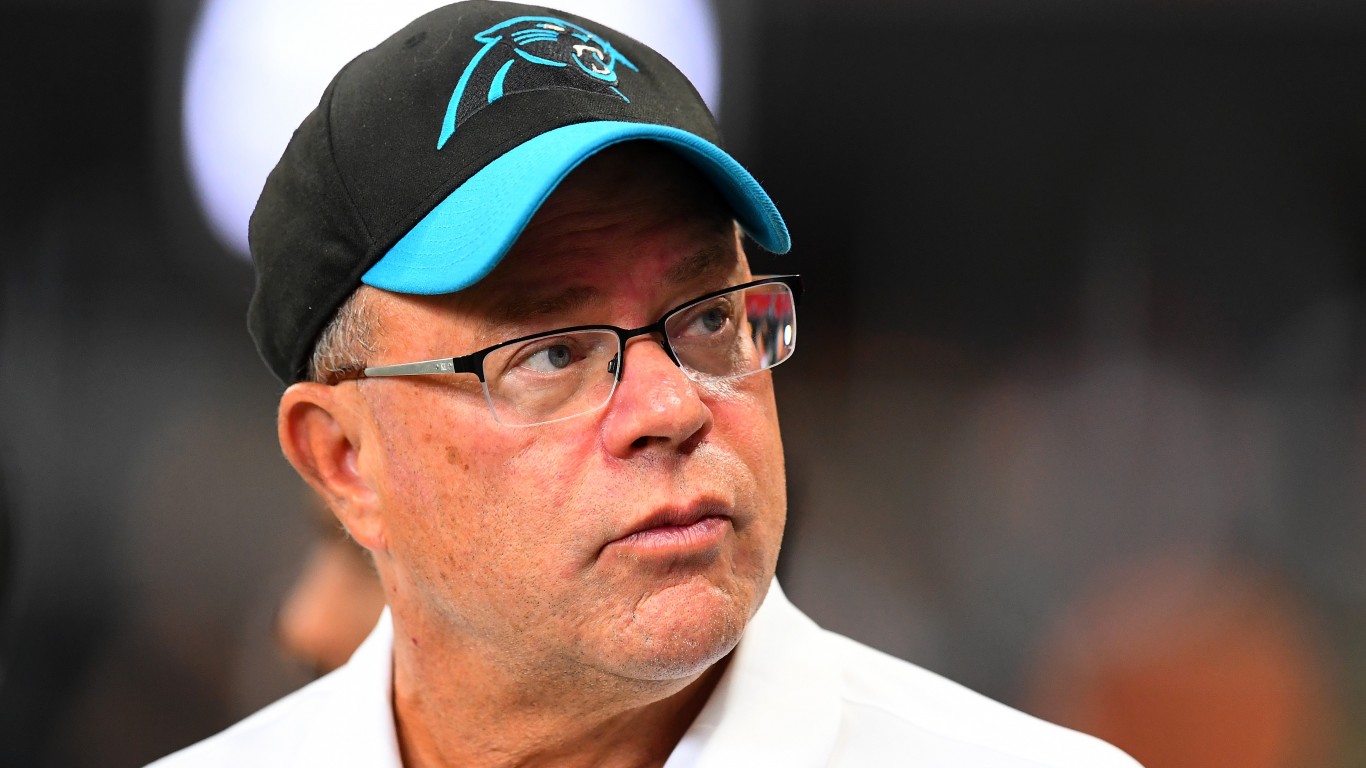

David Tepper Bets 30 % of His Fund on a Single ‘Fossil‑Free’ S&P Put—A $2.5 B Hedge You Can’t Ignore

With 13-F filing season now in the rear-view mirror, many retail investors now have a chance to see what the smart money (think billionaire hedge fund managers) have been up to in the first quarter. Undoubtedly, it’s tough to know the real reasons why a particular big-league investment manager may be hitting the sell button […] The post David Tepper Bets 30 % of His Fund on a Single ‘Fossil‑Free’ S&P Put—A $2.5 B Hedge You Can’t Ignore appeared first on 24/7 Wall St..

