Leading discount retailer invests in tech to improve shopping

A top discount retailer bets on tech to stay competitive and boost customer experience.

Economic headwinds are crushing retailers.

It's evident from the many bankruptcies in the retail space over the last two years.

When you look at current conditions of persistent inflation and high interest rates and take into account lingering post-pandemic effects, it's understandable why some businesses just couldn’t keep up.

Related: Home Depot local rival closing permanently after 120 years

In addition to all these challenges, retailers are also dealing with serious competition. In 2004, U.S. retail sales reached $7.26 trillion, and it is projected that by 2030 they’ll surpass $8.29 trillion, according to Capital One Shopping.

This suggests that retail isn't declining, but rather evolving by eliminating its weakest links.

That’s why retailers are investing resources to remain competitive by providing better service, diversifying quality offerings, and maintaining loyal customers. Among these strategies to improve their business operations is retail media strategy.

Retail media is one of the fastest-growing ad channels, projected to reach $62 billion in 2025, up $10 billion year over year, reports eMarketer.

According to the report, 75% of advertisers plan to increase retail media spending in 2025, with around one-third aiming for a double-digit increase.

One of America's fastest-growing retailers has recently upped its retail media game with a new partnership. Image source: Shutterstock

Dollar General teams up with Kevel to upgrade its retail media offering

The huge discount chain with more than 20,500 stores across 48 states has partnered with Kevel, the API-first ad serving company. Through this partnership, Dollar General (DG) will be able to offer advertisers access to its vast customer base.

"We're excited to partner with Kevel to take our retail media offerings to the next level," stated Natalie Ong, director of DG Media Network Operations. "By utilizing Kevel's flexible, API-based solution, we have enacted the basis for scalability and advancement of our retail media network while enhancing our ability to create custom ad experiences that resonate with our customers.”

More retail news:

- Nike delivers harsh news to employees amid major business shifts

- Popular restaurant chain brings back all-you-can-eat meal deal

- Johnnie Walker, Guinness owner sounds the alarm on price hike

Through this collaboration, the discount chain will create tailored ad products that match its brand and customer experience, keep full control of their first-party data, and offer participating advertisers advanced measurement and attribution analytics.

According to James Avery, founder and CEO of Kevel, “Dollar General's decision to partner with Kevel underscores the growing trend of retailers taking control of their retail media technology.”

The retailer also plans seamless integrations across several digital touchpoints, such as website, mobile app, and in-store displays.

Dollar General's recent developments

In fiscal 2024, Dollar General’s net sales improved 5.0%, hitting $40.6 billion for the first time in its history. Meanwhile, its operating profit decreased 29.9% to $1.7 billion, compared to $2.4 billion in fiscal 2023.

The discount retailer attributed the decrease to fourth-quarter charges of $232 million related to the store portfolio optimization review.

As a result of this review, the company confirmed it will close 96 Dollar General stores and 45 Popshelf stores, and convert six Popshelf stores to Dollar General stores.

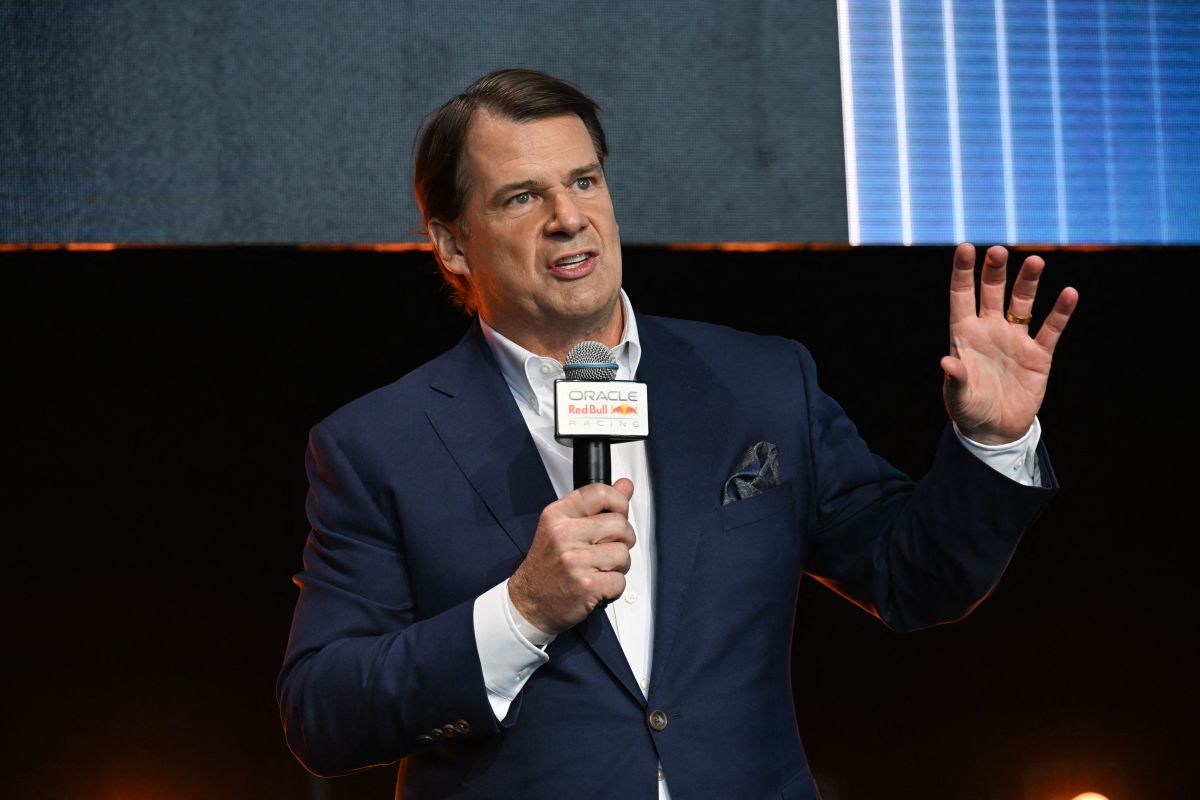

During the earnings call, the company’s CEO Todd Vasos revealed that the company has noticed customers’ financial capabilities have declined.

“Our customers continue to report that their financial situation has worsened over the last year as they have been negatively impacted by ongoing inflation,” said Vasos. “Many of our customers report that (they) only have enough money for basic essentials, with some noting that they have had to sacrifice even on the necessities.“

The statement underscores the severity of the financial strain facing Dollar General's core customer base, considering that the discount retailer mostly sells essential products priced between $1 and a little above $10.

Related: Another beloved furniture retailer closing, no bankruptcy

Year-to-date, Dollar General stock is up 35.13%, trading at $102.20.

Despite the economic challenges and competition pressure, Dollar General’s strategic investment in retail media suggests optimism in the long run. Data-driven marketing and improved digital integration could help the company maximize revenue per shopper while bringing more value to both consumers and advertisers.

-logo-1200x675.png?v=20240417094222&w=240&h=240&zc=2)