Stock Market Today: Despite lower rates, rally loses steam

But energy, utilities and real estate lagged even as interest rates faded. Some stocks, including Snowflake, surged.

Updated: 4:15 pm. ET

A day after stocks were just plain thumped, investors — and the bond market — relaxed, and the stock market recovered some of Wednesday's losses. For a while, anyway.

And then, because the market is so skittish — the trauma of the tariff crash — won't go away, the gains fell back.

The Dow Jones Industrial Average reached nearly to 42,100 but lost 232 points in just the last hour of trading, ending down a bit more than 1 point at 41,859. The Standard * Poor's 500 ended off 2 points to 5,842, but the Nasdaq Composite managed to end the day with a gain of 53 point 53,926.

It could have been worse because the bond market opened badly.

At about 830a.m. ET, the 30-year Treasury yield hit nearly 5.14%. The 10-year yield was at 4.67%. That pushed the rate on 30-year mortgages above 7%, at a time when sales are crimped by high prices and affordability.

But yields fell back. At 4 p.m. ET, the 30-year was down to 5.052%, and the 10-year yield was down to 4.54%.

The finish left the S&P 500 with three sectors up: Consumer Discretionary, Communication Services, and Info Tech stocks, one even (industrials) and the rest down.

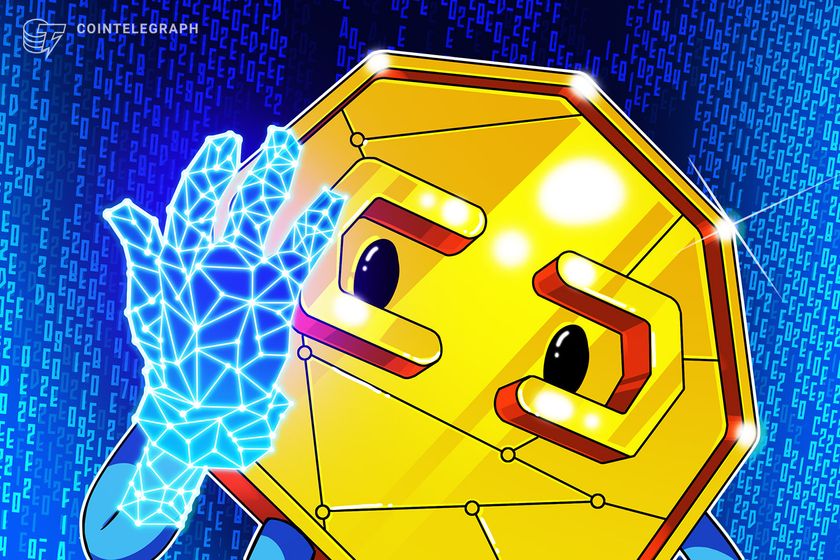

Coinbase Global (COIN) , the big crypto company, was the S&P leader, up 6.5% to $271.95. The move reflected bitcoin's jump to $111,794, which would be a record close if it holds.

Updated 1:20 p.m. ET

The Dow Jones industrials and S&P 500 were higher until about noon ET, then briefly fell to small losses.

The Dow has moved up again and is sporting a 70-point gain to 41,930. The S&P 500 is up eight points to 5,853.

The Nasdaq and Nasdaq-100 indices are still solidly higher.

One reason the Dow and S&P 500 may have slipped comes from deep in the S&P Global Flash Purchasing Managers Index report. The Index business confidence showed that average prices for goods and services jumped higher in May.

"At least some of the upturn in May can be linked to companies and their customers seeking to front-run further possible tariff-related issues, most notably the potential for future tariff hikes after the 90-day pause lapses in July," the report said.

In fact, the monthly price gains were the largest since August 2022.

- TheStreet Pro's Chris Versace offers more details on the report.

Oil prices move lower

Meanwhile, oil prices were lower on word that OPEC+ countries have agreed to boost production by 411,000 barrels a day. The group, which is affiliated with — but not part of —the Organization of Petroleum Exporting Countries, has boosted production by 411,000 barrels a day twice already in 2025.

The moves represent "a historic break with years of defending oil markets," Bloomberg News noted.

Crude oil was at $61.12 per 42-gallon barrel, down 45 cents on the day and down 22% from the Jan. 13 peak of $78.81 a barrel.

But retail gas prices are higher, with AAA’s national average at $3.195 a gallon going into the Memorial Day weekend. That’s up slightly from Wednesday but DOWN 11.5% a year ago.

Updated: 10:49 a.m.

Technology has emerged as primary market fuel in mid-morning trading.

Three sectors — Communications Services, Information Technology and Consumer Discretionary — are leading the Standard & Poor's 500 Index.