My 5 Favorite Stocks To Buy Right Now

Recent optimistic headlines have given a boost to the stock market and equities are inching higher. There’s hope that the U.S. and China will resolve tariff-related issues and consumer expectations for inflation are easing. Additionally, the earnings season has ended and has been a fairly positive period. Stocks showed high volatility at the beginning of […] The post My 5 Favorite Stocks To Buy Right Now appeared first on 24/7 Wall St..

Here are five growth stocks with a significant upside potential.

Besides the capital appreciation, a few of these stocks also pay dividends and are set for long-term growth.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

Key Points

Recent optimistic headlines have given a boost to the stock market and equities are inching higher. There’s hope that the U.S. and China will resolve tariff-related issues and consumer expectations for inflation are easing. Additionally, the earnings season has ended and has been a fairly positive period. Stocks showed high volatility at the beginning of the year but it looks like stability is on the horizon. The second half of the year could be much better and some of my favourite stocks could soar higher. If you’re planning to upgrade your portfolio, here are five stocks to buy right now.

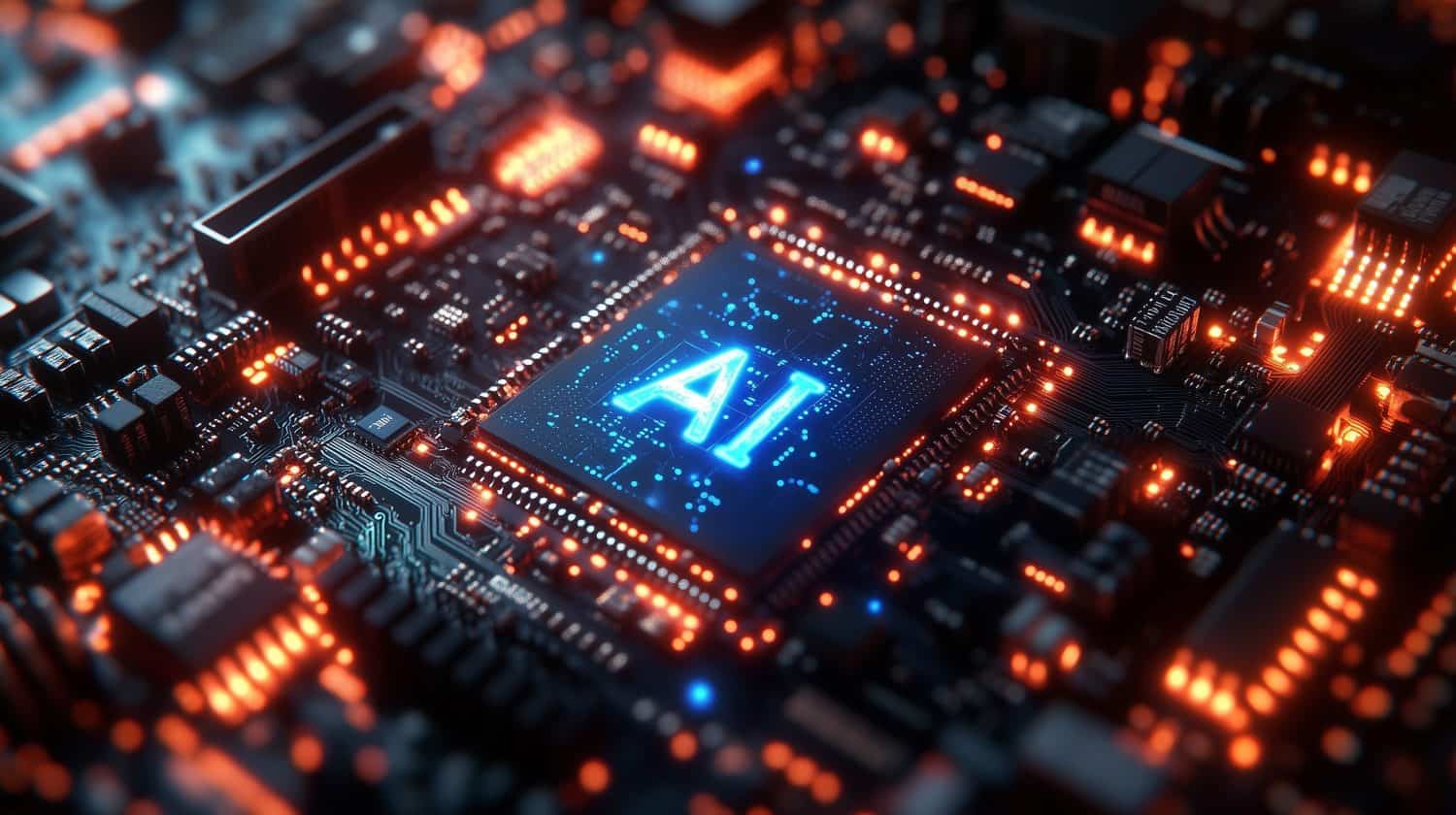

Palantir Technologies

Tech giant Palantir (NYSE: PLTR) provides data analytics tools to government and private companies. It is known for generative AI which has led to a massive growth in its commercial client base.

