Prediction: Buying Delta Air Lines Stock Today Will Set You Up for Life

No one should be under any illusions that the air travel market isn't under some pressure right now. It is. Still, the long-term case for investing in a higher-quality airline like Delta Air Lines (NYSE: DAL) remains undiminished, and some of the forces that created the weakness are now strengthening the case for buying the stock. Here's why buying Delta stock can set you up for many years of profitable income.Unfortunately, the escalation in trade conflicts and tariff actions has had a negative effect on the travel market in 2025. CEO Ed Bastian noted on the last earnings call in April that "given broad economic uncertainty around global trade, growth has largely stalled" with "softness in both consumer and corporate travel" in Delta's main cabin. As such, Delta's management elected not to update on its full-year guidance.While that's not a good sign, it's crucial to note Delta's and other airlines' reactions to events, as they help support the buy case for the stock. Simply put, Delta is planning to reduce its expected capacity growth in the second half to align supply with demand. United Airlines is also decreasing its international and domestic capacity relative to previous expectations in response to market conditions.Continue reading

No one should be under any illusions that the air travel market isn't under some pressure right now. It is. Still, the long-term case for investing in a higher-quality airline like Delta Air Lines (NYSE: DAL) remains undiminished, and some of the forces that created the weakness are now strengthening the case for buying the stock. Here's why buying Delta stock can set you up for many years of profitable income.

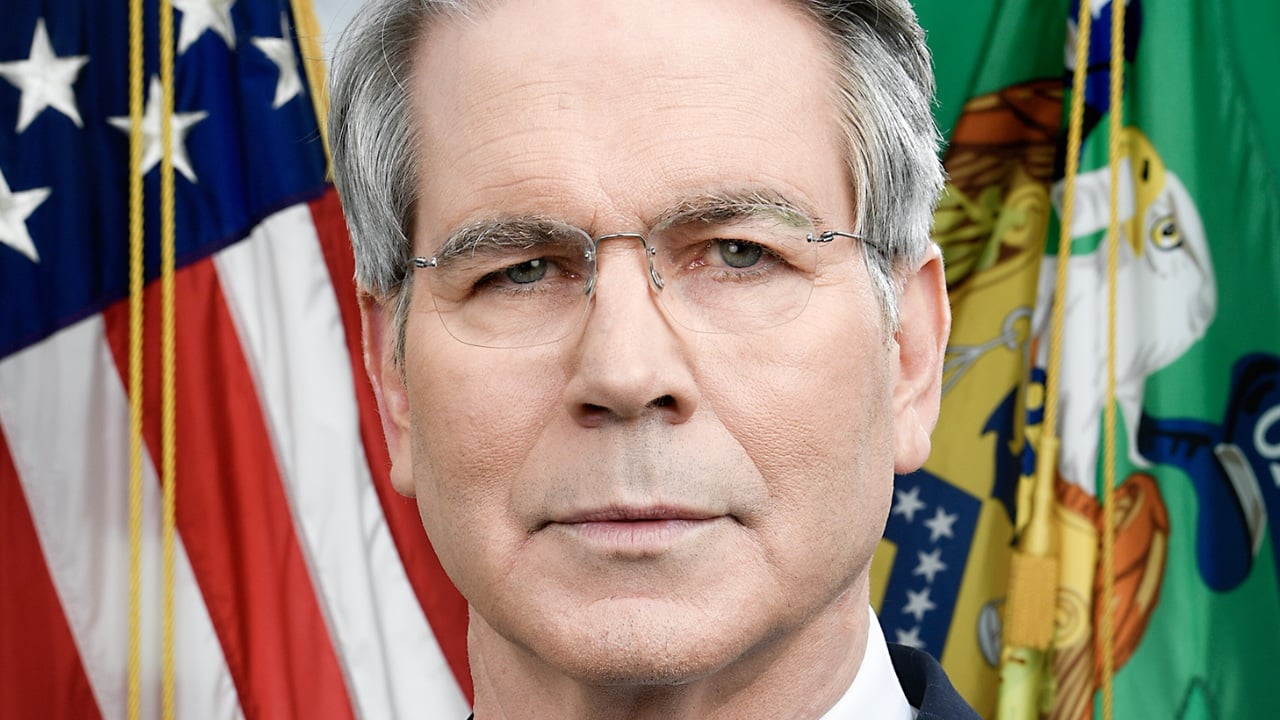

Unfortunately, the escalation in trade conflicts and tariff actions has had a negative effect on the travel market in 2025. CEO Ed Bastian noted on the last earnings call in April that "given broad economic uncertainty around global trade, growth has largely stalled" with "softness in both consumer and corporate travel" in Delta's main cabin. As such, Delta's management elected not to update on its full-year guidance.

While that's not a good sign, it's crucial to note Delta's and other airlines' reactions to events, as they help support the buy case for the stock. Simply put, Delta is planning to reduce its expected capacity growth in the second half to align supply with demand. United Airlines is also decreasing its international and domestic capacity relative to previous expectations in response to market conditions.