Invest $75K in Nvidia or Broadcom? A Strategy for Early Retirement

The artificial intelligence (AI) revolution has reshaped markets since 2022, propelled by breakthroughs like ChatGPT, which showcased AI’s transformative power. This has fueled massive gains for chipmakers powering AI infrastructure, with Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO) emerging as standout performers. Nvidia, synonymous with AI’s rise, has seen its market cap skyrocket, driven by its cutting-edge […] The post Invest $75K in Nvidia or Broadcom? A Strategy for Early Retirement appeared first on 24/7 Wall St..

Key Points in This Article

-

Nvidia’s leadership in AI infrastructure, driven by its H100 GPUs and upcoming Blackwell chips, fuels massive data center revenue growth, though high valuation and competition pose risks.

-

Broadcom’s pivot to AI accelerators and networking chips, alongside diversified mobile and broadband revenue, drives triple-digit AI gains, tempered by trade risks and a potential growth slowdown.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

The artificial intelligence (AI) revolution has reshaped markets since 2022, propelled by breakthroughs like ChatGPT, which showcased AI’s transformative power. This has fueled massive gains for chipmakers powering AI infrastructure, with Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO) emerging as standout performers.

Nvidia, synonymous with AI’s rise, has seen its market cap skyrocket, driven by its cutting-edge GPUs. Broadcom, transitioning from mobile chips to AI data center solutions, has nearly tripled its valuation.

With $75,000 to invest for early retirement, choosing between these titans requires balancing growth, valuation, and diversification. This article explores why both stocks are compelling, but only one is worth putting your money into for long-term growth and value..

