Phillips 66 and Elliott’s contentious proxy battle ends in split vote over fight to break up energy giant

Activist Elliott Investment Management successfully gained a foothold on the Phillips 66 board despite split voting results.

The barroom brawl of a boardroom fight between Phillips 66 and activist investor Elliott Investment Management to break up the massive energy company concluded May 21 with a split vote and both sides declaring victory.

With four board positions up for grabs, Phillips 66 and Elliott each claimed two seats amid Elliott’s campaign to force Phillips 66 to sell or spin off its petrochemical and midstream pipeline businesses and focus on its legacy refining unit. The battle pits one of the energy sector’s most storied players against arguably the most influential activist fund manager in the world, led by billionaire Paul Singer.

On a 14-person board chaired by CEO Mark Lashier, the future of Phillips 66 remains murky, but the vote is significant because no activist at an S&P 500 company had successfully won a board seat in at least 15 years without support of one of the big three index funds—BlackRock, Vanguard, and State Street, according to Insightia.

While Elliott’s campaign was backed by prominent proxy advisory firms Institutional Shareholder Services, Glass Lewis, and Egan-Jones, Phillips 66’s top three passive investors—the big three index funds—all sided with the company.

Elliott called the vote a clear mandate for change.

“Today’s vote sends a clear message: Shareholders demand meaningful change at Phillips 66,” Elliott said in a prepared statement.

On the other hand, Lashier called the vote supportive of maintaining Phillips 66’s current integrated structure.

“We welcome our new directors and look forward to working constructively as a board,” Lashier said in a statement. “This vote reflects a belief in our integrated strategy and a recognition that our early results do not yet reflect the full potential of our plan or the value inherent in this business.”

The fight continues

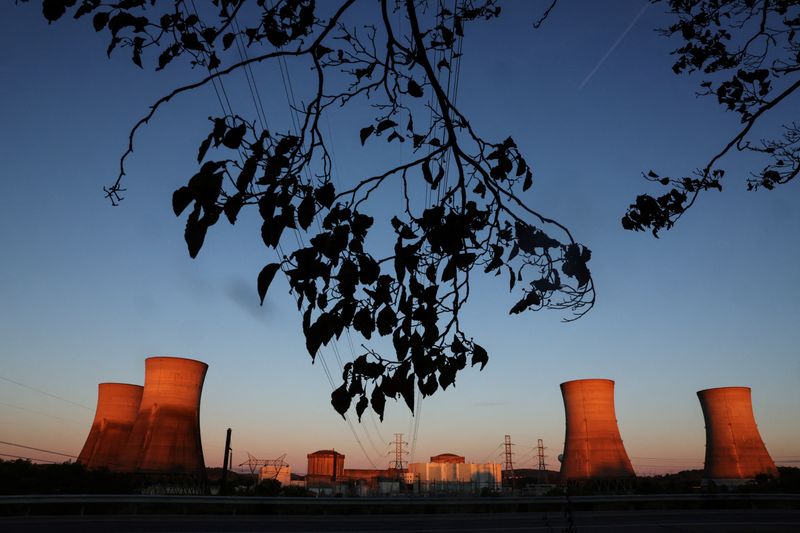

Elliott owns a nearly 6% stake in Phillips 66 and has pushed for major change, arguing that Phillips 66 has performed below peers such as Marathon Petroleum and Valero Energy. Likewise, Chevron has expressed an interest in buying out Phillips 66’s stake in its Chevron Phillips Chemical joint venture, which Lashier has resisted to this point.

Breaking up the company runs counter to Phillips 66’s strategy of late to grow its midstream pipeline business, especially in natural gas liquids (NGLs), such as propane, butane, and ethane—the primary petrochemical feedstock, which Phillips 66 sees as its largest growth potential.

Lashier argues Phillips 66 is in the early stages of its transformation strategy with refining improvements already demonstrated and that it needs to stay the course.

The two Elliott nominees elected were Sigmund “Sig” Cornelius, who recently retired as the president of Freeport LNG, and Michael Heim, an operating partner with Stonepeak who also was a founder and president of the Targa Resources midstream pipeline giant.

Elliott said Cornelius and Heim will aim to “improve operational execution and share-price performance, enhance corporate governance and help set a strategic course that can unlock Phillips 66’s full value-creation potential.”

On the Phillips 66 candidate slate, Robert Pease was reelected, and Harbour Energy Chief Operating Officer Nigel Hearne was added to the board.

Pease’s reelection stands out because he was originally backed by Elliott before being opposed this year.

Elliott first reached out to Phillips 66 in late September 2023. They reached a deal and détente—after Elliott privately threatened to start a proxy fight with six board nominees—naming Pease, former CEO of refiner Motiva Enterprises, to the board in mid-February 2024.

But Elliott alleged Pease flipflopped and supported Lashier as chairman when Elliott wanted a non-executive chair. With Pease’s seat up for grabs, Elliott took aim at his as well when the proxy fight escalated earlier this year.

Phillips 66 is making some divestments though, even if they were ones the company expressed a willingness to make last year. Just last week, Phillips 66 agreed to sell 65% stakes in its Germany and Austria retail fueling business to a consortium led by Energy Equation Partners and Stonepeak that will bring in $1.6 billion in pre-tax cash proceeds, giving the businesses a total enterprise value of $2.8 billion. The deal includes 970 retail fueling sites, of which 843 are JET-branded stores.

Phillips 66 said the proceeds will go toward debt reduction and shareholder returns.

Last fall, Phillips 66 also sold off its Switzerland and Lichtenstein businesses.

This story was originally featured on Fortune.com