance premium: $268 (9th highest of 50 states)

- Est. annual property tax payments: $2,705 (20th lowest of 50 states)

- Effective property tax rate: 0.5% (5th lowest of 50 states)

Connecticut

- Minimum annual income needed to afford a typical home: $149,973 (11th highest of 50 states)

- Median household income (2019-2023): $93,760

- Est. monthly expenses for a typical home: $3,499 (11th highest of 50 states)

- Median home list price in October 2024: $499,994 (14th highest of 50 states)

- Avg. annual homeowners insurance premium: $134 (21st lowest of 50 states)

- Est. annual property tax payments: $8,921 (4th highest of 50 states)

- Effective property tax rate: 1.8% (3rd highest of 50 states)

Delaware

- Minimum annual income needed to afford a typical home: $121,415 (20th highest of 50 states)

- Median household income (2019-2023): $82,855

- Est. monthly expenses for a typical home: $2,833 (20th highest of 50 states)

- Median home list price in October 2024: $487,450 (18th highest of 50 states)

- Avg. annual homeowners insurance premium: $81 (3rd lowest of 50 states)

- Est. annual property tax payments: $2,350 (14th lowest of 50 states)

- Effective property tax rate: 0.5% (9th lowest of 50 states)

Florida

- Minimum annual income needed to afford a typical home: $128,532 (16th highest of 50 states)

- Median household income (2019-2023): $71,711

- Est. monthly expenses for a typical home: $2,999 (16th highest of 50 states)

- Median home list price in October 2024: $434,995 (22nd highest of 50 states)

- Avg. annual homeowners insurance premium: $461 (2nd highest of 50 states)

- Est. annual property tax payments: $3,084 (23rd lowest of 50 states)

- Effective property tax rate: 0.7% (20th lowest of 50 states)

Georgia

- Minimum annual income needed to afford a typical home: $106,007 (18th lowest of 50 states)

- Median household income (2019-2023): $74,664

- Est. monthly expenses for a typical home: $2,474 (18th lowest of 50 states)

- Median home list price in October 2024: $394,773 (23rd lowest of 50 states)

- Avg. annual homeowners insurance premium: $168 (25th lowest of 50 states)

- Est. annual property tax payments: $2,824 (21st lowest of 50 states)

- Effective property tax rate: 0.7% (22nd lowest of 50 states)

Hawaii

- Minimum annual income needed to afford a typical home: $191,046 (3rd highest of 50 states)

- Median household income (2019-2023): $104,264

- Est. monthly expenses for a typical home: $4,458 (3rd highest of 50 states)

- Median home list price in October 2024: $798,500 (the highest of 50 states)

- Avg. annual homeowners insurance premium: $100 (11th lowest of 50 states)

- Est. annual property tax payments: $2,045 (6th lowest of 50 states)

- Effective property tax rate: 0.3% (the lowest of 50 states)

Idaho

- Minimum annual income needed to afford a typical home: $142,889 (15th highest of 50 states)

- Median household income (2019-2023): $74,636

- Est. monthly expenses for a typical home: $3,334 (15th highest of 50 states)

- Median home list price in October 2024: $572,988 (10th highest of 50 states)

- Avg. annual homeowners insurance premium: $107 (14th lowest of 50 states)

- Est. annual property tax payments: $2,668 (18th lowest of 50 states)

- Effective property tax rate: 0.5% (7th lowest of 50 states)

Illinois

- Minimum annual income needed to afford a typical home: $102,096 (16th lowest of 50 states)

- Median household income (2019-2023): $81,702

- Est. monthly expenses for a typical home: $2,382 (16th lowest of 50 states)

- Median home list price in October 2024: $317,450 (14th lowest of 50 states)

- Avg. annual homeowners insurance premium: $201 (18th highest of 50 states)

- Est. annual property tax payments: $6,198 (8th highest of 50 states)

- Effective property tax rate: 2.0% (2nd highest of 50 states)