Nvidia: Powering AI’s Core

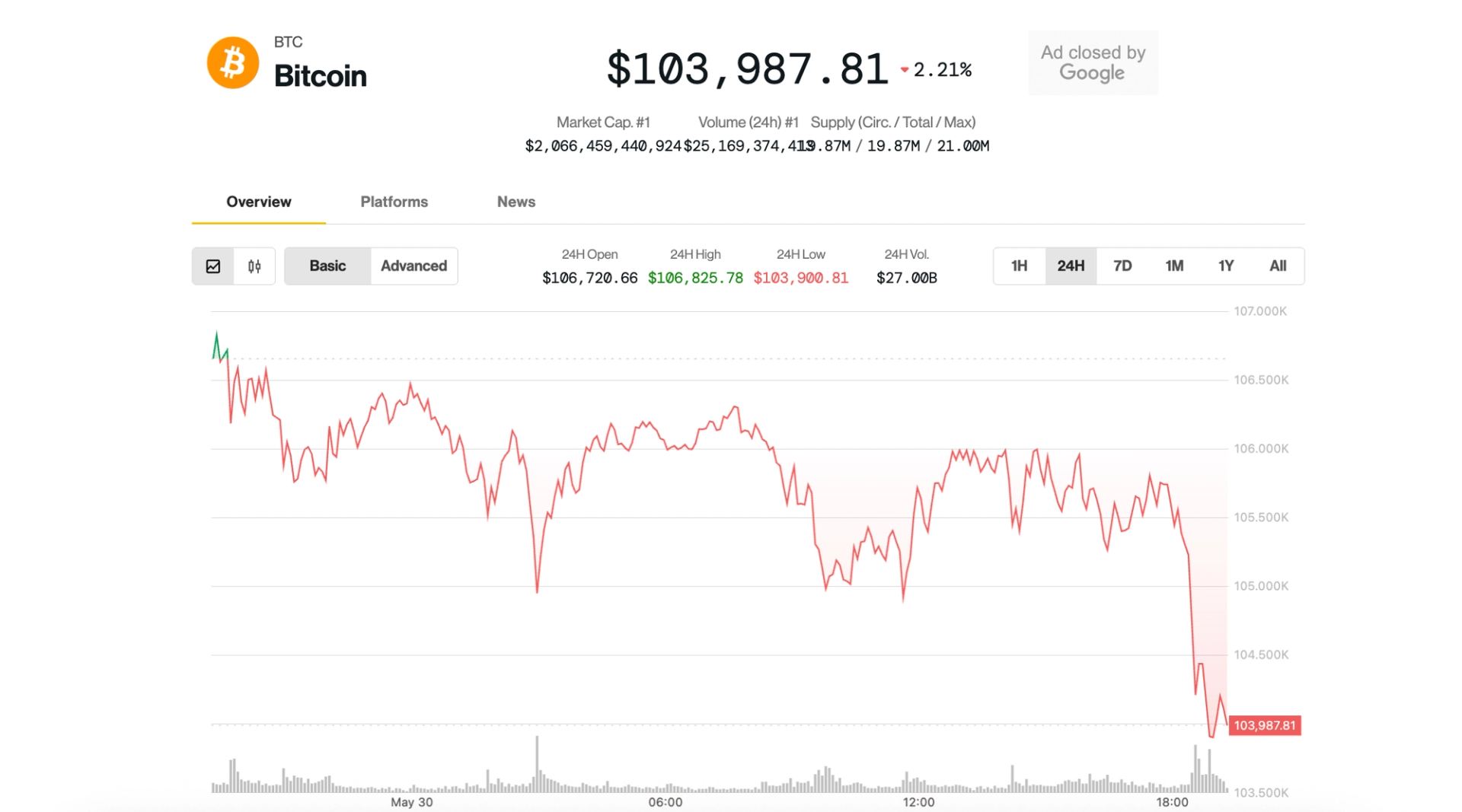

Nvidia’s role as AI’s backbone is unmatched, with its GPUs dominating data center computing. Its H100 processors, critical for AI model training, have made Nvidia a market leader, with Q4 2024 data center revenue soaring to $35.6 billion, a 93% year-over-year leap. As the chipmaker is scheduled to report first-quarter results on Wednesday, investors will get to see whether it can maintain the momentum.

The upcoming Blackwell chips, already pre-sold into 2026, promise even greater efficiency, ensuring Nvidia remains ahead of the curve. Its innovation pipeline, including next-gen Rubin chips, signals sustained growth.

However, Nvidia’s $3.2 trillion valuation and forward P/E of 23 suggest a premium price. Competition from Advanced Micro Devices (NASDAQ:AMD) and in-house chips by hyperscalers like Google could erode market share, while U.S.-China trade tensions may limit sales in key regions.

Despite these risks, Nvidia’s technological edge and AI’s long runway make it a growth powerhouse for early retirement portfolios, offering high returns for risk-tolerant investors.

Broadcom: A Diversified AI Contender

Broadcom has pivoted from a mobile chip leader, serving clients like Apple (NASDAQ:AAPL), to a major AI player, with its data center segment now driving growth. Its custom AI accelerators and networking chips, used by hyperscalers for cloud infrastructure, generated $4.1 billion in the first quarter, up 77% year-over-year and comprising 34% of revenue. Analysts project its AI market to reach $100 billion by 2028, fueled by Ethernet and routing solutions.

Broadcom’s $1.1 trillion valuation is lower than Nvidia’s, though its forward P/E of 29 is higher, but still offering better value. Its diversified revenue — spanning smartphones, broadband, and AI — reduces reliance on any single segment.

Risks include potential trade disputes affecting clients like ByteDance and a projected revenue growth slowdown to 21% in 2025 from 44% in 2024. Yet, Broadcom’s high-percentage AI growth and strategic acquisitions, like VMware, position it for robust expansion, appealing to investors seeking growth with relative stability.

Strategic Investment for Early Retirement

Both Nvidia and Broadcom are poised to capitalize on AI’s expansion, but Broadcom edges out as the better $75,000 investment for early retirement. Nvidia’s meteoric rise has pushed its valuation to stretched levels, and its growth, while strong, is slowing as competitors gain ground.

Broadcom, in an earlier AI growth phase, still offers the potential for further triple-digit segment gains and a more reasonable valuation, suggesting greater upside potential. Its diversified business mitigates risks tied to tech-specific volatility and aligns with a retirement-focused strategy.

Allocating $75,000 entirely to Broadcom could leverage its momentum, but diversification remains critical. You could split the investment between Broadcom and Nvidia to reduce risk while capturing both companies’ strengths. Alternatively, pairing either with broad-market ETFs such as the Vanguard Total Stock Market ETF (NYSEARCA:VTI) would stabilize your portfolio. Broadcom’s growth trajectory and lower valuation could help your investment compound faster, building a nest egg resilient to market swings. Its blend of value and AI-driven growth makes it the smarter play for 2025.

Key Takeaway

With $75,000 to invest, Broadcom offers a compelling path to early retirement, balancing AI-driven growth with a more attractive valuation than Nvidia. Its diversified revenue stream and “early-stage” AI positioning set it up for outperformance, though portfolio diversification remains key to long-term success.

The post Invest $75K in Nvidia or Broadcom? A Strategy for Early Retirement appeared first on 24/7 Wall St..