Stock Market Today: Small caps defy the major indexes

The Russell 2000 is gently up while the three major indexes have eased.

Updated at 2:23 EDT

Are investors complacent or bored?

Stocks have traded in a tight, 0.3% range today. The S&P 500 is currently off 0.35%, in line with the Dow and Nasdaq. You know what's up? Small Caps! The Russell 2000 is gaining 0.29%, so not a big win but at least it's in the positive column.

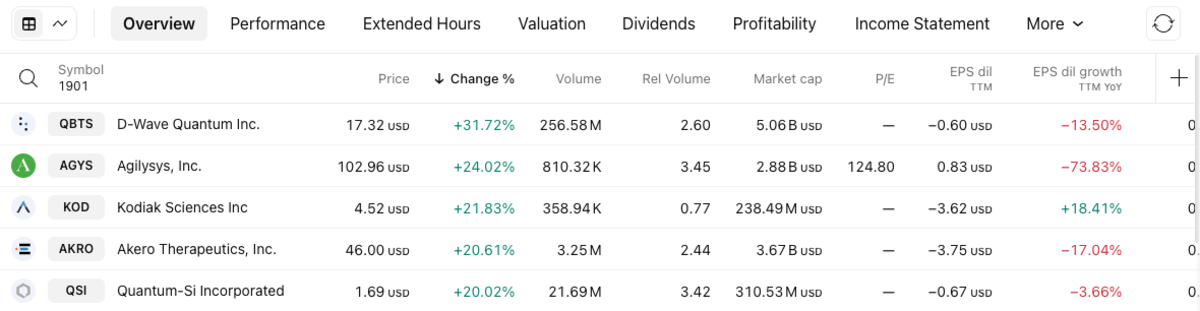

And it's not just penny stocks over there: $5 billion market cap D-Wave Quantum (QBTS) is leading the charge, up 32% today and continuing recent momentum on the heels of the release of its most advanced computer.

Here's a list of the top small-cap performers:

And let's finish this update with a chart of the S&P 500. As you can see, it's traded in a narrow range today.

The bottom panel is the S&P 500. The top panel is advancing issues vs. declining issues. The upper line, in pink, is the number of stocks that are down. The lower line in that panel is the number of stocks that are higher. Decliners have led advancers all day, and are currently leading by about 3:2.

Updated at 10:45 EDT

Sharing some content from TheStreet Pro's James "Rev Shark" DePorre in How I'm Trading as the Market Takes a Rest.

The market did a nice job of shrugging off the Moody’s downgrade of US debt on Monday, but there isn’t any positive news to keep the rebound going on Tuesday. All indices are in the red with breadth running 3400 gainers to 5600 decliners.

The biggest issue currently is that technical conditions are extended. When that happens, market participants tend to look for excuses to sell rather than buy. The most convenient excuse is concerns that the economy is slowing and that inflation is staying sticky. The cut in China tariffs helped to relieve some of the worries about stagflation, but more progress is needed on tariffs and trade deals to reassure the bulls.

Otherwise, it's worth taking a look at the drug companies. Pfizer (PFE) is the strongest performer in the S&P 100 today, on the heels of a $6 billion deal for China's 35Bio cancer drug. Bristol-Myers (BMY) is rallying, too. Both are trading near 1-year lows.

Updated at 9:15 EDT

Stocks are looking lower this morning, although futures are off the worst levels of the day. At last check S&P 500 futures were down 18 points or 0.3%. Nasdaq futures were off 82 points, or 0.46%.

Bonds are flat to higher with the yield on the US 10-year Treasury at 4.48%.

The big news is that JP Morgan Chase (JPM) Chief Executive Jamie Dimon says investors have become complacent about the sharp risks they face.

Between inflation, credit, and geopolitics, this is no time to take your eye off the ball.

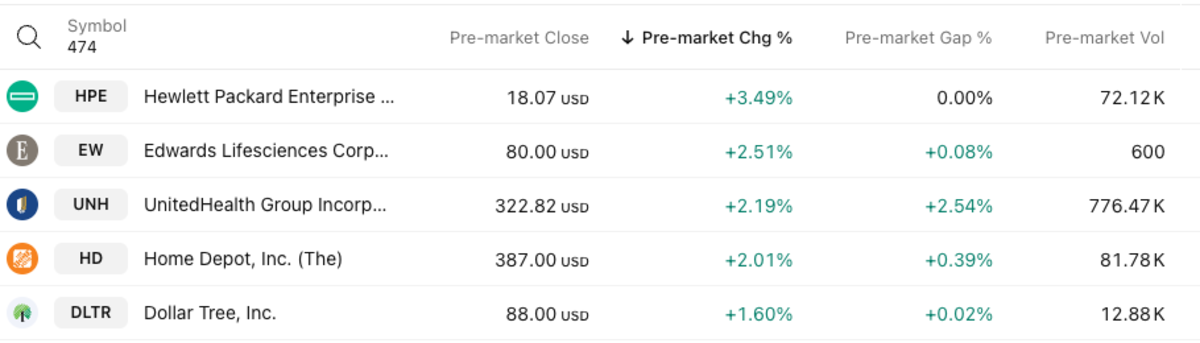

Premarket gainers:

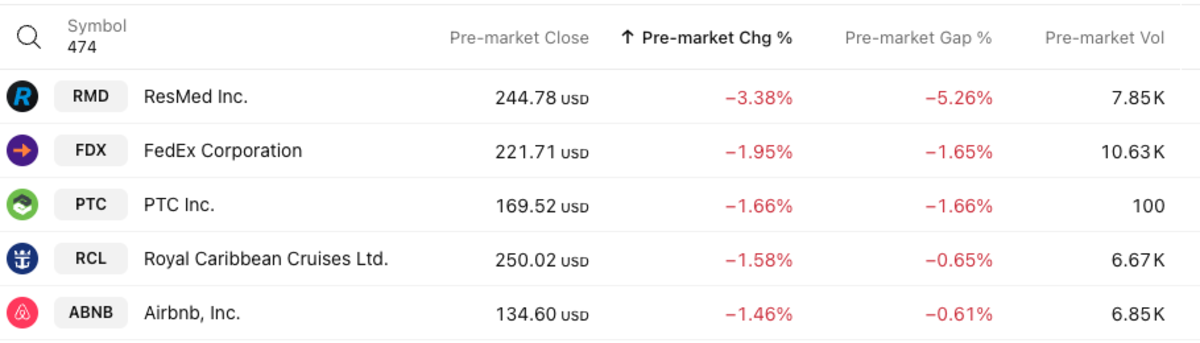

Premarket losers: