It's about to get a lot harder to buy knock-off Ozempic

Lots of people are on cheaper compounded weight-loss drugs that mimic brands like Ozempic, Wegovy, and Zepbound. They're about to lose access.

Nicolas Ortega for BI

Jessica DeBenedetto has only been on compounded tirzepatide for a couple of weeks, but she already feels like it's a life-changer. Her doctor prescribed the cheaper, generic version of the weight-loss drug after her insurer refused to cover Zepbound, the brand-name version made by Eli Lilly. DeBenedetto, now 43, tells me she's been prediabetic since her 20s, and after going through hormone injections with IVF, she's put on a worrying amount of weight she just can't take off. As we talk, she marvels that she's had a box of chocolates on her desk all day that she still hasn't touched, which is probably the result of both the drug and a psychological shift, since she hasn't been taking the injections that long. Still, the optimism is palpable. Those chocolates would "normally be gone in an hour," she says.

DeBenedetto's excitement has been stunted, however, by recent developments that will make compounded tirzepatide no longer widely available. The FDA has removed the drug from its shortage list and set a timeline for pharmacies to stop making compounded versions of the drug — meaning the only version available will be the FDA-approved, pricier type. She feels like the rug has been pulled out from under her.

"I'm so devastated that this option is going away," she says.

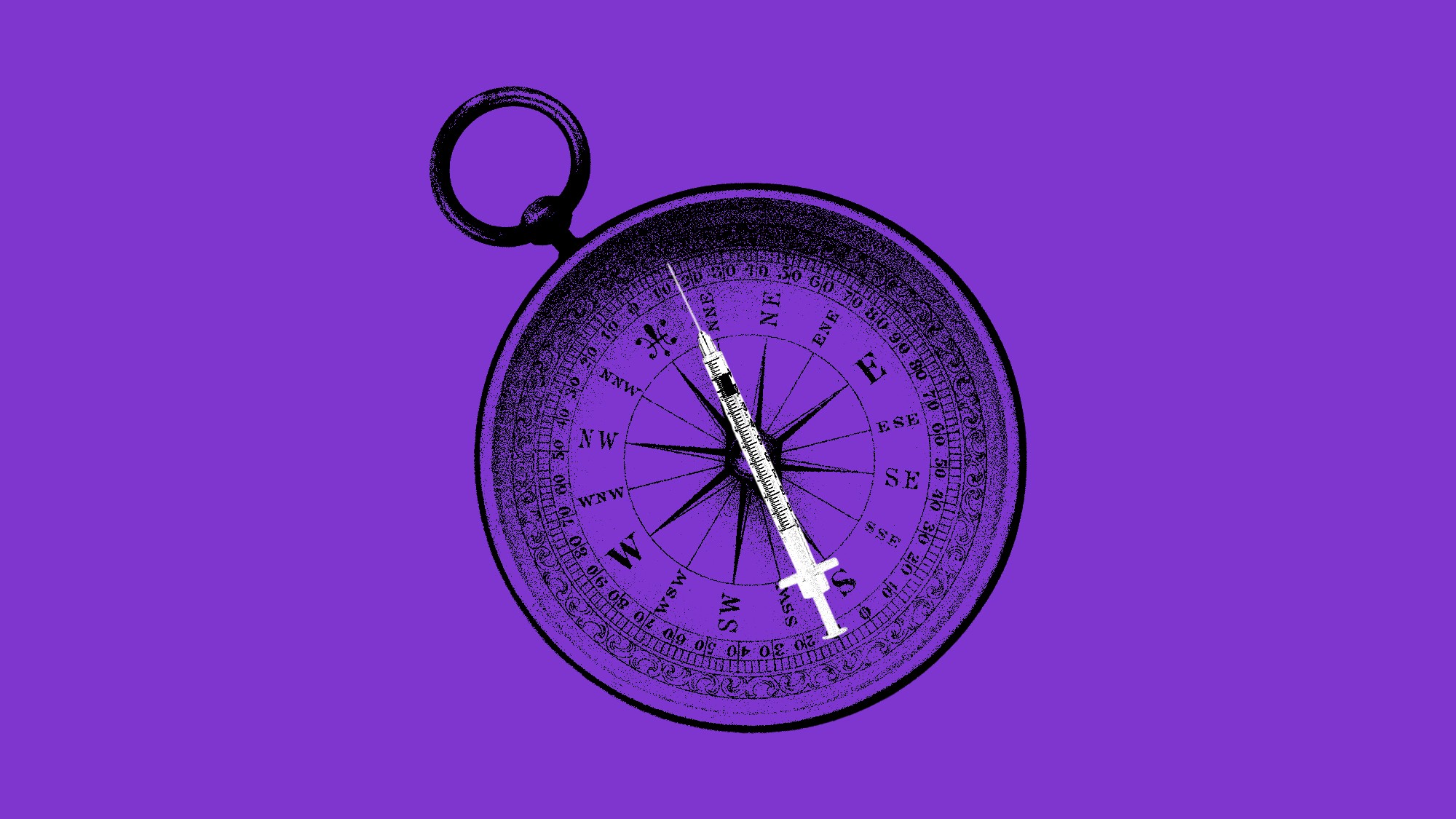

For now, her doctor is going to switch her over to compounded semaglutide — the active pharmaceutical ingredient in Ozempic and Wegovy, made by Novo Nordisk. The problem is, that's a temporary fix, too. While semaglutide is still on the shortage list, the FDA is expected to eventually end that designation, and compounders will have to stop making it, too. Lots of people could be in DeBenedetto's situation: The perfect candidate for a miracle drug whose miracle will no longer be easily accessible.

GLP-1 drugs such as semaglutide and tirzepatide are at the center of a weight-loss drug revolution. The biggest development in weight-loss medicine since bariatric surgery (not to mention less invasive), the medications, which were initially approved to treat type 2 diabetes, have exploded in popularity in recent years. People say the drugs help them drop pounds by cutting the "food noise" — making them feel fuller longer and quieting their appetites. Recent research suggests these drugs could help treat a variety of other conditions, from sleep apnea to heavy drinking.

