Fund manager who correctly predicted stocks rally delivers blunt 8-word update

The veteran hedge fund manager correctly predicted the S&P 500's drop and recent rally.

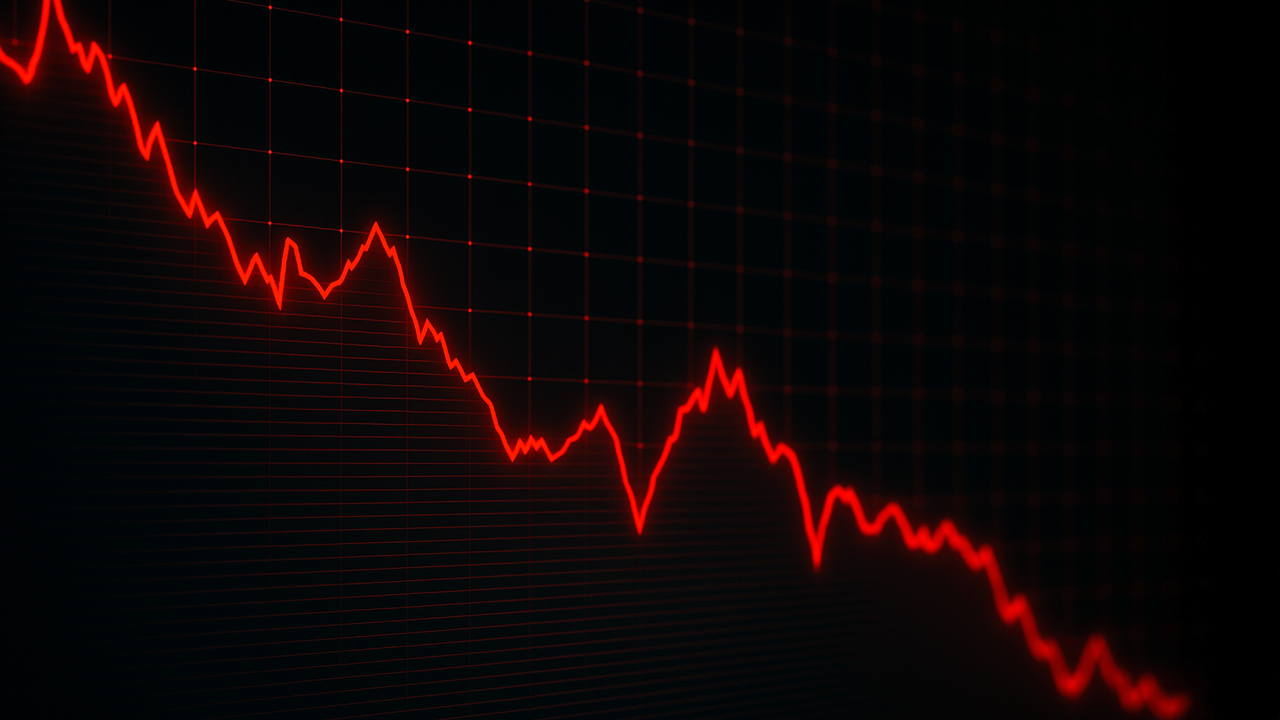

The S&P 500 gained an impressive 24% in 2024, marking back-to-back 20%-plus annual returns, but it's been more of a roller-coaster in 2025.

The benchmark index retreated 10% from recent highs last month, putting it in correction territory and raising red flags among investors accustomed to gains.

Stocks' selloff surprised many investors, but Wall Street hedge fund manager Doug Kass wasn't caught flat-footed.

Kass predicted a stock market reckoning in December and continued to beat the bearish drum on the S&P throughout February.

And that wasn't his only prescient prediction this year. As stocks were mired in a fast and steep selloff in March, he switched gears, saying stocks were oversold and ready to head higher.

Kass's correct forecast is rooted in his having experienced more than his share of good and bad markets firsthand during his 50-year career, including his time as research director for Leon Cooperman's Omega Advisors.

He successfully navigated the inflation battle in the 1970s and early 1980s, the savings and loan crisis in the 1980s and early 1990s, the internet boom and bust, the Great Recession, the Covid drop and 2022's bear market.

In short, Kass knows a lot about stock market cycles, which makes his latest take on the market worth considering.

The stock market gets rattled by recession worries

Stocks have good reason to have struggled this year.

Recession risks mounted last month following middling economic data showing sticky inflation to a weaker jobs market. Worries about a tariff war following President Donald Trump's decision to impose 25% tariffs on Canada and Mexico and 20% tariffs on China did little to assuage investors' concerns.

Related: Jamie Dimon sends curt 6-word response to tariff war

It's certainly welcome news that inflation has retreated to below 3% since peaking above 8% in summer 2022. The dip in inflation enabled the Federal Reserve to take its foot off the economic brake pedal last fall, resulting in a dovish monetary policy that included cuts to the Federal Funds Rate in September, November and December.

However, the relief on rates has proven short-lived. A recent increase in the Consumer Price Index inflation to 2.8% from 2.4% in September has since caused Fed Chairman Jerome Powell to pause additional rate cuts, disappointing businesses and borrowers.

There have also been concerning job data. Layoffs have become more common, and the unemployment rate has inched up to 4.1% from 3.5% as recently as 2023. American employers cut 172,017 jobs in February, the most for the month since 2009.

According to the Job Openings and Labor Turnover Survey released by the Bureau of Labor Statistics, 7.7 million jobs were open in the U.S. in January, about 728,000 less than one year ago.

Stubborn inflation and sluggish growth aren't great recipes for a healthy economy, and as a result, consumer confidence has suffered. The Conference Board's Consumer Confidence measure fell 7.2 points last month to 92.9, marking its lowest reading since January 2021.

Stocks find their footing after tumbling

Given the backdrop, little wonder that stocks tumbled 10% last month. However, stocks don't go up or down in a straight line, and bargain hunters like Kass often materialize following rapid drops that push stocks to oversold levels.

Related: Major national bank closing dozens of branches (locations revealed)

Once some of the air was let out of the S&P 500's arguably sky-high valuation, Kass began trading more activity in his hedge fund on the long side.

Near the lows, Kass cited technical market indicators, like the S&P Short Range Oscillator, entering oversold territory and relative strength index readings near bargain-basement lows among the reasons for his bullish shift.

Kass took advantage of the dip, buying the technology-heavy Nasdaq 100 and S&P 500, as well as big tech stocks and major banks, writing on March 7, "I have moved to large Amazon (AMZN) at $193.02."

Clearly, his bullishness paid off, making him a nice profit on those buys.

More fund manager buys and sells:

- Veteran fund manager goes shopping, buys 5 stocks after big drops

- Billionaire Ray Dalio sends hard-nosed message on economy

- Veteran fund manager who predicted S&P 500 drop revamps outlook

However, he's become less excited about owning stocks now that they've rallied, prompting him to lock in his gains and start planning for another decline.

"Based on my five scenarios (from very negative to very positive and attaching multiples to that distribution) I expect the S&P index to be down between 5% and 10% for the full year," said Kass in a post on TheStreet Pro. "My thinking remains that the high might have been already made in late January."

Kass says the downside risk this year is between 10% to 15% on the S&P 500, and he adds that throughout the year there will be "plenty of long and short opportunities" for active investors.

Nobody knows what's next for stocks, but Kass is preparing for another swing.

"Gun to my head, we head down shortly," said Kass bluntly.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast