Prediction: Lucid Group Stock Is a Buy Before Aug. 4

Lucid Group (NASDAQ: LCID) stock has been volatile so far in 2025, with shares gyrating between $2 and $3.50. And while shares look expensive according to some metrics, sales growth is expected to explode higher in both 2025 and 2026. In fact, there are three compelling reasons to consider buying more Lucid shares before the company's next earnings call, which is expected to occur sometime around Aug. 4.In general, investing in electric car stocks can be tricky. But the upside potential is clearly gigantic. Just take a look at Tesla's historic rise. Since 2010, Tesla shares have risen in value by more than 26,000%. Yet over that time period, more than a dozen EV start-ups have gone bankrupt. What determines whether an EV start-up becomes the next Tesla rather than go bankrupt? As Tesla has proven, one of the keys is to release new vehicles, especially affordable ones like the Model Y and Model 3. That's exactly what Lucid is hoping to replicate in the coming years.Continue reading

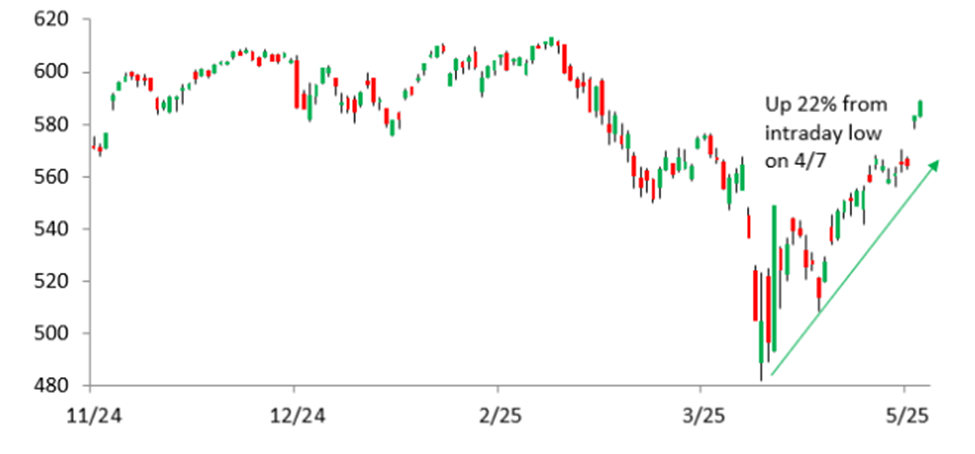

Lucid Group (NASDAQ: LCID) stock has been volatile so far in 2025, with shares gyrating between $2 and $3.50. And while shares look expensive according to some metrics, sales growth is expected to explode higher in both 2025 and 2026. In fact, there are three compelling reasons to consider buying more Lucid shares before the company's next earnings call, which is expected to occur sometime around Aug. 4.

In general, investing in electric car stocks can be tricky. But the upside potential is clearly gigantic. Just take a look at Tesla's historic rise. Since 2010, Tesla shares have risen in value by more than 26,000%. Yet over that time period, more than a dozen EV start-ups have gone bankrupt.

What determines whether an EV start-up becomes the next Tesla rather than go bankrupt? As Tesla has proven, one of the keys is to release new vehicles, especially affordable ones like the Model Y and Model 3. That's exactly what Lucid is hoping to replicate in the coming years.