Stock Market Today: Uptrend Stalls; Dollar General and Wells Fargo Higher, CrowdStrike Disappoints

Stocks ended higher, with Dollar General strong after its fiscal-Q1 report and Wells Fargo and CrowdStrike news after the close.

Final Update

Let's check on the final numbers, plus Wells Fargo.

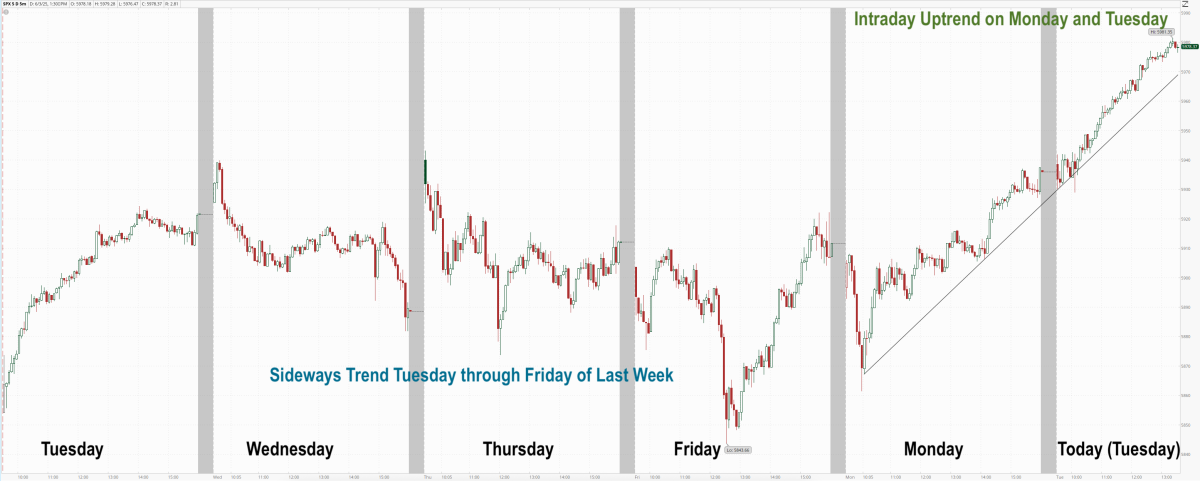

That uptrend I identified earlier in the day has more or less given way to sideways chop. That's not a bad thing. Stocks can't (shouldn't) go straight up, or else they tend to go straight down once they're overvalued.

Here's an updated version of that earlier S&P 500 chart zoomed in to just today's action:

So, what put a halt to the rally?

President Trump announced plans to increase steel and aluminum tariffs to 50% from 25% beginning tomorrow, June 4th. This, of course, will benefit U.S. steel manufacturers, but will hurt manufacturing companies that source their steel from outside of the U.S. Stocks began falling immediately after the news.

At the end of the day the Dow Jones Industrial Average was higher by 214.16 points, or 0.51%, to finish the session at 42,519.64, while the S&P 500 advanced 0.58% to close at 5,970.37. The tech-heavy Nasdaq climbed 0.81% to end the day 19,398.96.

Breadth remained unchanged from earlier in the day. About 71% of stocks were higher and 29% lower.

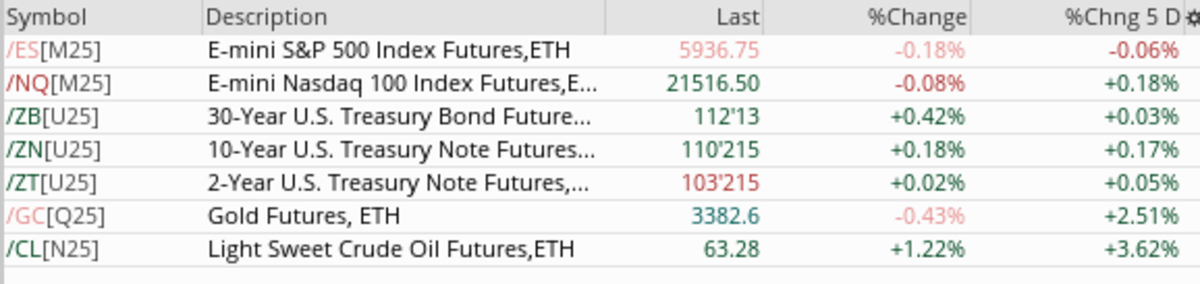

Gold was off 0.55%, while Crude Oil gained 1.3%.

What else do you need to know?

