Kraken to offer tokenized US stocks to non-US clients

Crypto exchange Kraken is planning to offer non-US customers the option of trading tokenized US stocks, part of the company’s push to offer more traditional assets via tokenization.The products will be offered through Backed, a new Kraken partner, according to a statement shared with Cointelegraph. Tokens representing the stocks will be stored on the Solana blockchain due to its “unmatched performance, low latency and thriving global ecosystem,” the statement said.“The whole point of crypto is that we're able to see things very transparently,” Kraken co-CEO Arjun Sethi said during Solana's Accelerate event on May 22. ”It's decentralized. It is open-source. You can innovate as quickly as possible, and there's no reason why companies like us can't morph to do that."The decision to incorporate more traditional investment options may indicate a shift by Kraken to compete less with crypto-native exchanges like Coinbase and more with larger brokerages like Robinhood, which provide a wide range of investment options.Arjun Sethi on screen at Solana's Accelerate event in New York City. Source: CointelegraphOn April 14, Kraken opened access to exchange-traded funds and stock trading to US clients based in New Jersey, Connecticut, Wyoming, Oklahoma, Idaho, Iowa, Rhode Island, Kentucky, Alabama and the District of Columbia.In 2021, cryptocurrency exchange Binance launched a similar initiative but ultimately canceled it due to issues with regulatory agencies in various countries worldwide.According to Sethi, Kraken is building “a set of microservices" to scale out its products to customers.Related: Crypto exchange Kraken exploring $1B raise ahead of IPO: Report Kraken’s tokenization moveReal-world assets (RWA) tokenization has been a central topic in crypto over the past few months. The sector's market capitalization has climbed from $15.9 billion on Jan. 3 to $22.7 billion on May 20, representing a 42.8% jump in the period.Tokenized private credit and US Treasurys are dominant assets in the market, while stocks account only for $373.4 million.Robinhood is also moving to offer tokenized stocks. According to a recent announcement, the brokerage is working on a blockchain for tokenized securities that will offer European investors exposure to US-listed companies.RWA tokenization is gaining traction among brokerages, exchanges, and firms due to several key advantages. It reduces upfront costs by minimizing reliance on traditional financial infrastructure. Additionally, tokenization helps democratize access to investment opportunities, enabling retail investors to participate in markets that were previously limited to accredited investors.Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs — Inside story

Crypto exchange Kraken is planning to offer non-US customers the option of trading tokenized US stocks, part of the company’s push to offer more traditional assets via tokenization.

The products will be offered through Backed, a new Kraken partner, according to a statement shared with Cointelegraph. Tokens representing the stocks will be stored on the Solana blockchain due to its “unmatched performance, low latency and thriving global ecosystem,” the statement said.

