Finding the Ideal Balance in a High-Yield Savings Account

For some people, putting all their money into the stock market isn’t the safest place to park it. Everyone has their own financial needs and what they might want to get out of their money over the course of one year or ten years, which lends itself to finding alternative solutions to the market. In […] The post Finding the Ideal Balance in a High-Yield Savings Account appeared first on 24/7 Wall St..

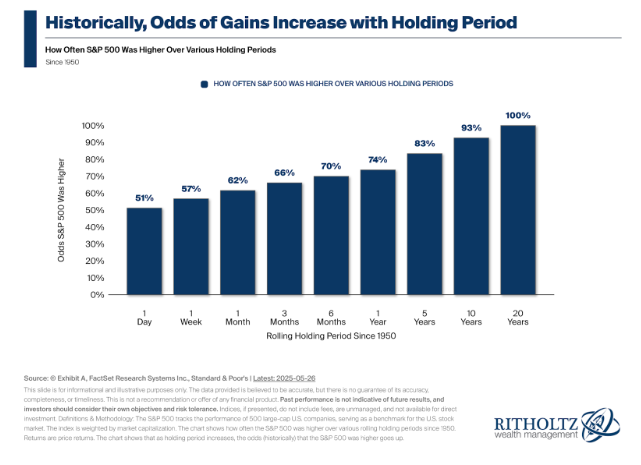

For some people, putting all their money into the stock market isn’t the safest place to park it. Everyone has their own financial needs and what they might want to get out of their money over the course of one year or ten years, which lends itself to finding alternative solutions to the market.

Going with a high-yield savings account is a great way to earn money with less risk.

Unlike traditional savings accounts, HYSA offers upwards of 4 to 5% interest annually.

Using these accounts for emergency funds is a great way to earn money while still having liquidity.

Key Points

In many ways, parking money in a high-yield savings account is a great way to ensure you have money that is earning interest but is ready to spend. Federally insured, there is a lot of peace of mind with these accounts, and if interest rates are high, you can earn quite a bit of interest.

What Is High-Yield Savings?

Unlike an average checking or savings account, which often pays (way) less than 0.01% interest on money, a high-yield savings account, or HYSA, pays significantly more. Alongside higher interest payments, you also have FDIC coverage up to $250,000 per depositor, as well as the option of having multiple accounts open at the same bank or different banks.

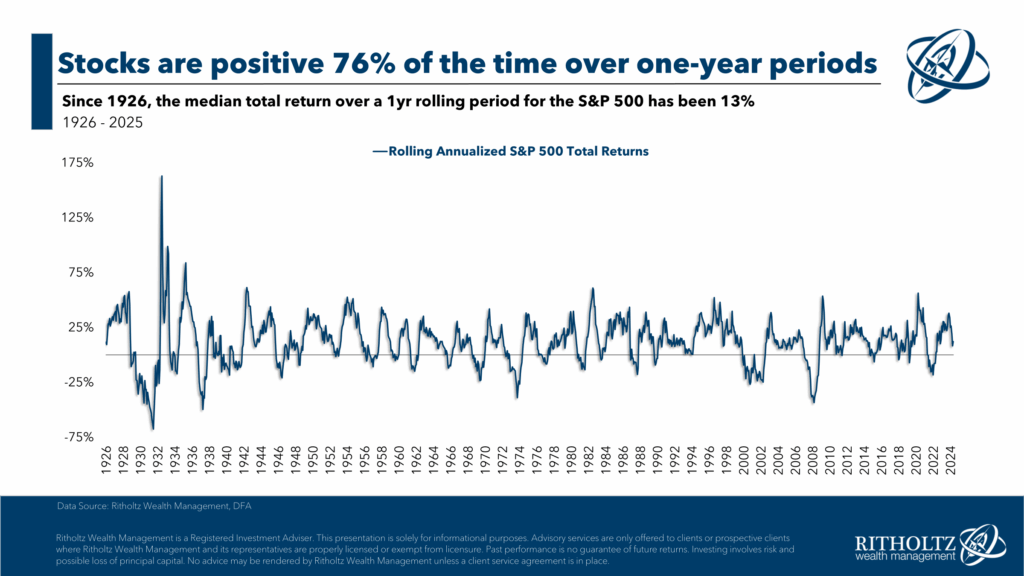

There is also the consideration that if you are not comfortable investing in the market during volatile times, HYSA interest is a guaranteed return. You won’t make as much with a HYSA as you can in the stock market with investments like ETFs, but it’s a far safer and reliable investment vehicle.

How Much Should You Deposit?

Knowing that you can deposit as much as $250,000 in a high-yield savings account gives you a sense of what’s possible. For most people, it would be great to add at least 6-12 months’ worth of emergency savings that can just sit and accrue interest until the funds are needed. If the funds are never needed, that works too, as the money can just sit and grow and grow over time.

The unsurprising reality is that everyone has different needs and financial goals, so it’s up to you to know how much cash you want to have on hand. The hope is that most people consider HYSA a better option than just dropping the money into a traditional savings account and earning far less. The goal is to have cash you can quickly get without liquidating investment assets, and it’s earning money in the interim.

What Will I Earn?

The big question around a high-yield savings account is what you can and will earn. It’s important to note that interest rates with these types of accounts can and do change regularly. As of May 25, 2025, the highest rate you can earn is 4.40%, offered by Openbank, while better-known names like Capital One earn as much as 3.60%.

Compare these numbers to your traditional savings or checking accounts from Chase or Bank of America, each earning only 0.01% on your deposits. Given these numbers, if you were to make an investment at Openbank of $250,000, you’d be earning around $11,000 in interest.

To find the right balance with a high-yield savings account, you must know the difference between compounding interest daily and monthly. The interest rate can be slightly different, but at the end of a 12-month timeframe, you should have an extra $11,000 in your high-yield savings account with Openbank, and the same goes for Capital One, Sallie Mae, and any other financial institution currently offering higher-than-normal interest levels.

Finding the Right Balance

Given that HYSA assets are generally viewed more as funds you might need quick access to, they shouldn’t represent the bulk of your asset holdings unless you are risk-averse. Depending on how much money you have to your name, spreading this over five or ten HYSA accounts could be a lot to keep track of.

However, if you are risk-averse and care about liquidity and safety more than anything else, there is no reason to think you couldn’t have more than one HYSA to your name. Ideally, you should want to be diversified, all while these account types can play a major role in ensuring your money is spread out. This would also mean that you might want money in a money market account, a mutual fund, or even treasury bills.

If you want concrete numbers for your initial deposit, consider how much you would need to set aside for savings if you lost your job and had to live off this money for up to 12 months. Deposit that number, and then let the rest of your money grow outside this account type.

The post Finding the Ideal Balance in a High-Yield Savings Account appeared first on 24/7 Wall St..