Indiana

- Minimum annual income needed to afford a typical home: $78,875 (3rd lowest of 50 states)

- Median household income (2019-2023): $70,051

- Est. monthly expenses for a typical home: $1,840 (3rd lowest of 50 states)

- Median home list price in October 2024: $290,750 (6th lowest of 50 states)

- Avg. annual homeowners insurance premium: $143 (23rd lowest of 50 states)

- Est. annual property tax payments: $2,073 (9th lowest of 50 states)

- Effective property tax rate: 0.7% (21st lowest of 50 states)

Iowa

- Minimum annual income needed to afford a typical home: $85,075 (7th lowest of 50 states)

- Median household income (2019-2023): $73,147

- Est. monthly expenses for a typical home: $1,985 (7th lowest of 50 states)

- Median home list price in October 2024: $279,950 (4th lowest of 50 states)

- Avg. annual homeowners insurance premium: $190 (20th highest of 50 states)

- Est. annual property tax payments: $3,924 (19th highest of 50 states)

- Effective property tax rate: 1.4% (9th highest of 50 states)

Kansas

- Minimum annual income needed to afford a typical home: $94,813 (15th lowest of 50 states)

- Median household income (2019-2023): $72,639

- Est. monthly expenses for a typical home: $2,212 (15th lowest of 50 states)

- Median home list price in October 2024: $295,475 (9th lowest of 50 states)

- Avg. annual homeowners insurance premium: $353 (5th highest of 50 states)

- Est. annual property tax payments: $3,718 (23rd highest of 50 states)

- Effective property tax rate: 1.3% (13th highest of 50 states)

Kentucky

- Minimum annual income needed to afford a typical home: $87,001 (10th lowest of 50 states)

- Median household income (2019-2023): $62,417

- Est. monthly expenses for a typical home: $2,030 (10th lowest of 50 states)

- Median home list price in October 2024: $299,950 (12th lowest of 50 states)

- Avg. annual homeowners insurance premium: $273 (8th highest of 50 states)

- Est. annual property tax payments: $2,209 (12th lowest of 50 states)

- Effective property tax rate: 0.7% (24th lowest of 50 states)

Louisiana

- Minimum annual income needed to afford a typical home: $82,488 (4th lowest of 50 states)

- Median household income (2019-2023): $60,023

- Est. monthly expenses for a typical home: $1,925 (4th lowest of 50 states)

- Median home list price in October 2024: $276,438 (3rd lowest of 50 states)

- Avg. annual homeowners insurance premium: $358 (4th highest of 50 states)

- Est. annual property tax payments: $1,405 (3rd lowest of 50 states)

- Effective property tax rate: 0.5% (11th lowest of 50 states)

Maine

- Minimum annual income needed to afford a typical home: $120,968 (21st highest of 50 states)

- Median household income (2019-2023): $71,773

- Est. monthly expenses for a typical home: $2,823 (21st highest of 50 states)

- Median home list price in October 2024: $450,000 (20th highest of 50 states)

- Avg. annual homeowners insurance premium: $102 (12th lowest of 50 states)

- Est. annual property tax payments: $4,329 (17th highest of 50 states)

- Effective property tax rate: 1.0% (21st highest of 50 states)

Maryland

- Minimum annual income needed to afford a typical home: $115,472 (24th highest of 50 states)

- Median household income (2019-2023): $101,652

- Est. monthly expenses for a typical home: $2,694 (24th highest of 50 states)

- Median home list price in October 2024: $425,000 (24th highest of 50 states)

- Avg. annual homeowners insurance premium: $130 (20th lowest of 50 states)

- Est. annual property tax payments: $4,028 (18th highest of 50 states)

- Effective property tax rate: 0.9% (22nd highest of 50 states)

Massachusetts

- Minimum annual income needed to afford a typical home: $207,469 (the highest of 50 states)

- Median household income (2019-2023): $101,341

- Est. monthly expenses for a typical home: $4,841 (the highest of 50 states)

