Tariffs are threatening the accuracy of fall fashion trends by forcing earlier clothing shipments amid supply-chain headaches, Urban Outfitters CEO says

“The further out someone tries to predict the future, the more incorrect the prediction will be,” one supply-chain expert said. “That's where we get into trouble with the fashion industry.”

- The fashion industry had a unique concern about the impact of tariffs. Continued uncertainty has pushed Urban Outfitters to move up shipments of its fall product, putting it at an increased risk of miscalculating fall fashion trends. Apparel retailers must strike a balance in giving themselves time to predict new styles, while also shipping inventory early enough to sell it all to consumers, Northeastern University professor Shawn Bhimani told Fortune.

President Donald Trump’s tariffs may mean that your new autumn sweaters may already be so last year.

The U.S.’s steep levies on clothing production giants like China and India is forcing retailers like Urban Outfitters to make supply-chain changes that may result in stocking inventories that don’t fully align with seasonal fashion trends.

Urban Outfitters chief financial officer Melanie Marein-Efron said the Philadelphia-based apparel retailer will likely have to pull forward shipments of its products for autumn as result of tariff concerns.

“While our teams continue to focus on increasing inventory turns, the uncertainty around tariffs means we are likely to bring in fall product a bit earlier,” Marein-Efron told investors on Wednesday following its first-quarter earnings report.

She added that because of tariffs, as well as to plan for future supply-chain disruptions, the retailer needed to plan to pull forward its fall inventory, which is less sensitive to changing fashion trends.

In order to save on costs, the company will shift its shipping method from air to sea, which will add about 30 days to the products’ delivery time. While Urban Outfitters may secure its fall inventory, the earlier shipment dates means it won’t have as much time to predict what styles consumers will want once the leaves start to change colors and temperatures cool.

