Tesla (TSLA) Price Prediction and Forecast

Shares of Tesla (NASDAQ: TSLA) fell by -3.97% on Wednesday, compounding shareholders woes after what has been a difficult start to the year. Over the past month, the stock has fallen -26.78%, and it is now down -39.40% since its six-month high on Dec. 17, 2024. Still, Tesla has gained 45.84% over the past year, leaving […] The post Tesla (TSLA) Price Prediction and Forecast appeared first on 24/7 Wall St..

Shares of Tesla (NASDAQ: TSLA) fell by -3.97% on Wednesday, compounding shareholders woes after what has been a difficult start to the year. Over the past month, the stock has fallen -26.78%, and it is now down -39.40% since its six-month high on Dec. 17, 2024.

Still, Tesla has gained 45.84% over the past year, leaving plenty of investors drawn to the Elon Musk-led EV market leader which has experienced a meteoric rise that’s resulted in a 22,618.75% gain since the company’s IPO on June 29, 2010 when it debuted at $17 per share — or roughly $1 when adjusting for stock splits.

Regardless, investors are more concerned with the stock’s future performance over the next one, five and 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Tesla’s own numbers, along with business and market development information that may be of help to our readers’ own research.

Key Points In This Article

- Tesla has continued to generate record revenues in spite of softness in the EV industry due to its vertically integrated expansion into related sectors.

- Besides EVs, Tesla has a robust and profitable battery and storage division, 6,000 locations, a growing chain of charging stations across the U.S. and a menu of AI developments large enough to qualify it for analyst inclusion in the AI category.

- Tesla’s Full Self Driving (FSD) AI-powered driverless cars are getting closer to an actual launch for Tesla’s Robotaxi, which would dramatically impact the transportation industry.

- For our best market-beating stock tips, check out 24/7 Wall Street’s “The Next NVIDIA”. It includes 3 Top Stock Picks poised to take off from the next breakthroughs in AI. One company is a ‘10X Moonshot’ that could become the dominant software player in AI.

Tesla’s Recent Stock Success

Tesla’s Model S became the best-selling plug-in electric car in both 2015 and 2016. The mass-market Model 3 sedan would follow, and the Model 3 would become the best-selling electric car from 2018 to 2021. The Model Y mass-market SUV version of the Model 3 made its debut in 2019, with deliveries commencing in 2020. Since then, TSLA has experienced incredible growth.

Coupled with the Tesla’s energy storage business as well as its charging station network, the company saw its revenues grow from

| Fiscal Year | Price | Revenues | Net Income |

| 2015 | $16.00 | $4.046B | -$888.7M |

| 2016 | $14.25 | $7.000B | -$674.9M |

| 2017 | $21.60 | $11.759B | -$1.962B |

| 2018 | $21.18 | $21.461B | -$976M |

| 2019 | $29.53 | $24.578B | -$862M |

| 2020 | $235.23 | $31.536B | $721M |

| 2021 | $352.26 | $53.823B | $5.519B |

| 2022 | $123.18 | $81.462B | $12.556B |

| 2023 | $248.48 | $96.773B | $14.997B |

| 2024 | $403.84 | $97.690B | $7.13B |

Key Drivers for Tesla’s Stock Performance

- Improved Margins: Tesla’s management is cutting manufacturing costs and expanding margins, trending with strong revenue and net income gains since 2020. Its Shanghai, China, and Berlin, Germany gigafactories should help Tesla cut a chunk of export-related red tape and tariffs for forthcoming EVs that will result in lower overseas sticker prices and enhanced sales.

- R&D Paying Off: Thanks to its FSD and Robotaxis R&D, Tesla is leading nicely ahead of GM’s Cruise and Alphabet’s Waymo. Chinese companies like Apollo Go and WeRide are viewed as better-equipped Robotaxi competitors, in a field that may explode in the upcoming future.

- Diversified Business Segments: Tesla’s Supercharger, energy and battery businesses have taken off strongly and further separated it from its EV peers as a company with many more technology irons in the fire.