- Median home list price in October 2024: $769,500 (2nd highest of 50 states)

- Avg. annual homeowners insurance premium: $139 (22nd lowest of 50 states)

- Est. annual property tax payments: $8,000 (5th highest of 50 states)

- Effective property tax rate: 1.0% (17th highest of 50 states)

Michigan

- Minimum annual income needed to afford a typical home: $85,262 (8th lowest of 50 states)

- Median household income (2019-2023): $71,149

- Est. monthly expenses for a typical home: $1,989 (8th lowest of 50 states)

- Median home list price in October 2024: $289,950 (5th lowest of 50 states)

- Avg. annual homeowners insurance premium: $170 (25th highest of 50 states)

- Est. annual property tax payments: $3,587 (24th highest of 50 states)

- Effective property tax rate: 1.2% (14th highest of 50 states)

Minnesota

- Minimum annual income needed to afford a typical home: $109,793 (22nd lowest of 50 states)

- Median household income (2019-2023): $87,556

- Est. monthly expenses for a typical home: $2,562 (22nd lowest of 50 states)

- Median home list price in October 2024: $387,000 (22nd lowest of 50 states)

- Avg. annual homeowners insurance premium: $215 (14th highest of 50 states)

- Est. annual property tax payments: $3,809 (21st highest of 50 states)

- Effective property tax rate: 1.0% (19th highest of 50 states)

Mississippi

- Minimum annual income needed to afford a typical home: $85,417 (9th lowest of 50 states)

- Median household income (2019-2023): $54,915

- Est. monthly expenses for a typical home: $1,993 (9th lowest of 50 states)

- Median home list price in October 2024: $294,950 (7th lowest of 50 states)

- Avg. annual homeowners insurance premium: $274 (7th highest of 50 states)

- Est. annual property tax payments: $2,068 (7th lowest of 50 states)

- Effective property tax rate: 0.7% (19th lowest of 50 states)

Missouri

- Minimum annual income needed to afford a typical home: $83,564 (6th lowest of 50 states)

- Median household income (2019-2023): $68,920

- Est. monthly expenses for a typical home: $1,950 (6th lowest of 50 states)

- Median home list price in October 2024: $299,450 (11th lowest of 50 states)

- Avg. annual homeowners insurance premium: $176 (22nd highest of 50 states)

- Est. annual property tax payments: $2,442 (15th lowest of 50 states)

- Effective property tax rate: 0.8% (23rd highest of 50 states)

Montana

- Minimum annual income needed to afford a typical home: $170,482 (6th highest of 50 states)

- Median household income (2019-2023): $69,922

- Est. monthly expenses for a typical home: $3,978 (6th highest of 50 states)

- Median home list price in October 2024: $646,975 (5th highest of 50 states)

- Avg. annual homeowners insurance premium: $211 (15th highest of 50 states)

- Est. annual property tax payments: $4,490 (15th highest of 50 states)

- Effective property tax rate: 0.7% (18th lowest of 50 states)

Nebraska

- Minimum annual income needed to afford a typical home: $114,341 (25th lowest of 50 states)

- Median household income (2019-2023): $74,985

- Est. monthly expenses for a typical home: $2,668 (25th lowest of 50 states)

- Median home list price in October 2024: $342,450 (16th lowest of 50 states)

- Avg. annual homeowners insurance premium: $462 (the highest of 50 states)

- Est. annual property tax payments: $4,922 (12th highest of 50 states)

- Effective property tax rate: 1.4% (8th highest of 50 states)

Nevada

- Minimum annual income needed to afford a typical home: $122,373 (18th highest of 50 states)

- Median household income (2019-2023): $75,561

- Est. monthly expenses for a typical home: $2,855 (18th highest of 50 states)

- Median home list price in October 2024: $495,000 (16th highest of 50 states)

- Avg. annual homeowners insurance premium: $80 (2nd lowest of 50 states)

- Est. annual property tax payments: $2,155 (10th lowest of 50 states)