Wells Fargo (WFC) shares are trading over $77 in the after hours following news that the Fed has lifted the asset cap that was imposed in 2018 following disclosure of fraudulent activities. Under CEO Charlie Scharf, the company has improved oversight of employees and met all conditions for the asset cap to be removed.

And then there's CrowdStrike. The company missed earnings and revenue estimates for the first quarter. Investors had expected strong numbers today and bid shares up to 491.20, which was a new high. Anyone who bought CRWD over the last 6 days is bound to be upset now that they're trading around $455, down close to 7%.

Tomorrow morning, we'll be looking for Services PMI and ISM data, as well as the Fed's Beige Book in the afternoon.

Enjoy your evening.

Updated 2:43 p.m. EDT

Traders would look at this chart and say, "yup, that's an uptrend."

Specifically, we're looking at the intraday gyrations of the S&P 500 Index over the past week or so, and the past two days have done almost nothing but move higher.

Last week's trading was choppier. Lots of ups followed by downs. Not much movement overall.

Zooming out, you can see how choppy the market has been, specifically for the past two to three weeks, which I've highlighted in blue.

Now, there's a chance that traders get really bullish and stocks break out to new highs. We're just 170 points, about 3%, below the all-time high.

But as Helene Meisler has been suggesting over on TheStreet Pro, there's a high likelihood that we begin to see an increase in volatility. That could mean more choppiness. Or it could mean bigger swings up and down.

Time will tell.

Generally, more than 70% of stocks are higher, too, with Nvidia (NVDA) and Tesla (TSLA) being the strongest of the megacap names.

Why is the market higher? Well, one reason is that we were Jolted into it. The US Bureau of Labor Statistics released the Job Openings and Labor Turnover Survey, or Jolts, number, and it was stronger than expected.

For April, the latest job openings level was 7,391,000, around 200,000 above the previous month.

That's good news, showing that the labor market is holding up through the tariff talks and budget negotiations.

At last check the Dow was up 0.58%, the S&P 500 added 0.62% and the Nasdaq Composite tacked on 0.86%.

Treasury yields rose on the news as traders raised money to buy riskier stocks. The 10-year U.S. Treasury is currently yielding 4.46%.

Updated 11:05 a.m. EDT

Stocks gently higher; Dollar General jumps

In the first hour and a half stocks are gently higher, with the Dow ticking 0.11% into the green, the S&P 500 up 0.28% and the Nasdaq Composite up 0.61%.

Topping the S&P gainers is retailer Dollar General, (DG) which for the first quarter ended May 2 reported profit rose nearly 8% to $1.78 a share, net sales added 5.3% to $10.44 billion and same-store sales advanced 2.4%.

The Goodlettsville, Tenn., discount retailer also raised its outlook.

In a statement the company said: "While the company’s first-quarter 2025 financial results exceeded its internal expectations, uncertainty exists for the remainder of the year regarding the potential impact of tariffs on the business, and particularly on consumer behavior.

"The tariff environment remains highly dynamic, and the specific tariffs applicable to goods imported by the company and its suppliers into the U.S. continue to evolve."

It added that the stronger outlook "assumes the company will be able to mitigate a significant portion of the potential impact to its cost of goods from tariffs at currently implemented rates, but that consumer spending could be pressured by tariff-related price increases."

DG shares at last check were up 13%.

Constellation Energy (CEG) shares are close to 2% higher as the Baltimore energy supplier inked a 20-year deal to provide nuclear power from an Illinois plant to Meta Platforms.

Urvi Parekh, head of global energy at the parent of Facebook and Instagram, (META) said in a statement that "securing clean, reliable energy is necessary to continue advancing our AI ambitions.”

Stock Market Today

It's Tuesday, and it's time to look at the markets.

Today, we're expecting earnings from CrowdStrike (CRWD) after the close. After the close the $117 billion market-cap company is expected to report earnings of 66 cents a share.

CrowdStrike is working closely with Microsoft (MSFT) on threat-actor detection. According to TheStreet Pro's Stephen "Sarge" Guilfoyle, the two companies claim to have already deconflicted more than 80 adversaries, including state-sponsored actors from China and Russia.

This comes just a little late for me. A former coworker's LinkedIn account was recently hacked, and an unsuspecting me gave my phone number to the hackers.

I am now deluged with spam texts asking if I'm free for dinner and whether this is my number. So far, this phishing scheme is just annoying. But the big surprise was that I thought LinkedIn was more secure than Twitter (I know, X) or Facebook. It's not. Beware.

Let's look at today's markets.

