Stock Market Live June 13: S&P 500 (VOO) Tumbles as War Returns to Middle East

This article will be updated throughout the day, so check back often for more daily updates. Israeli warplanes struck multiple targets in Iran over the evening, killing senior Iranian military officers and nuclear scientists, damaging military and nuclear assets — and spooking investors around the globe. Iran has already retaliated with drone strikes on Israel […] The post Stock Market Live June 13: S&P 500 (VOO) Tumbles as War Returns to Middle East appeared first on 24/7 Wall St..

This article will be updated throughout the day, so check back often for more daily updates.

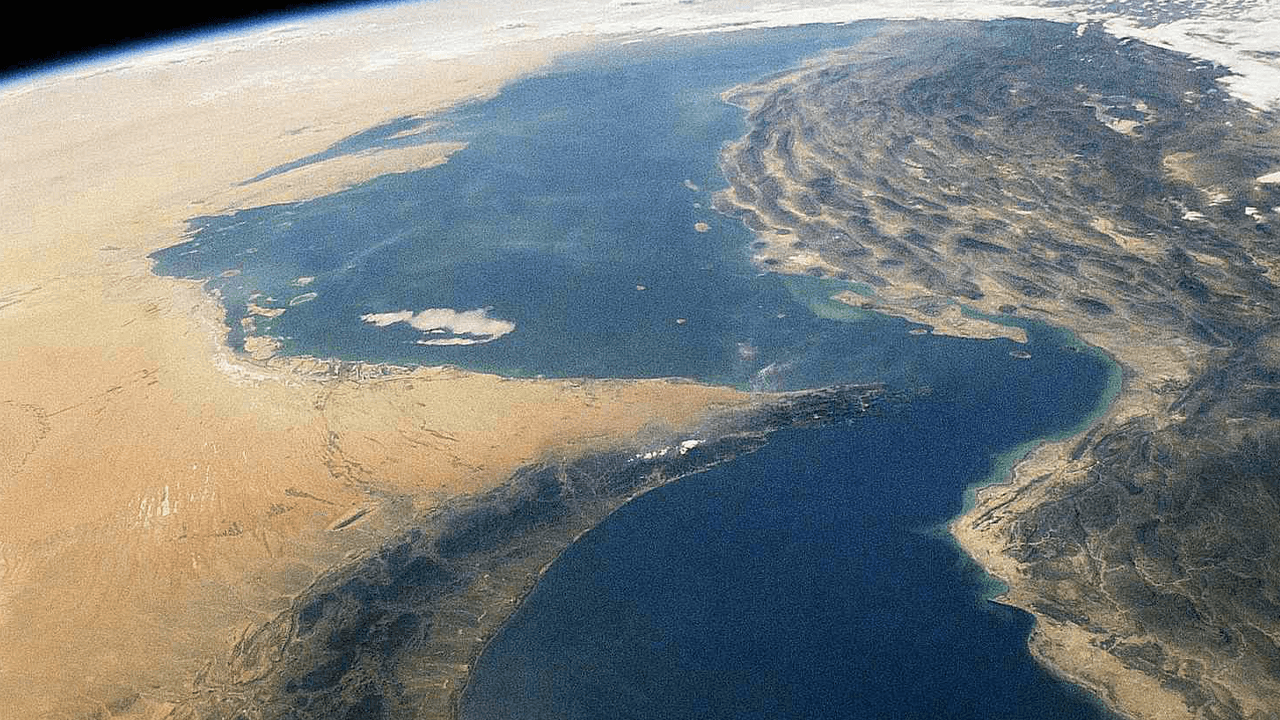

Israeli warplanes struck multiple targets in Iran over the evening, killing senior Iranian military officers and nuclear scientists, damaging military and nuclear assets — and spooking investors around the globe. Iran has already retaliated with drone strikes on Israel as the situation spirals out of control.

And the Vanguard S&P 500 ETF (NYSEMKT: VOO) is down 1% in premarket trading.

Conflict in the Middle East always raises worries about the security of oil supply, and this time is no different. Prices of both Brent and WTI crude oil spiked more than $5 per barrel this morning, up 7.9% for Brent, and 8.5% for WTI, from Thursday’s close.