- Effective property tax rate: 0.4% (3rd lowest of 50 states)

New Hampshire

- Minimum annual income needed to afford a typical home: $165,009 (8th highest of 50 states)

- Median household income (2019-2023): $95,628

- Est. monthly expenses for a typical home: $3,850 (8th highest of 50 states)

- Median home list price in October 2024: $571,950 (11th highest of 50 states)

- Avg. annual homeowners insurance premium: $82 (5th lowest of 50 states)

- Est. annual property tax payments: $9,227 (3rd highest of 50 states)

- Effective property tax rate: 1.6% (4th highest of 50 states)

New Jersey

- Minimum annual income needed to afford a typical home: $175,922 (5th highest of 50 states)

- Median household income (2019-2023): $101,050

- Est. monthly expenses for a typical home: $4,105 (5th highest of 50 states)

- Median home list price in October 2024: $574,500 (9th highest of 50 states)

- Avg. annual homeowners insurance premium: $97 (8th lowest of 50 states)

- Est. annual property tax payments: $11,942 (the highest of 50 states)

- Effective property tax rate: 2.1% (the highest of 50 states)

New Mexico

- Minimum annual income needed to afford a typical home: $106,679 (19th lowest of 50 states)

- Median household income (2019-2023): $62,125

- Est. monthly expenses for a typical home: $2,489 (19th lowest of 50 states)

- Median home list price in October 2024: $399,000 (24th lowest of 50 states)

- Avg. annual homeowners insurance premium: $173 (24th highest of 50 states)

- Est. annual property tax payments: $2,686 (19th lowest of 50 states)

- Effective property tax rate: 0.7% (16th lowest of 50 states)

New York

- Minimum annual income needed to afford a typical home: $187,954 (4th highest of 50 states)

- Median household income (2019-2023): $84,578

- Est. monthly expenses for a typical home: $4,386 (4th highest of 50 states)

- Median home list price in October 2024: $649,775 (4th highest of 50 states)

- Avg. annual homeowners insurance premium: $145 (24th lowest of 50 states)

- Est. annual property tax payments: $9,998 (2nd highest of 50 states)

- Effective property tax rate: 1.5% (6th highest of 50 states)

North Carolina

- Minimum annual income needed to afford a typical home: $110,202 (23rd lowest of 50 states)

- Median household income (2019-2023): $69,904

- Est. monthly expenses for a typical home: $2,571 (23rd lowest of 50 states)

- Median home list price in October 2024: $409,950 (25th lowest of 50 states)

- Avg. annual homeowners insurance premium: $205 (16th highest of 50 states)

- Est. annual property tax payments: $2,599 (16th lowest of 50 states)

- Effective property tax rate: 0.6% (15th lowest of 50 states)

North Dakota

- Minimum annual income needed to afford a typical home: $102,752 (17th lowest of 50 states)

- Median household income (2019-2023): $75,949

- Est. monthly expenses for a typical home: $2,398 (17th lowest of 50 states)

- Median home list price in October 2024: $356,248 (18th lowest of 50 states)

- Avg. annual homeowners insurance premium: $240 (11th highest of 50 states)

- Est. annual property tax payments: $3,473 (25th lowest of 50 states)

- Effective property tax rate: 1.0% (20th highest of 50 states)

Ohio

- Minimum annual income needed to afford a typical home: $77,636 (2nd lowest of 50 states)

- Median household income (2019-2023): $69,680

- Est. monthly expenses for a typical home: $1,812 (2nd lowest of 50 states)

- Median home list price in October 2024: $269,200 (2nd lowest of 50 states)

- Avg. annual homeowners insurance premium: $109 (15th lowest of 50 states)

- Est. annual property tax payments: $3,490 (25th highest of 50 states)

- Effective property tax rate: 1.3% (11th highest of 50 states)

Oklahoma

- Minimum annual income needed to afford a typical home: $92,397 (13th lowest of 50 states)

- Median household income (2019-2023): $63,603

- Est. monthly expenses for a typical home: $2,156 (13th lowest of 50 states)