Stock market futures are marginally lower. Yesterday was a low volume day, and there isn't much news on the horizon today to spark trading activity. The big question is whether today will be like yesterday, where we start lower but rally to close up on the day.

Additionally, as I reported yesterday, the number of stocks that were up was about the same as the stocks that were down. Kind of a dull day, unless you owned steel stocks or big tech.

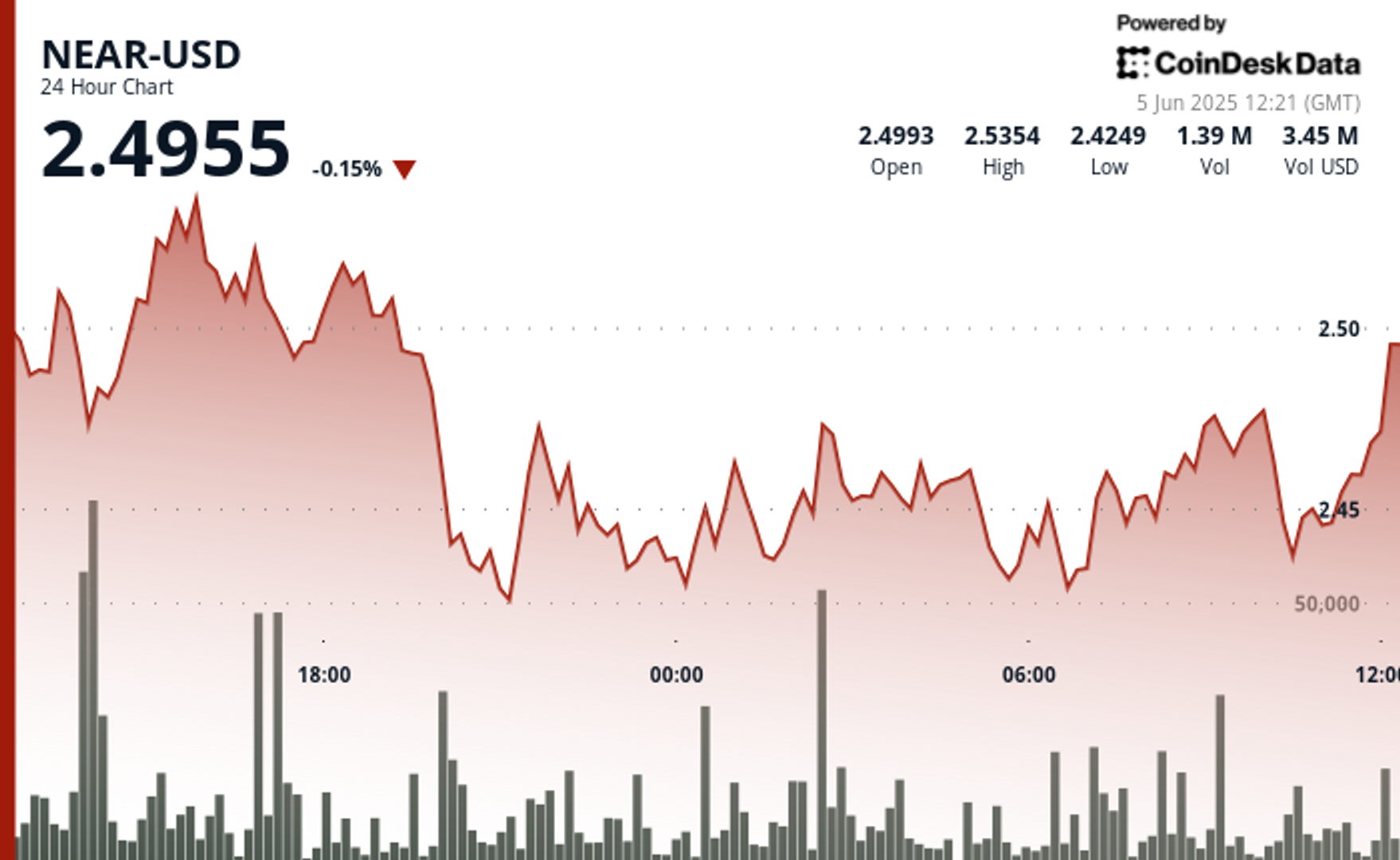

Here's a chart of the futures. Following the market close on Monday, futures began trading lower but bottomed around 4:30 a.m. EDT and have been rallying into Tuesday's market open.

Bonds, which remain higher, are beginning to struggle.

Gold and crude oil are higher.