Live Nasdaq Composite: PDD Falls While APP Rebounds as Inflation Rears Its Head

The markets are off to a wobbly start on Friday morning, with all three of the major stock market averages coming out of the gate lower. Today’s modest declines come on the heels of the latest sign of inflation rearing its head. February’s core inflation rate came in at 2.8%, loftier than economists had predicted, […] The post Live Nasdaq Composite: PDD Falls While APP Rebounds as Inflation Rears Its Head appeared first on 24/7 Wall St..

The markets are off to a wobbly start on Friday morning, with all three of the major stock market averages coming out of the gate lower. Today’s modest declines come on the heels of the latest sign of inflation rearing its head. February’s core inflation rate came in at 2.8%, loftier than economists had predicted, amid a monthly increase of 0.4% in personal consumption expenses. Core inflation hasn’t risen this dramatically since early 2024, giving traders and investors yet another reason to worry, as if auto tariffs weren’t enough.

The Nasdaq Composite is being dragged lower by declines in each of the Magnificent Seven stocks this morning. Amazon (Nasdaq: AMZN) is down the steepest with a 1.8% drop.

Here’s a look at the performance as of morning trading:

Dow Jones Industrial Average: Down 204.92 (-0.48%)

Nasdaq Composite: Down 92.93 (-0.53%)

S&P 500: Down 18.92 (-0.33%)

Key Points

-

Stocks came out of the gate lower on hotter than expected core inflation data.

-

The Mag 7 stocks are weighing on the Nasdaq Composite.

-

AppLovin is recouping some of yesterday’s declines as it goes on offense.

Market Movers

China’s PDD Holdings (Nasdaq: PDD) is weighing on the Nasdaq Composite, falling 4% amid profit taking as the stock is up 24% year-to-date. Also pressuring the stock was a Wall Street downgrade. One analyst firn downgraded shares of PDD Holdings to “neutral” from “buy” and lowered the price target.

Applovin Corp (Nasdaq: APP), a mobile-tech stock, is rising 4% on the day after yesterday’s sell-off in which it shaved off 20% of its value. AppLovin has gone on offense, reportedly hiring lawyers to probe accusations from short sellers that it is skewing its ad performance results. Wall Street firm Loop Capital has come on in defense of AppLovin, advising investors to add the stock aggressively.

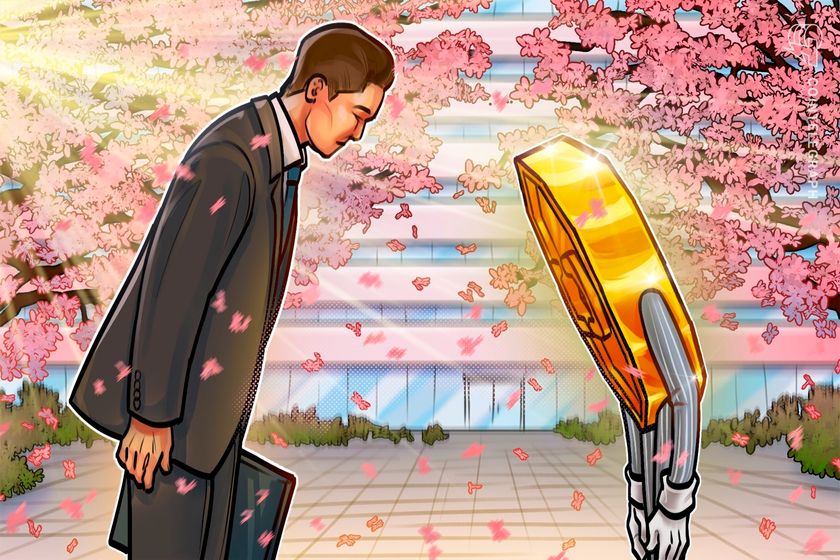

Insurer W.R. Berkley Corp (NYSE: WRB) is soaring on deal news. Japan insurer Mitsui Sumitomo is scooping up 15% of WRB’s outstanding stock. The Japanese insurer is also getting a board seat in addition to its minority ownership stake.

Mondelez International (Nasdaq: MDLZ) is continuing its recession-proof rally, rising 1% on the day, 5.6% over the past five-day stretch and an impressive 14% year-to-date.

The post Live Nasdaq Composite: PDD Falls While APP Rebounds as Inflation Rears Its Head appeared first on 24/7 Wall St..