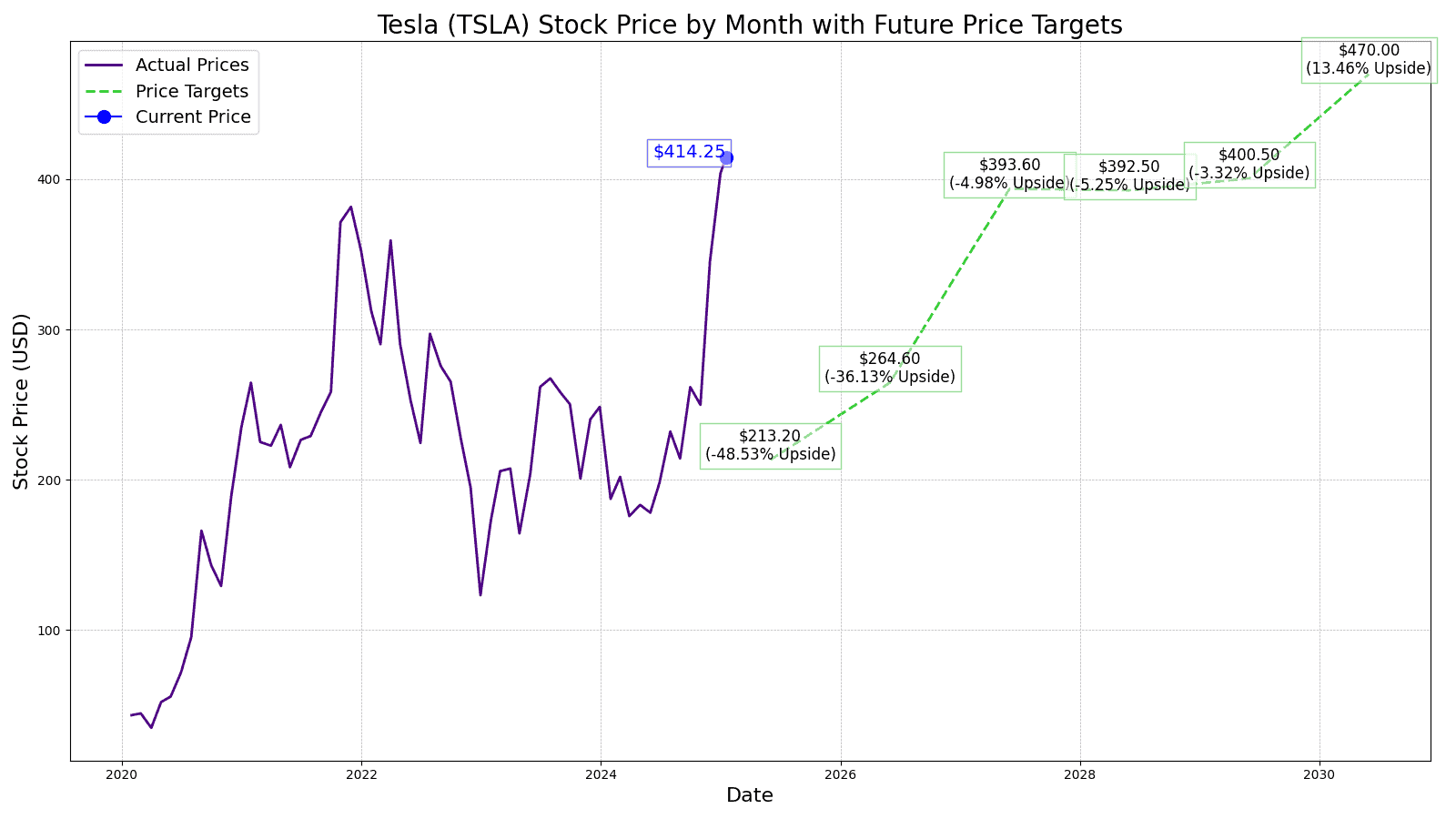

Tesla (TSLA) Price Prediction in 2025

According to Wall Street analysts, the consensus 12-month price target for Tesla is $357.68 per share, which is good for 22.99% upside potential from today’s closing price. The stock currently receives a consensus “Hold” rating.

However, 24/7 Wall Street’s 12-month Tesla price target for Tesla is $213.20, which represents downside potential of -26.68%. The mixed opinions likely stem from the unconventional way that Musk runs not only Tesla, but all of his companies. Fears over the potential for a domino effect, if negative events impact one to cause a spillover effect due to his mercurial temperament, are not unfounded. Additionally, his often negatively perceived public persona has contributed to lagging Tesla sales in European markets since late January.

Tesla (TSLA) Stock Forecast Through 2030

| Year | Normalized EPS | P/E Ratio | Projected Stock Price | % Change From Current Price |

| 2025 | $3.28 | 65 | $213.20 | -26.68% |

| 2026 | $4.41 | 60 | $264.60 | -9.00% |

| 2027 | $6.56 | 60 | $393.60 | 35.35% |

| 2028 | $7.85 | 50 | $392.50 | 34.97% |

| 2029 | $8.01 | 50 | $400.50 | 37.72% |

| 2030 | $9.40 | 50 | $470.00 | 61.62% |

The post Tesla (TSLA) Price Prediction and Forecast appeared first on 24/7 Wall St..