The drugs became so popular so fast that manufacturers began running out, and patients scrambled to find Ozempic or Wegovy (the brand-name versions of semaglutide) and Monjauro or Zepbound (tirzepatide). There were other barriers to access: The brand-name versions of the drugs are expensive, in most cases costing thousands of dollars a year without insurance, and insurers have been hesitant to cover them. Moreover, not everyone who wants to lose weight has a clinical need to — a doctor saying no to a prescription doesn't always quell the desire to get one.

Some of these access issues were alleviated when the FDA put the drugs on its shortage list in 2022. This allowed compounding pharmacies to get into the GLP-1 game by creating their own versions of the injectible drugs using active ingredients obtained from chemical wholesalers and manufacturers that they could dispense when prescribed by a provider. Even though the FDA warned patients about the potential dangers of getting non-FDA-approved, compounded GLP-1s, the cat was out of the bag. Compounding pharmacies and telehealth companies saw an enormous opportunity to meet the demand for these copycat medications and offer them at a lower price point. Eli Lilly and Novo Nordisk, obviously, didn't love the setup, but there wasn't much they could do to stop it, given the shortages.

The thing about shortages is that they don't last forever. After some legal wrangling, the FDA pulled tirzepatide from its shortage list in December, giving compounders a short grace period to wrap things up. That means people taking the copycats will soon need to switch to the name-brand version, find another drug, or stop taking anything altogether. The party is over — or at least it's supposed to be.

"We all knew when semaglutide went into shortage and then when tirzepatide went into shortage that this was not a permanent status. Eventually, those drugs would be available in quantities sufficient enough to meet demand," said Scott Brunner, the CEO of the Alliance for Pharmacy Compounding, an industry group. Since October, when the FDA first determined the shortage was resolved, they've been warning members that "the end was near," he said.