- Median home list price in October 2024: $295,000 (8th lowest of 50 states)

- Avg. annual homeowners insurance premium: $421 (3rd highest of 50 states)

- Est. annual property tax payments: $2,256 (13th lowest of 50 states)

- Effective property tax rate: 0.8% (25th highest of 50 states)

Oregon

- Minimum annual income needed to afford a typical home: $147,335 (13th highest of 50 states)

- Median household income (2019-2023): $80,426

- Est. monthly expenses for a typical home: $3,438 (13th highest of 50 states)

- Median home list price in October 2024: $569,950 (12th highest of 50 states)

- Avg. annual homeowners insurance premium: $85 (7th lowest of 50 states)

- Est. annual property tax payments: $4,368 (16th highest of 50 states)

- Effective property tax rate: 0.8% (24th highest of 50 states)

Pennsylvania

- Minimum annual income needed to afford a typical home: $87,998 (11th lowest of 50 states)

- Median household income (2019-2023): $76,081

- Est. monthly expenses for a typical home: $2,053 (11th lowest of 50 states)

- Median home list price in October 2024: $309,900 (13th lowest of 50 states)

- Avg. annual homeowners insurance premium: $103 (13th lowest of 50 states)

- Est. annual property tax payments: $3,902 (20th highest of 50 states)

- Effective property tax rate: 1.3% (12th highest of 50 states)

Rhode Island

- Minimum annual income needed to afford a typical home: $155,240 (9th highest of 50 states)

- Median household income (2019-2023): $86,372

- Est. monthly expenses for a typical home: $3,622 (9th highest of 50 states)

- Median home list price in October 2024: $549,950 (13th highest of 50 states)

- Avg. annual homeowners insurance premium: $174 (23rd highest of 50 states)

- Est. annual property tax payments: $6,772 (7th highest of 50 states)

- Effective property tax rate: 1.2% (15th highest of 50 states)

South Carolina

- Minimum annual income needed to afford a typical home: $94,287 (14th lowest of 50 states)

- Median household income (2019-2023): $66,818

- Est. monthly expenses for a typical home: $2,200 (14th lowest of 50 states)

- Median home list price in October 2024: $355,000 (17th lowest of 50 states)

- Avg. annual homeowners insurance premium: $202 (17th highest of 50 states)

- Est. annual property tax payments: $1,637 (5th lowest of 50 states)

- Effective property tax rate: 0.5% (6th lowest of 50 states)

South Dakota

- Minimum annual income needed to afford a typical home: $107,418 (20th lowest of 50 states)

- Median household income (2019-2023): $72,421

- Est. monthly expenses for a typical home: $2,506 (20th lowest of 50 states)

- Median home list price in October 2024: $372,500 (20th lowest of 50 states)

- Avg. annual homeowners insurance premium: $238 (12th highest of 50 states)

- Est. annual property tax payments: $3,780 (22nd highest of 50 states)

- Effective property tax rate: 1.0% (18th highest of 50 states)

Tennessee

- Minimum annual income needed to afford a typical home: $111,730 (24th lowest of 50 states)

- Median household income (2019-2023): $67,097

- Est. monthly expenses for a typical home: $2,607 (24th lowest of 50 states)

- Median home list price in October 2024: $427,450 (23rd highest of 50 states)

- Avg. annual homeowners insurance premium: $193 (19th highest of 50 states)

- Est. annual property tax payments: $2,070 (8th lowest of 50 states)

- Effective property tax rate: 0.5% (10th lowest of 50 states)

Texas

- Minimum annual income needed to afford a typical home: $116,611 (22nd highest of 50 states)

- Median household income (2019-2023): $76,292

- Est. monthly expenses for a typical home: $2,721 (22nd highest of 50 states)

- Median home list price in October 2024: $370,739 (19th lowest of 50 states)

- Avg. annual homeowners insurance premium: $324 (6th highest of 50 states)

