Surprising inflation, China news sends S&P 500 stumbling

The stock market fell amid inflation and China trade updates.

The stock market needs a new catalyst.

Until now, the S&P 500's rally since early April was built on the potential for sellers to be caught off guard by surprising trade deals. Since the benchmark index has rallied 21% after Trump paused reciprocal tariffs on April 9, fewer investors will likely be surprised by developments, and many may be disappointed with outcomes.

The possibility that tariff deals may be baked into stock prices appeared when a softer-than-expected May inflation report, alongside what should've been positive China trade news, fell flat. The S&P 500 posted early gains on the news, but reversed to close lower by the end of trading.

Related: CPI inflation report resets interest rate cut bets

The culprit? While CPI showed inflation was relatively tame last month, most still believe tariffs will cause inflation to reassert itself later this year. Advancing China and the U.S. negotiations are encouraging, but President Trump's comments regarding China tariffs are disheartening.

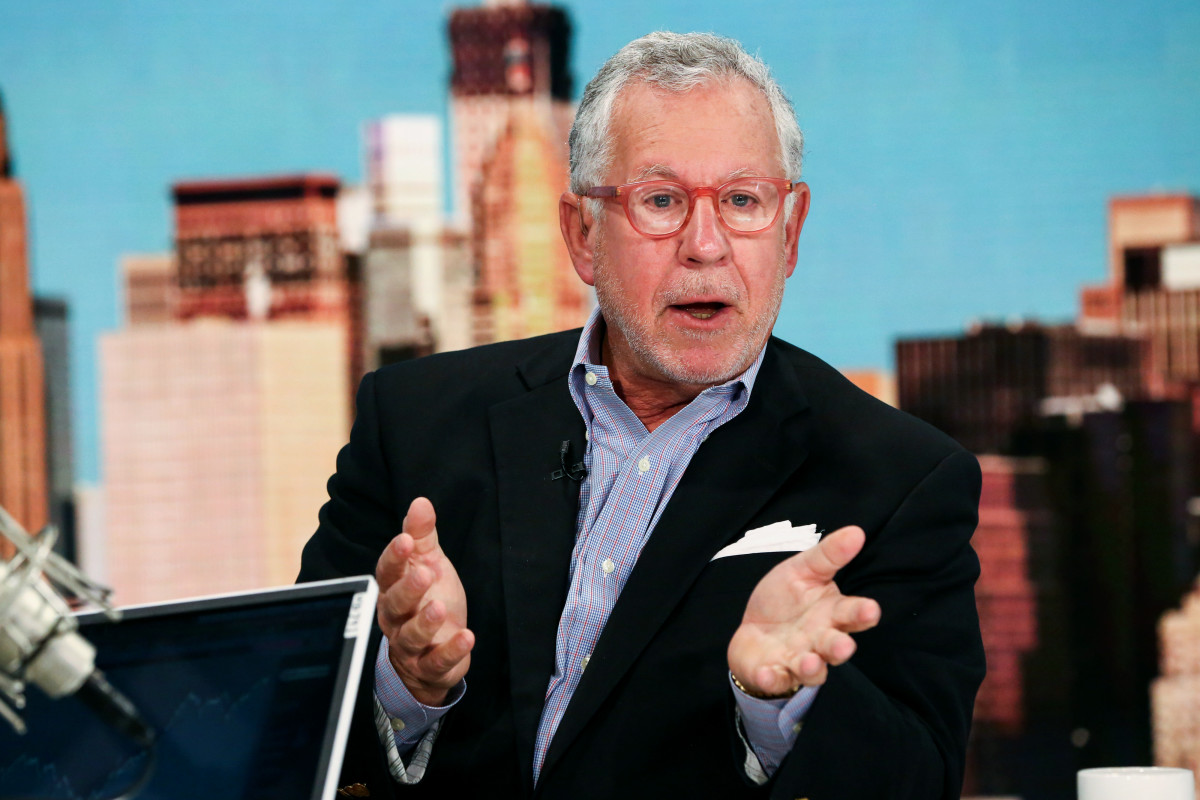

The "meh" reaction to the inflation and China trade news caught the attention of veteran hedge fund manager Doug Kass. Kass has been tracking the markets professionally since the 1970s, and he's the former research director for Leon Cooperman's Omega Advisors, one of the most famous hedge funds in history.

