Rivian Automotive (NASDAQ: RIVN) Stock Price Prediction for 2025: Where Will It Be in 1 Year (June 4)

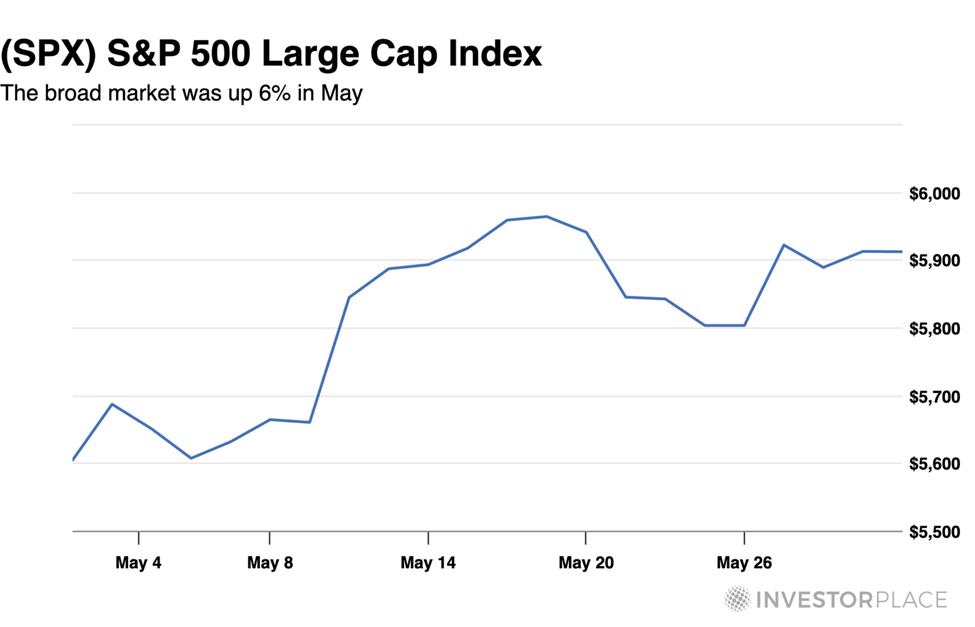

Shares of Rivian Automotive Inc. (NASDAQ: RIVN) have retreated 7.2% over the past five trading sessions, reducing the stock’s year-to-date gain to 8.05%. After the recent first-quarter earnings report and downbeat guidance, some Wall Street analysts have downgraded the stock or decreased their price targets. Rivian, a prominent electric vehicle (EV) manufacturer, is striving to […] The post Rivian Automotive (NASDAQ: RIVN) Stock Price Prediction for 2025: Where Will It Be in 1 Year (June 4) appeared first on 24/7 Wall St..

Shares of Rivian Automotive Inc. (NASDAQ: RIVN) have retreated 7.2% over the past five trading sessions, reducing the stock’s year-to-date gain to 8.05%. After the recent first-quarter earnings report and downbeat guidance, some Wall Street analysts have downgraded the stock or decreased their price targets.

Rivian, a prominent electric vehicle (EV) manufacturer, is striving to regain momentum after its first-quarter earnings report on May 6. Despite surpassing Wall Street’s expectations with adjusted losses of $0.48 per share versus analyst expectations of $0.92 per share, and posting revenue of $1.24 billion compared to the $1.01 billion forecast, the stock fell almost 6% the next day, closing at $12.72 per share. This reflected a year-to-date loss of 4% and a 90% decline from its November 2021 IPO high.

24/7 Wall St. Key Points:

-

The EV market is expected to grow at a compound annual growth rate (CAGR) of 32% through 2030, but Rivian Automotive Inc. (NASDAQ: RIVN) forecasts lower deliveries for 2025 than in 2024.

-

After reporting first-quarter earnings, the company has now seen consecutive quarters of positive gross profit, and its cash position remains strong.

-

If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. This report breaks down AI stocks with 10x potential and will give you a huge leg up on profiting from this massive sea change.