Palantir’s numbers are very strong. It reported a 39% year-over-year growth in the top line with $883.9 million and the EPS came in at 13 cents. It has managed to close 31 deals worth at least $10 million in the quarter. The commercial sector revenue was up 71% while the government segment revenue soared 45%. Palantir is highly profitable and this is one reason why investors love the stock.

Up 75% so far this year, Palantir is one of the best S&P 500 performers in 2025. It is exchanging hands for $132 and is very close to the 52-week high of $135. The stock has soared over 450% in 12 months and over 1,300% in 5 years.

The stock’s future looks bright but investors have been worried about the high valuation. I believe the stock is worth the premium and if you plan to hold on to to it for five years, it will generate impressive returns. The company is well positioned to gain from the growing AI popularity.

Nvidia

Hot AI stock Nvidia (NASDAQ:NVDA) has become a part of many portfolios today. While it may not be possible for the company to show another rally like last year, Nvidia still has the potential to expand.

The industry-leading company reported a 69% year-over-year jump in sales despite regulatory challenges. Its first quarter revenue came in at $44.1 billion and the net income stood at $22.1 billion. The data center business was the driving force behind the strong numbers and it showed a 73% year-over-year growth.

Nvidia will continue to benefit from the growing adoption of AI across different industries and sectors. Besides the data center, Nvidia has also seen growing revenue in the automotive and PC segment. It is set to benefit from partnerships in the automotive market where automakers are using Nvidia’s platform to build self-driving features. This could be a solid growth driver for the company. Analysts have high growth expectations from the company and it could command a higher valuation in the long term.

Exchanging hands for $142, NVDA stock is up 17% in 12 months and 3.12% year-to-date. It has a P/E ratio of 45 and the shares look affordable. Investors should not expect another rally this year but the stock will not disappoint.

Nike

Down 15% so far this year, Nike (NYSE:NKE) is exchanging hands for $62. The athletic apparel company has seen a slowdown in sales and investors are worried about its ability to bounce back. However, I think the dip is a good chance to load up on the stock.

Nike continues to remain a leader in the industry and it owns a premium label that attracts consumer loyalty. It has seen impressive results and built a strong brand name over the years but the macroeconomic conditions have led to a slump in sales. The company saw a 9% drop in sales in the recent quarter and the management is guiding for another drop in the current quarter. This is due to the tariffs on products that are coming from China. However, all is not lost.

Nike has gone through several market ups and downs and has a plan to bounce back. The company got a new CEO in 2024 who is focusing on innovation efforts and working on launching new products that can keep the consumers interested. Nike is a dominant player and continues to remain number 1 in the U.S. and China. The current slump could be temporary and I think Nike will gain its momentum again.

The stock also has a dividend yield of 2.55% and is trading at a discount, making it a compelling buy for the long term. TipRanks analysts have an average price target of $74, a 19.77% upside from the current level.

Coca-Cola

If you do not have Coke (NYSE: KO) in your portfolio, now is the right time to buy it. Up 16.80% in 2025, KO stock is exchanging hands for $72 and is steadily moving higher. The beverage giant has a global presence and the ability to handle tariffs. Coca-Cola enjoys pricing power and has a loyal fan base which has ensured steady growth over the years. The company caters to local tastes and preferences across different markets which has helped it heighten consumer loyalty.

Besides holding a global presence, the company is a diversified business with brands like Diet Coke, Fanta, and Minute Maid. It saw a 2% year-over-year drop in net sales but managed a 6% jump in organic revenue. The sales for the quarter stood at $11.22 billion while the EPS was 73 cents. It reported a 32.9% operating margin in the first quarter, up from 18% in the same period the previous year.

The Dividend King has increased dividends for 63 years straight and has a yield of 2.83%. It is one of the best dividend stocks to own. As the economy recovers, Coca-Cola will be in a stronger position and will continue to grow. Coca-Cola is a top beverage pick at Morgan Stanley and has an overweight rating with a price target of $81.

Uber

Up 36% year-to-date and 24% in 12 months, Uber (Nasdaq: UBER) stock is on a strong rally. The ride-hailing and delivery platform has impressed investors despite macroeconomic factors and rising competition.

While many were worried about Uber’s future due to the growing adoption of autonomous vehicles, the company turned it into an opportunity through a strategic deal with Alphabet’s (NASDAQ: GOOG) Waymo. It has also announced a partnership with Wayne, a U.K.-based startup for the launch of a robotaxi service in London. This shows that the company has competitive advantages which is drawing the attention of key industry players.

Once a ride-hailing platform, Uber is a highly diversified business today with strong delivery and mobility revenue. In the first quarter, it generated $6.5 billion in the mobility segment and $3.8 billion from delivery. It reported an operating income of $1.2 billion and is a highly profitable business today.

Uber has become a globally recognized name today and attracts consumer loyalty. The company has entered into partnerships with Delta Air Lines (NYSE: DAL) and OpenTable. Autonomous vehicle technology players like WeRide and Waymo have also partnered with Uber to commercialize their services.

Uber enjoys a competitive advantage in the industry and has a lot of space to grow. While the stock isn’t cheap, it is worth every penny.

The post My 5 Favorite Stocks To Buy Right Now appeared first on 24/7 Wall St..