After witnessing today's reaction to the news, Kass offered up a frank opinion that may frustrate some investors.

Inflation was tame, but tariffs still present problems for the Fed

The Federal Reserve's mission is to balance inflation and unemployment. It does this by adjusting the Fed Funds Rate. When it increases rates, economic activity slows, crimping inflation but increasing unemployment. When it lowers rates, GDP expands, lowering unemployment but increasing inflation.

The dual mandate means that the Fed is in a pickle this year. After the most hawkish monetary policy since the 1980s caused inflation to drop below 3% from over 8% in 2022, the Fed switched gears, cutting rates in September, November, and December to lower unemployment, which has risen to 4.2% from 3.4% in 2023.

Related: Billionaire fund manager sends strong message on Fed Chair Powell's future

Hopes were for more cuts in 2025, but Fed Chair Powell was forced to pause additional reductions amid sticky inflation and the threat of tariffs driving prices higher.

As a result, many Wall Street economists have gone from expecting many cuts this year to none.

The CPI report showed that inflation in May only inched up 0.1% month over month, less than the 0.2% predicted. However, headline CPI showed inflation of 2.4% year over year last month, up from 2.3% in April. Meanwhile, core CPI, excluding volatile energy and food prices, was up 2.8% in May, matching April.

That's undoubtedly not barn-burning progress.

Nevertheless, some latched onto the lower-than-expected increase as evidence that the tariff impact on inflation is overblown, helping stocks in early action.

Also contributing to optimism was news out of London that a meeting between Chinese and U.S. officials, including Treasury Secretary Scott Bessent, had led to progress in uncorking supplies of rare earth minerals necessary for EVs and other next-gen technology.

President Trump heralded the deal, saying, "OUR DEAL WITH CHINA IS DONE, SUBJECT TO FINAL APPROVAL WITH PRESIDENT XI AND ME. FULL MAGNETS, AND ANY NECESSARY RARE EARTHS, WILL BE SUPPLIED, UP FRONT, BY CHINA. LIKEWISE, WE WILL PROVIDE TO CHINA WHAT WAS AGREED TO, INCLUDING CHINESE STUDENTS USING OUR COLLEGES AND UNIVERSITIES."

More Economic Analysis:

- Hedge-fund manager sees U.S. becoming Greece

- A critical industry is slamming the economy

- Reports may show whether the economy is toughing out the tariffs

However, details were scant, and Trump threw some cold water onto hopes that a trade deal would ease tariffs on Chinese goods, which already currently stand near 55% all-in.

"WE ARE GETTING A TOTAL OF 55% TARIFFS, CHINA IS GETTING 10%," he said on Truth Social.

Veteran fund manager casts doubt on stock market strength

Doug Kass has seen more than his share of good and bad tapes. He's survived the 1970s inflation, 1980s skyrocketing interest rates, the S&L crisis, Internet boom and bust, the Great Recession, Covid, and 2022's bear market.

Related: Fed official revamps interest-rate cut forecast for rest of this year

His experience led to him correctly predicting this year's steep sell-off and his accurate bet that stocks would bounce in early April after the drop.

He isn't convinced that the latest inflation progress is bullish for the S&P 500.

"The market has likely already discounted a better than expected Core CPI," wrote Kass on TheStreet Pro. "Market participants may interpret this number as being less exciting for equities because companies/manufacturers are likely eating the higher costs/tariffs, leading to concerns about lower margins and profits over the balance of the year."

Kass says that "swings in the trade balance" show importers stockpiled inventory ahead of Trump's April 2 "Liberation Day" tariff announcements. As a result, May data still reflects inventory brought in before tariffs hit.

"When that inventory runs out, they will likely have to put through price hikes and inflation will heat up," said Kass.

Kass is similarly unimpressed by the outcome of the China meeting.

"The China/U.S. tariff meeting ended up being a complete non-event (with no evidence of lowering tariffs)," wrote Kass.

Absent tariff relief, companies absorbing at least some additional costs will see earnings come under pressure. And since earnings growth is a cornerstone of stock prices and tariffs don't seem destined to retreat further anytime soon, there may be little impetus to support a rip-roaring rally.