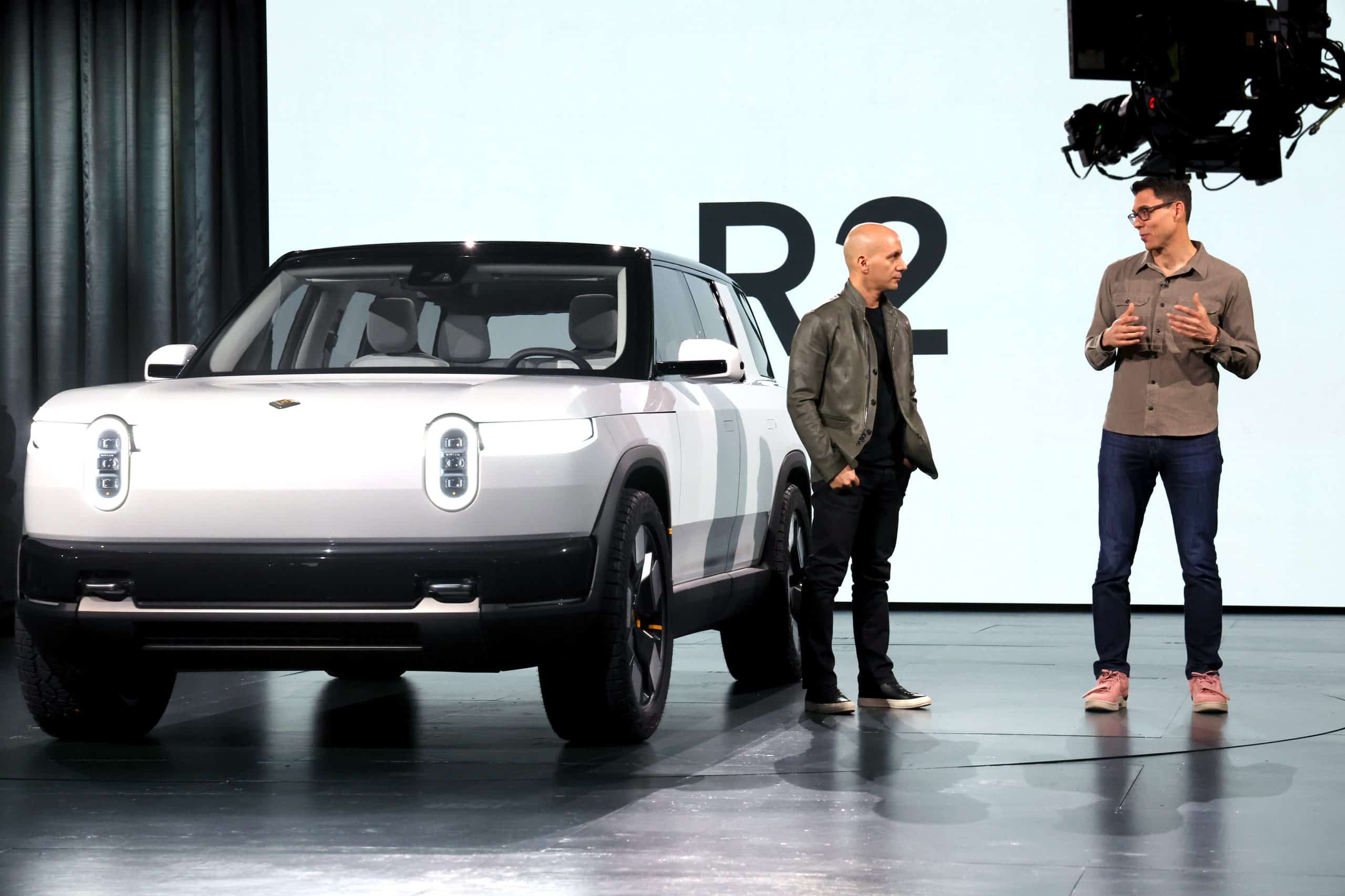

Still, the stock has trended upward recently despite facing challenges from reduced delivery targets and tariff pressures. But it is countering those headwinds with cost efficiencies, strategic partnerships, and the anticipated R2 launch. 24/7 Wall St. conducted some analysis to give investors a better idea of where they can expect the stock to be in a year. Let’s take a look at whether Rivian can overcome its hurdles and return to growth.