Compounders aren't eager to pack it in. The Outsourcing Facilities Association, another industry group that represents compounders that produce large batches of medications, has sued to overturn the FDA's decision. Eli Lilly has since joined the FDA as a defendant to try to make sure the shortage stays resolved — it wants people taking and paying for its Monjauro and Zepbound, not cheaper copies.

You're going to have a lot of very disappointed people.

In a statement to Business Insider, an Eli Lilly spokesperson said the FDA has "correctly determined" that tirzepatide is not in shortage and that it was "clear that compounders must immediately begin transitioning patients taking compounded tirzepatide knockoffs to FDA-approved tirzepatide medicines," adding that the company will "vigorously defend" the FDA's decision. The spokesperson said the best way to ensure patients get tirzepatide is for "employers, insurers, and the government to recognize that obesity is a chronic disease and to increase coverage of medicines to treat it."

The OFA did not respond to a request for comment on this story. The APC has not joined the suit in defense of the compounders, but Brunner expressed concerns that Eli Lilly's brief had gone too far, and if the court agrees, it could end compounding by smaller pharmacies of common drugs, such as lidocaine or amoxicillin, if they were to happen to fall into a shortage for one reason or another.

The bigger picture is that there's a lot of money on the line when it comes to GLP-1s, and the parties involved know it. Compounders have found a big revenue stream they don't want to easily give up. At the same time, Eli Lilly and Novo Nordisk have market exclusivity — meaning no generics are allowed — for a limited amount of time and they want to make as much money as they can before it runs out.

For patients, this all adds up to a lot of confusion, changes, and, potentially, interruptions in treatment. The transition period will not be seamless.

"You're going to have a lot of very disappointed people," said Melanie Jay, the director of the NYU Langone Comprehensive Program on Obesity.

Many providers have begun to switch patients from tirzepatide to semaglutide or, when they can afford it, to the brand-name drug. The telehealth company Ro, which in the past offered compounded tirzepatide, in December announced it would be offering single-dose vials of Zepbound to patients with obesity. (It comes at a lower price point than the medication when delivered in an injection pen.) "We'll follow the FDA's guidance on compounding, and we'll work to ensure our patients have the best treatment options available," a Ro spokesperson said in an email.

Some compounders and telehealth companies may try to find workarounds and loopholes, especially once semaglutide is no longer in shortage. John Hertig, an associate professor at Butler University's College of Pharmacy and Health Sciences, explained that much of this depends on what's determined to be "essentially" a copy of the GLP-1 in question, meaning it's too close to see it as anything other than a duplicate. Compounders can make patient-specific (and prescription-specific) versions of medications if, for example, a person is allergic to a dye in the FDA-approved version or has trouble swallowing something in pill form. But they're only allowed to make "essential" copies in very specific circumstances — say, a drug shortage.

"There is a space in this world where compounders are important when things go on shortage or if there's a supply chain issue or you need a patient-specific alteration of a medicine because of that patient's condition," Hertig said. The problem, he added, comes when compounders are "playing games" and "skirting that essential copy regulation" by adding a minor ingredient to make the drug technically different or changing its form of delivery.

The question now becomes what counts as too close a copy to be allowed and whether a small alteration is really different — some entities might try to add vitamin B12 to their drugs or deliver it in oral form and argue that it's OK. This could very well become battleground territory.

GLP-1s are a golden goose no one wants to give up, and investors know it. When the FDA took tirzepatide off of its shortage list in December, the stock price of Hims & Hers fell amid concerns about the telehealth company's GLP-1 business. In January, Citi downgraded its rating on the stock based on the assumption that semaglutide would be off the shortage list within the next year. Hims & Hers has not offered compounded tirzepatide in the past, a spokesperson for the company said, but it does offer compounded semaglutide.

