I’m 20 – My Credit Score is 587 and I Have Only $1,500 in Savings – What Should I Do?

A 20-year-old Reddit user was dismayed to learn recently that he has a low credit score. He already knew he had a limited amount of savings, but he was unaware of just how bad his credit was. He’s not sure what to do to improve his financial situation, and his parents aren’t really able to […] The post I’m 20 – My Credit Score is 587 and I Have Only $1,500 in Savings – What Should I Do? appeared first on 24/7 Wall St..

Key Points

-

A Reddit poster has hurt his credit score by using a BNPL service.

-

The poster also has very little savings to his name, which has him concerned.

-

Since he is young, he has time to change course and improve his future.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

A 20-year-old Reddit user was dismayed to learn recently that he has a low credit score.

He already knew he had a limited amount of savings, but he was unaware of just how bad his credit was. He’s not sure what to do to improve his financial situation, and his parents aren’t really able to help him, so he’s turned to the Internet to try to get some advice.

So, what should the Redditor do to get things turned around and get back on track?

Financial mistakes when you are young don’t have to derail your future

The Reddit user is clearly not in the best financial shape here, given that he indicated his credit score is just 587. His score is low because he used a buy now, pay later (BNPL) service and did not understand the implications of it. He also has only $1,500 saved.

However, on the plus side, he lives with his parents, has no kids or spouse, and his only bills are his groceries and $20 per month for his cell phone. So, while he shouldn’t have damaged his credit through his borrowing behavior, he is definitely not yet trapped in a situation he can’t recover from relatively easily.

In fact, many young people end up dealing with worse financial problems, including graduating from school with a lot of credit card debt and spending years struggling to repay it.

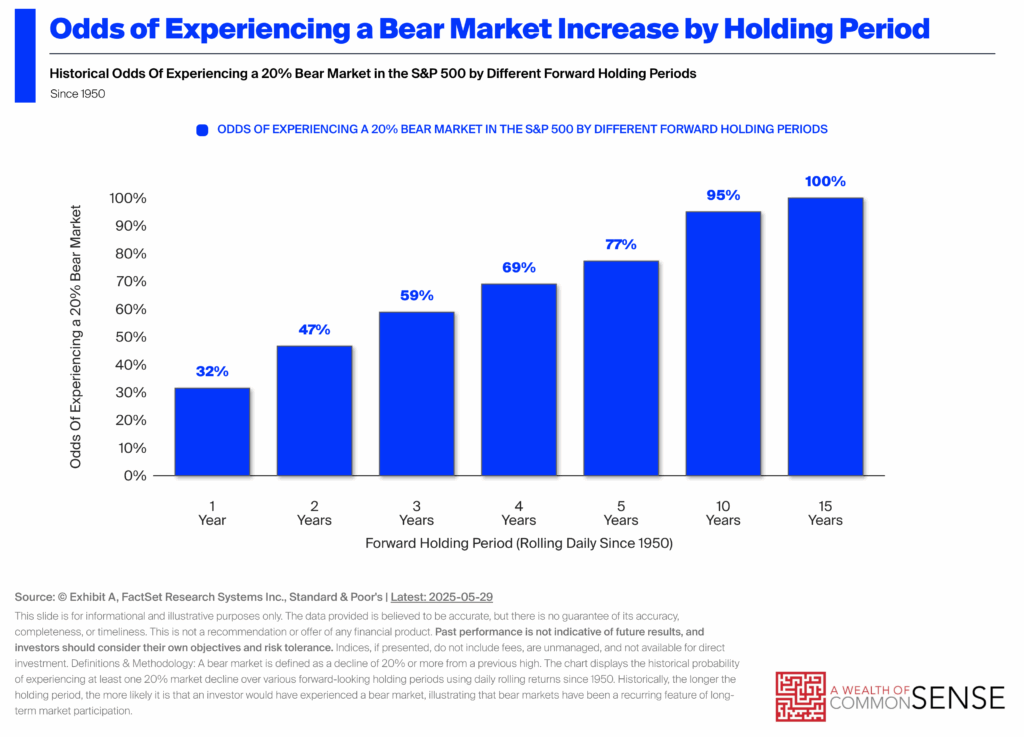

Regardless, though, with time on their side, young people can recover from these issues and end up in a great financial situation — if they make the right decisions to make that possible.

How to fix a bad credit score and a low savings account balance

In this case, the Reddit poster’s biggest problem is the low credit score, so he should get right to work on fixing that. Many people commenting on his post advised paying off any balance due on his BNPL loans ASAP and focusing on getting a credit card and building credit responsibly. If the poster has a hard time getting approved for a card with his 587 score, which is entirely possible, he could opt for a secured credit card. These require you to put down collateral equal to your credit line, so there’s no risk to the lender.

The OP could use some of his savings to get a secured card with a $250 or $500 limit and then use the card wisely each month to develop a positive payment history and keep his credit used well below his credit limit. Payment history and credit utilization are two of the most important factors in the credit scoring formula. If he does this, soon enough, that positive record will bring his score up.

Many posters also advised starting to automate the process of saving money to grow his account balance. Since the OP is still living with his parents, he hopefully has plenty of money he can use to build an emergency fund in a high-yield savings account and to potentially start investing in a brokerage account for retirement as well.

As the OP starts to make these money moves and improve his finances, he may want to talk with a financial advisor — especially since he said his parents don’t know much about money and can’t help him make smart choices. An advisor can assist him in making a comprehensive plan to build wealth by making the right decisions going forward, so he doesn’t make things harder for himself again in the future by making money mistakes he didn’t fully understand the long-term implications of.

Advisors aren’t just for the wealthy, and getting this kind of help could allow the OP to end up in a great financial place since his post shows he’s committed to doing the right thing with his money when empowered to do so.

The post I’m 20 – My Credit Score is 587 and I Have Only $1,500 in Savings – What Should I Do? appeared first on 24/7 Wall St..