Why Invest in Rivian?

Rivian is grappling with significant obstacles. First-quarter deliveries fell to 8,640 vehicles from 14,183 in the fourth quarter. A supply shortage in its Enduro motor system had an impact, and Los Angeles wildfires affected demand in a key market. The company lowered its 2025 delivery guidance to 40,000 to 46,000 vehicles from 46,000 to 51,000. It cited tariff uncertainties under the Trump administration, which could raise per-vehicle costs by thousands due to imported parts like steel, lithium-ion batteries, and rare earth minerals. The potential repeal of federal EV tax credits further threatens demand.

Rivian is still losing a lot of money on every car it builds, even if it was able to reduce the per-share vehicle losses from $43,000 in Q4 to $38,798 in Q1. Moreover, it is likely car buyers front-loaded their purchases into the first quarter to beat any tariffs. Sales for the current quarter — and possibly the third quarter — could be weak.

Still, a $5.8 billion joint venture with Volkswagen, with $1 billion expected by June 2025, bolsters Rivian’s $7.2 billion in cash, equivalents, and short-term investments. The R2, a $45,000 midsize SUV set for 2026 production in Illinois, targets broader appeal, while plant upgrades — including a planned month-long shutdown in the second half of 2025 — aim to boost efficiency by 30%.

Further, the EV market is expected to grow at a 32% CAGR through 2030, though Rivian projects full-year 2025 revenue of $4.7 billion to $4.9 billion, which at the midpoint is down from $4.97 billion last year. The hope is that the new R2 release and fleet sales could boost revenue further.

For its part, Rivian has now seen consecutive quarters of positive gross profit. The EV maker just completed a 1.2 million sq. ft. manufacturing facility in Normal, Illinois, with plans for another facility in Georgia underway. That second facility could add an additional 400,000 units of annual capacity. As of the end of the first quarter, the company reported $7.2 billion in cash, cash equivalents and short-term investments.

Rivian as a Company

In its recent earnings call, Rivian reported $206 million of gross profit, making it the second consecutive quarter the company has seen positive gross profit figures. In order to address some challenges, the company also announced capex guidance of $1.8 billion to $1.9 billion to help it address issues about its lagging deliverables.

More recently the company said it aims to raise $1.25 billion through a private bond sale to refinance 2026 debt. And it said it would invest nearly $120 million in a new facility in Illinois to fortify its supply chain and increase production capacity for R1 and R2 models.

There are lingering concerns about how tariffs will impact Rivian, though. Material costs are expected to be elevated, equating to a few thousand dollars of impact per unit produced in 2025. Additionally, the company — despite seeing positive gross profit — has recorded adjusted EBITDA losses of $329 million, which it attributes to ongoing investment in R2 and key technologies.

Despite the company manufacturing 100% of its vehicles in the U.S., tariff uncertainty presents a challenge to near-term growth prospects. But Rivian isn’t focusing strictly on individual consumers. In its first quarter, the company announced a partnership with HelloFresh, which has incorporated 70 Rivian Commercial Vans into its fleet. The endeavor marks the first major fleet customer for the EV maker since van sales opened more broadly earlier in 2025.

Rivian as a Stock

Since its 2021 IPO, Rivian’s stock has been volatile, soaring to $180 before crashing 90%. After hitting a year-to-date low of $10.36 in April, it rebounded in May, supported by first-quarter gross profit and Volkswagen funding. The share price is down 88.0% since going public.