- Est. annual property tax payments: $5,433 (9th highest of 50 states)

- Effective property tax rate: 1.5% (7th highest of 50 states)

Utah

- Minimum annual income needed to afford a typical home: $149,036 (12th highest of 50 states)

- Median household income (2019-2023): $91,750

- Est. monthly expenses for a typical home: $3,477 (12th highest of 50 states)

- Median home list price in October 2024: $599,000 (7th highest of 50 states)

- Avg. annual homeowners insurance premium: $100 (11th lowest of 50 states)

- Est. annual property tax payments: $2,836 (22nd lowest of 50 states)

- Effective property tax rate: 0.5% (8th lowest of 50 states)

Vermont

- Minimum annual income needed to afford a typical home: $142,901 (14th highest of 50 states)

- Median household income (2019-2023): $78,024

- Est. monthly expenses for a typical home: $3,334 (14th highest of 50 states)

- Median home list price in October 2024: $499,000 (15th highest of 50 states)

- Avg. annual homeowners insurance premium: $67 (the lowest of 50 states)

- Est. annual property tax payments: $7,807 (6th highest of 50 states)

- Effective property tax rate: 1.6% (5th highest of 50 states)

Virginia

- Minimum annual income needed to afford a typical home: $115,810 (23rd highest of 50 states)

- Median household income (2019-2023): $90,974

- Est. monthly expenses for a typical home: $2,702 (23rd highest of 50 states)

- Median home list price in October 2024: $440,527 (21st highest of 50 states)

- Avg. annual homeowners insurance premium: $127 (19th lowest of 50 states)

- Est. annual property tax payments: $3,181 (24th lowest of 50 states)

- Effective property tax rate: 0.7% (23rd lowest of 50 states)

Washington

- Minimum annual income needed to afford a typical home: $167,404 (7th highest of 50 states)

- Median household income (2019-2023): $94,952

- Est. monthly expenses for a typical home: $3,906 (7th highest of 50 states)

- Median home list price in October 2024: $644,450 (6th highest of 50 states)

- Avg. annual homeowners insurance premium: $119 (17th lowest of 50 states)

- Est. annual property tax payments: $4,891 (13th highest of 50 states)

- Effective property tax rate: 0.8% (25th lowest of 50 states)

West Virginia

- Minimum annual income needed to afford a typical home: $63,429 (the lowest of 50 states)

- Median household income (2019-2023): $57,917

- Est. monthly expenses for a typical home: $1,480 (the lowest of 50 states)

- Median home list price in October 2024: $245,000 (the lowest of 50 states)

- Avg. annual homeowners insurance premium: $83 (6th lowest of 50 states)

- Est. annual property tax payments: $1,347 (2nd lowest of 50 states)

- Effective property tax rate: 0.5% (13th lowest of 50 states)

Wisconsin

- Minimum annual income needed to afford a typical home: $108,285 (21st lowest of 50 states)

- Median household income (2019-2023): $75,670

- Est. monthly expenses for a typical home: $2,527 (21st lowest of 50 states)

- Median home list price in October 2024: $379,450 (21st lowest of 50 states)

- Avg. annual homeowners insurance premium: $100 (11th lowest of 50 states)

- Est. annual property tax payments: $5,242 (10th highest of 50 states)

- Effective property tax rate: 1.4% (10th highest of 50 states)

Wyoming

- Minimum annual income needed to afford a typical home: $121,988 (19th highest of 50 states)

- Median household income (2019-2023): $74,815

- Est. monthly expenses for a typical home: $2,846 (19th highest of 50 states)

- Median home list price in October 2024: $479,225 (19th highest of 50 states)

- Avg. annual homeowners insurance premium: $113 (16th lowest of 50 states)

- Est. annual property tax payments: $2,644 (17th lowest of 50 states)

- Effective property tax rate: 0.6% (14th lowest of 50 states)

The post The Cost of Homeownership Now Outpaces Median Incomes in Every State appeared first on 24/7 Wall St..