With 13-F filing season now in the rear-view mirror, many retail investors now have a chance to see what the smart money (think billionaire hedge fund managers) have been up to in the first quarter. Undoubtedly, it’s tough to know the real reasons why a particular big-league investment manager may be hitting the sell button on a stock.

And while it’s typically not a cause for concern (and certainly not panic), I do think having a glance at recent moves can help investors better navigate the sort of turbulent, tariff-filled market environment we currently find ourselves in. Of course, even the seasoned investment pros and legends may be encountering uncharted waters as Trump winds down a bit from his most aggressive tariff stance to date.

Now that the big money has shown their cards to the public, we’ve had more than enough of a sample size to gauge the sentiment of the biggest and best minds on Wall Street. Of course, profit-taking and cautious optimism have remained the main theme, at least in my view, for the first quarter.

Key Points

-

David Tepper’s big put bet on the SPYX, I believe, is a hedge that should cause investors to tread cautiously into the second half.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

David Tepper’s huge put position in the SPYX is perhaps the most remarkable move made of late.

The most striking and remarkable move has to be from Appaloosa Management’s David Tepper, who built a rather sizeable put position in a “fossil-free” variant of the SPDR S&P 500 ETF (NYSEARCA:SPY), the SPDR S&P 500 Fossil Fuel Reserves Free ETF (NYSEARCA:SPYX). The SPYX is essentially the SPY minus the fossil fuel stocks. Tepper reportedly picked up 4.5 billion put options worth around $2.5 billion (or around 30% of the portfolio).

That’s a hedge that’s very difficult to ignore, especially as the S&P 500 looks to make new highs again after mostly shrugging off the Liberation Day sell-off and the looming economic impact of Trump tariffs. Of course, such a position may signal that the S&P 500 (minus the cheap energy stocks) is overvalued and perhaps overdue for a nasty spill.

While Tepper hasn’t addressed the position, I do view the big SPYX put bet as a wise one to hedge against rising market risks. Indeed, after the S&P 500’s swift rebound off those Liberation Day lows, valuations have become a bit frothier again. Add the Trump tariff wildcard, which markets may have been too quick to recover from, into the equation, and hedging one’s bets only seems prudent. While Tepper’s big SPYX put bet is sizeable, so too is Appaloosa’s exposure to large-cap tech stocks that would probably be most at risk if a growth scare or recession were to cause markets to revisit those April market lows.

For a portfolio that’s quite heavy on the high-quality tech stocks, I’d argue that the addition of a big hedge is only prudent. In my view, it certainly makes more sense to hedge one’s bets than liquidate the rest of the portfolio as Dr. Michael Burry of Scion Asset Management did in his 13-F filing, especially since there’s a good chance the AI tailwind warrants today’s heftier market multiples.

In any case, I do find it interesting that Appaloosa went down the route of betting against the “fossil-fuel-free” version of the S&P 500. Given recent headwinds in the oil patch, many of the big energy firms certainly stand out as too cheap to bet against.

The bottom line

David Tepper’s hedge fund was quite active in the first quarter. Apart from a big new put position in the SPYX, his fund also trimmed its exposure in a broad range of large-cap tech stocks. After such notable moves, Appaloosa definitely looks far better positioned to ride out a tariff storm.

Of course, only time will tell if the markets will be in for more rough waters in the second half. In any case, I’d argue it’s only prudent to be cautiously optimistic rather than blindly optimistic now that the S&P 500 has its sights on new highs. The tariff threat still exists, even though they don’t appear to be as troubling to stocks as much anymore.

The post David Tepper Bets 30 % of His Fund on a Single ‘Fossil‑Free’ S&P Put—A $2.5 B Hedge You Can’t Ignore appeared first on 24/7 Wall St..