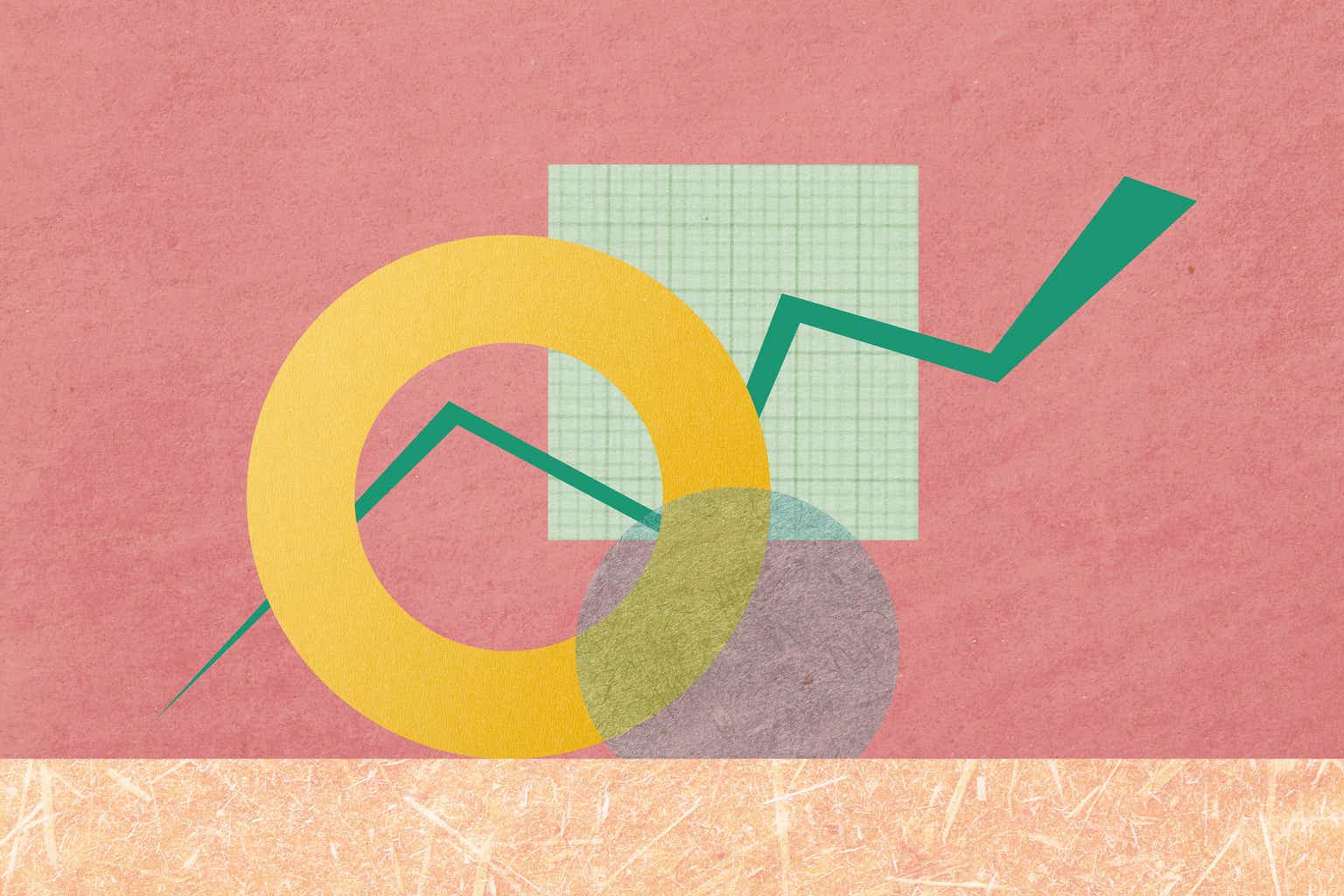

Analyst sentiment remains cautious, with a consensus Hold rating from 29 analysts. Their average price target of $14.73 per share implies nearly 2% downside. Targets range between $7.05 and $23.00 per share.