The spokesperson said it's heard from patients who are "unable to access branded GLP-1 medications" and that over half of its customers couldn't access GLP-1s they were prescribed because of its price. They added that compounders serve a "critical purpose" and pointed to part of the Federal Food, Drug, and Cosmetic Act that "permits the compounding of medications to address patients' clinical needs irrespective of whether a particular drug is subject to a shortage." When I asked whether that meant they would keep compounding semaglutide, the response was vague. It indicated that, at the very least, they're going to keep trying but in a way that's "personalized" for patients, though it's unclear how they'll achieve that for thousands of individuals.

"Many patients benefit from the standardized dose of GLP-1s, and right now, in this current shortage, we are committed to unlocking access to these life-changing medications," the spokesperson said. "With that, many patients can benefit from something different than the standardized dose, they need something more personalized, and this is an option that we make available on our platform and plan to do that for the long term."

A spokesperson for the FDA said the agency recommends patients use FDA-approved drugs when available and that compounded drugs should "only be used to fulfill the needs of patients whose medical needs cannot be met by an FDA-approved drug." The agency also warned that compounded drugs pose a higher risk to patients.

To further complicate things, the new presidential administration means new leadership at the Department of Health and Human Services and the FDA, and Donald Trump has picked Ozempic-skeptic Robert F. Kennedy Jr. to head the health department. In January, Hims & Hers donated $1 million to Trump's inauguration fund.

In the short term, this is going to be a mess. The spigot is turning off for patients on compounded tirzepatide, and compounded semaglutide's days are numbered, too. Some providers will try to find workarounds, but it's not clear how successful they'll be — or how successful regulators will be in stopping them. Patients can access the brand-name drugs, but insurance coverage and affordability remain problems. Once more reputable compounders leave the market, people might resort to sketchier operations, which could lead them to scammers, counterfeiters, and unsafe concoctions.

On the flip side, this could also be a moment for a reset. It could lead to the healthcare industry taking a better approach to GLP-1 access and care.

"Up to 70% of people with obesity who start these meds are not on it at one year anyway," Jay said. "There's a lot of reasons why people go off of it. Certainly insurance and costs, but also because I don't think people really know what they're getting into or don't have the support to really stay on them, or they think that somehow once they lose weight, they can go off of them, which is not true."

"The real thing is expensive" is not a valid reason for copying, as much as many patients wish that was the case.

"If you're Eli Lilly, you're also looking at, how do we work with patient access?" Hertig said. "How do we work with insurers? How do we manage the cost here where we're then incentivizing more patients to go to the manufacturer, which is FDA-approved? My hope would be that the manufacturers are also looking at that patient access."

Generic versions of Ozempic and Monjauro won't be available until their patents expire. What happens with compounding is unclear, but once these drugs are no longer in shortage, compounders are supposed to stop making them, except under very specific circumstances. Within that framework, "the real thing is expensive" is not a valid reason for copying, as much as many patients wish that was the case.

It's impossible to untangle exactly who's to blame here, to the extent any one party is at fault. It's the result of how the American health system is set up. Brand-name GLP-1s are much cheaper in many other parts of the world than in the US, and the drugmakers could slash their prices, but the profit motive dictates that if they don't have to, they won't. Compounding pharmacies have been filling in a legitimate gap, though some have overstepped — it's quite easy to get GLP-1s from many providers without much of an examination. Both the big guys and little guys are pushing these drugs onto consumers through ads on television and online. Of course, people are clamoring for drugs that will improve their health, help them lose weight, and reduce the stigma around their weight.

DeBenedetto said it's "ridiculous" that the government would take compounded tirzepatide away from her, even though the government is just doing what's outlined in the law. But like many other people, she didn't realize that. For the most part, the drug makers and marketers have papered over the fact that while the medications are ubiquitous, they're not widely available at a price point patients can easily afford.

"It's always about money," DeBenedetto said. "Everything's always about money, and it sucks."

Emily Stewart is a senior correspondent at Business Insider, writing about business and the economy.

What's Your Reaction?