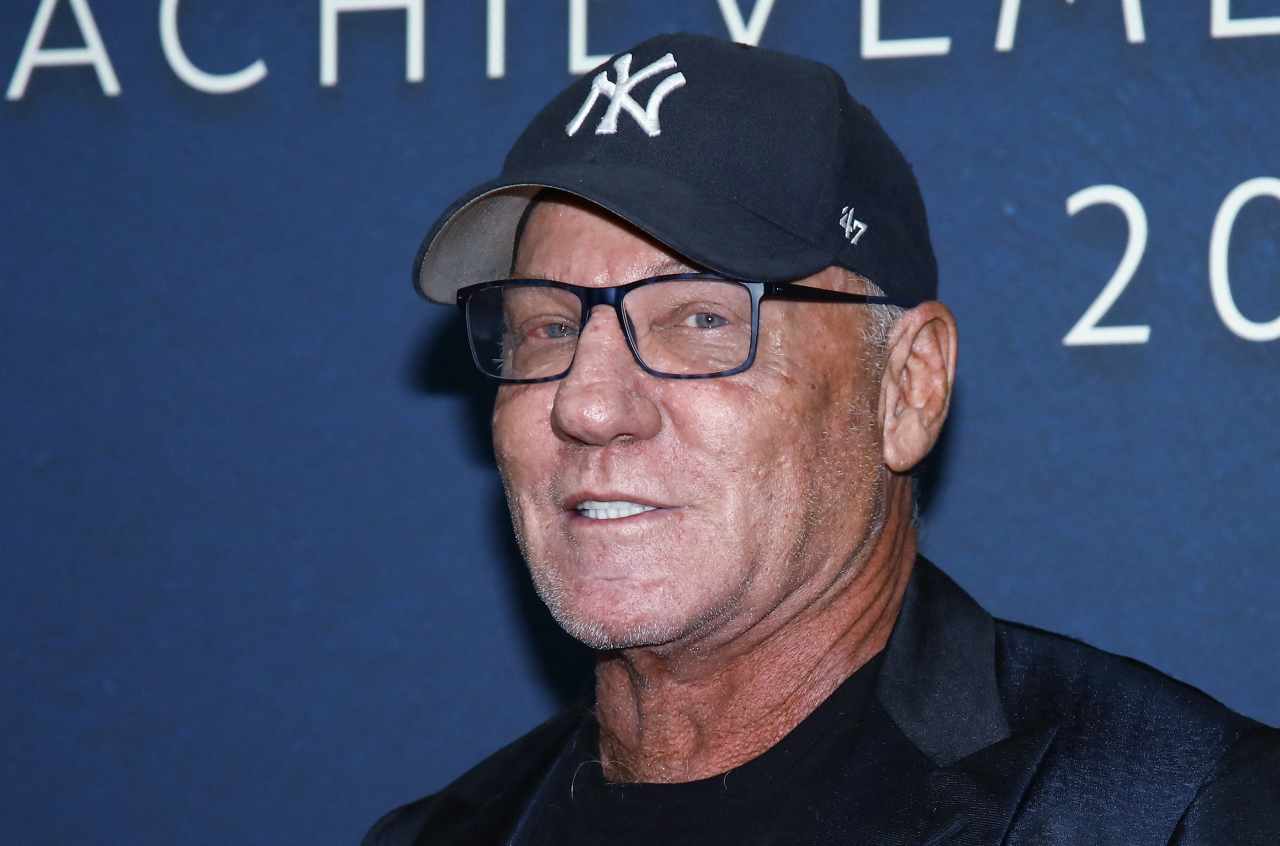

“The whole point of crypto is that we're able to see things very transparently,” Kraken co-CEO Arjun Sethi said during Solana's Accelerate event on May 22. ”It's decentralized. It is open-source. You can innovate as quickly as possible, and there's no reason why companies like us can't morph to do that."

The decision to incorporate more traditional investment options may indicate a shift by Kraken to compete less with crypto-native exchanges like Coinbase and more with larger brokerages like Robinhood, which provide a wide range of investment options.

On April 14, Kraken opened access to exchange-traded funds and stock trading to US clients based in New Jersey, Connecticut, Wyoming, Oklahoma, Idaho, Iowa, Rhode Island, Kentucky, Alabama and the District of Columbia.

In 2021, cryptocurrency exchange Binance launched a similar initiative but ultimately canceled it due to issues with regulatory agencies in various countries worldwide.

According to Sethi, Kraken is building “a set of microservices" to scale out its products to customers.

Related: Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Kraken’s tokenization move

Real-world assets (RWA) tokenization has been a central topic in crypto over the past few months. The sector's market capitalization has climbed from $15.9 billion on Jan. 3 to $22.7 billion on May 20, representing a 42.8% jump in the period.

Tokenized private credit and US Treasurys are dominant assets in the market, while stocks account only for $373.4 million.

Robinhood is also moving to offer tokenized stocks. According to a recent announcement, the brokerage is working on a blockchain for tokenized securities that will offer European investors exposure to US-listed companies.

RWA tokenization is gaining traction among brokerages, exchanges, and firms due to several key advantages. It reduces upfront costs by minimizing reliance on traditional financial infrastructure. Additionally, tokenization helps democratize access to investment opportunities, enabling retail investors to participate in markets that were previously limited to accredited investors.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs — Inside story