Piper Sandler recently downgraded Rivian stock to Neutral, citing tariff risks. Wedbush lowered its target to $18 per share, though it is still optimistic about R2. Rivian’s cash reserves show it has money to keep from going out of business anytime soon. However, substantial, ongoing losses reflect the long-term profitability challenges it faces. Other analysts are more bullish, with Stifel’s Stephen Gengaro raising his price target to $18 from $16 and maintaining a Buy rating.

Institutional investors hold 43.9% of the company’s outstanding shares. Incidentally, the largest holder of Rivian stock is not Vanguard, BlackRock, or another financial services firm. It is Amazon.com Inc. (NASDAQ: AMZN), which holds more than 158 million shares.

| Estimate | Price Target | Change From Current Price |

| Low | $7.05 | −51.2% |

| Median | $14.73 | −1.9% |

| High | $23.00 | 59.2% |

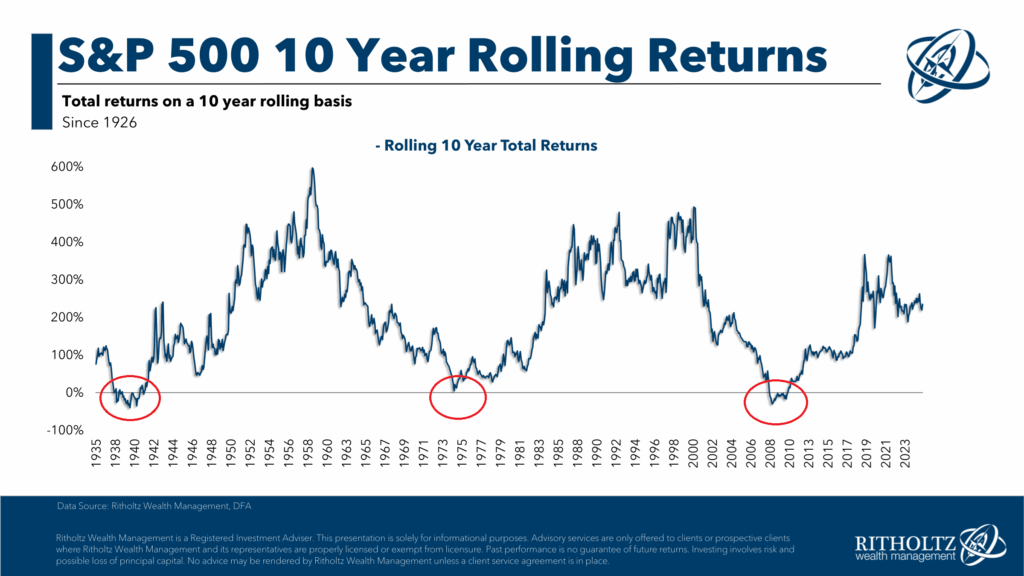

Rivian’s cost efficiencies, gross profit milestone, and R2 launch position it for growth. Yet, tariff uncertainties and demand softness require investor caution. With 32% projected EV market growth and strategic partnerships, Rivian could achieve modest delivery gains in 2025. Its cash buffer and Volkswagen deal offer some stability, but execution risks remain. Rivian should only be considered a speculative buy for risk-tolerant investors betting on its long-term EV market role.

24/7 Wall St.’s 12-month price target for Rivian Automotive is bearish at $13.20 per share. That represents 8.7% downside potential from the stock’s current price. Those figures are based on Rivian facing existing weakness in the EV market due to sales having been pulled forward into the first quarter and the new R2 not due out till next year. We see projected growth rates allowing revenue to rise from $4.8 billion in 2025 to $9.6 billion in 2030, alongside net losses improving from $4.69 per share in 2025 to break even by 2030.

I Was About to Buy a Rivian, but These Eight Factors Scared Me Off

The post Rivian Automotive (NASDAQ: RIVN) Stock Price Prediction for 2025: Where Will It Be in 1 Year (June 4) appeared first on 24/7 Wall St..