Gold prices also moved higher, up 1.3% to $3,426.31 on the spot market. The US Dollar gained 0.5% against, for example, the safe haven Japanese Yen. And U.S. Treasury bond prices are rising as investors look for safe assets, pushing T-bill yields lower.

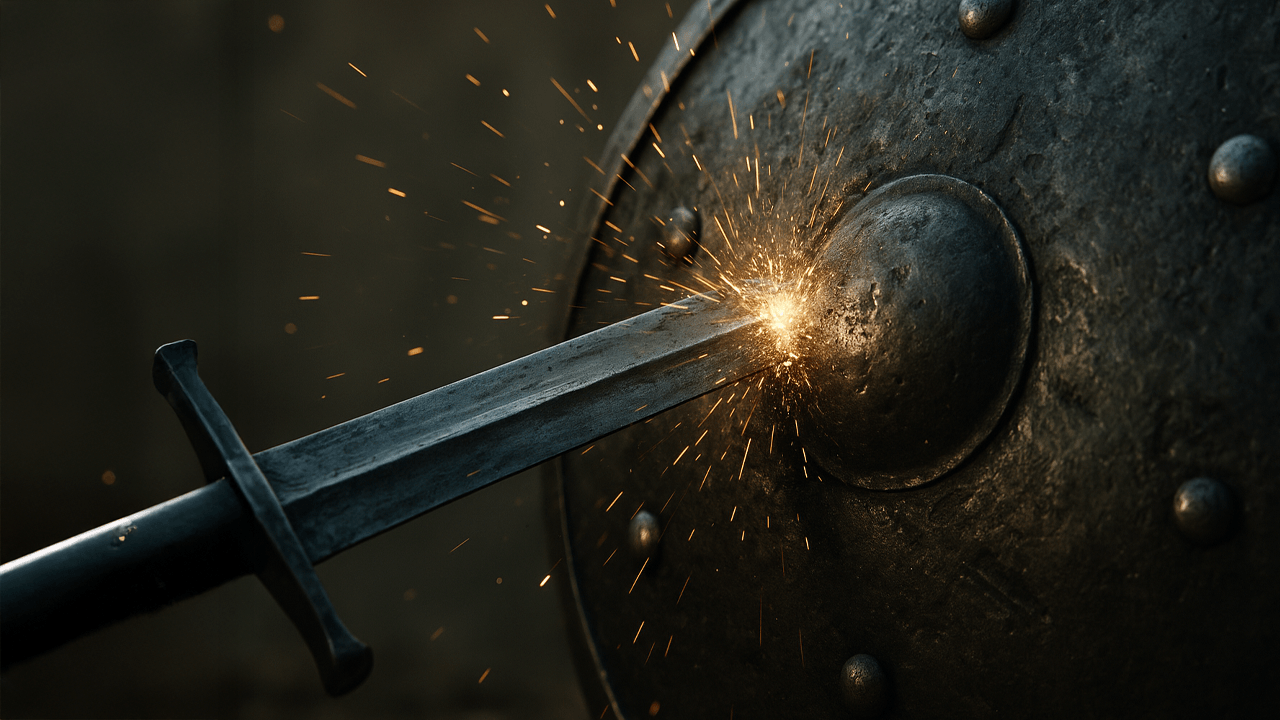

Defense stocks

Another logical response to war worries is for investors to buy defense stocks — and they are. In pre-market trading, General Dynamics (NYSE: GD) is up 2.9%, Lockheed Martin (NYSE: LMT) is gaining 3.1%, and RTX Corporation (NYSE: RTX) is doing best of all, up 2.6%.

Earnings

In more run-of-the-mill earnings news, S&P 500 component company Adobe Systems (Nasdaq: ADBE) reported its fiscal Q2 financial results last night. Earnings came in at $5.06 per share, and revenue was $5.9 billion, both numbers better than expected. Guidance was also good, with Adobe forecasting another earnings beat in Q3.

Furniture seller RH (NYSE: RH) also beat expectations last night, reporting a $0.13 per share Q1 profit where analysts had forecast a $0.07 per share loss. Only revenue came in a bit below expectations at $814 million.

The post Stock Market Live June 13: S&P 500 (VOO) Tumbles as War Returns to Middle East appeared first on 24/7 Wall St..