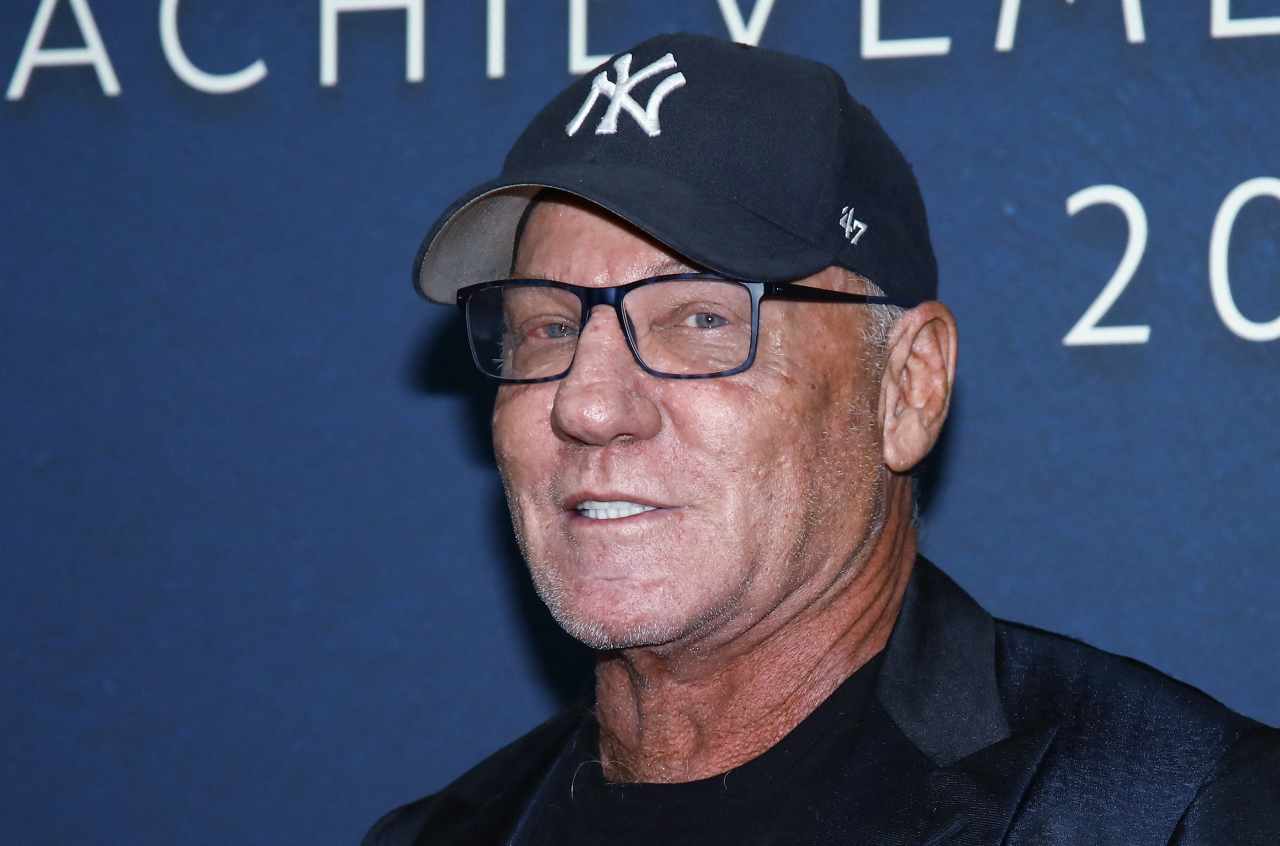

“There is always a risk as you go out in time that the fashion might not be as accurate as we would like it to be,” Urban Outfitters CEO Richard Hayne told investors.

As Urban Outfitters grapples with the ramifications of tariffs, so too do other retailers having to scramble to rearrange supply chains, as well as pull forward shipments of goods to dodge the impact of the levies. Logistics professionals warn whipsaw tariff policies are encouraging stockpiling behaviors, which may result in headaches down the line for retailers like shortages or inventory pile-ups.

URBN—the parent company of Urban Outfitters, as well as Anthropologie, Free People, and Nuuly—reported strong first-quarter earnings, posting 11% sales growth in the first quarter and a 5% increase in same-stores sales. Its quarterly revenue of $1.33 billion exceeded the $1.29 billion analysts expected.

Trouble for the fashion world

For the apparel industry, widespread tariffs represent a threat to the delicate balance retailers have in predicting what people will want to buy, and procuring those items on a timeline that will allow them to sell most of that inventory, according to Shawn Bhimani, assistant professor of supply chain and information management at Northeastern University.

“To mitigate the cost of tariffs, we are procuring inventory early or shipping it on a more economical ocean trade, and that means that we’re having to predict much earlier,” Bhimani told Fortune. “The further out someone tries to predict the future, the more incorrect the prediction will be. That’s where we get into trouble with the fashion industry.”

Retailers are also having to contend with consumers who may slow down their spending once tariff-induced price hikes go into effect. Combined with plenty of products that may not resonate with consumers, stores may be saddled with inventory or be forced to sell it to third-party vendors at a massive discount.

Retailers will weigh their options on how best to mitigate the impact of tariffs. Some may switch from ocean freight to the more expensive air freight to give themselves more time to assess consumer trends. Others may resort to delayed differentiation, shipping products to their facilities, but waiting on more seasonal-trends data to dye or alter pieces of clothing in bulk, for example, Bhimani said.

More broadly, many companies will look for new suppliers, or have candid conversations with current suppliers about their changing needs. The results of these conversations may be changes in “incoterms,” or rules that distinguish the responsibilities of buyers and sellers. Rather than a supplier shipping a product to a port, for instance, it may instead ship goods to a factory. Ultimately, Bhimani said, these changes in terms become a broader conversation around who pays for tariffs: the supplier, or the retailer.

The fashion industry is just one of many that has turned to expanding supply chains and stockpiling goods as a means of bracing for the impact of tariffs, the terms of which will likely continue to shift as they have since February. These near unanimous concerns have already caused foundational changes in global supply chains, Bhimani argued.

“We’re seeing this mass canvas, people canvassing around the world looking for alternative options and backup options,” he said. “That’s what’s really coming out here, is uncertainty has led to the need for diversification.”

This story was originally featured on Fortune.com