Consumer-price inflation slows in April, but tariff impact on prices will linger

Headline inflation is approaching the Fed's 2% target, but tariff price hikes could derail its progress.

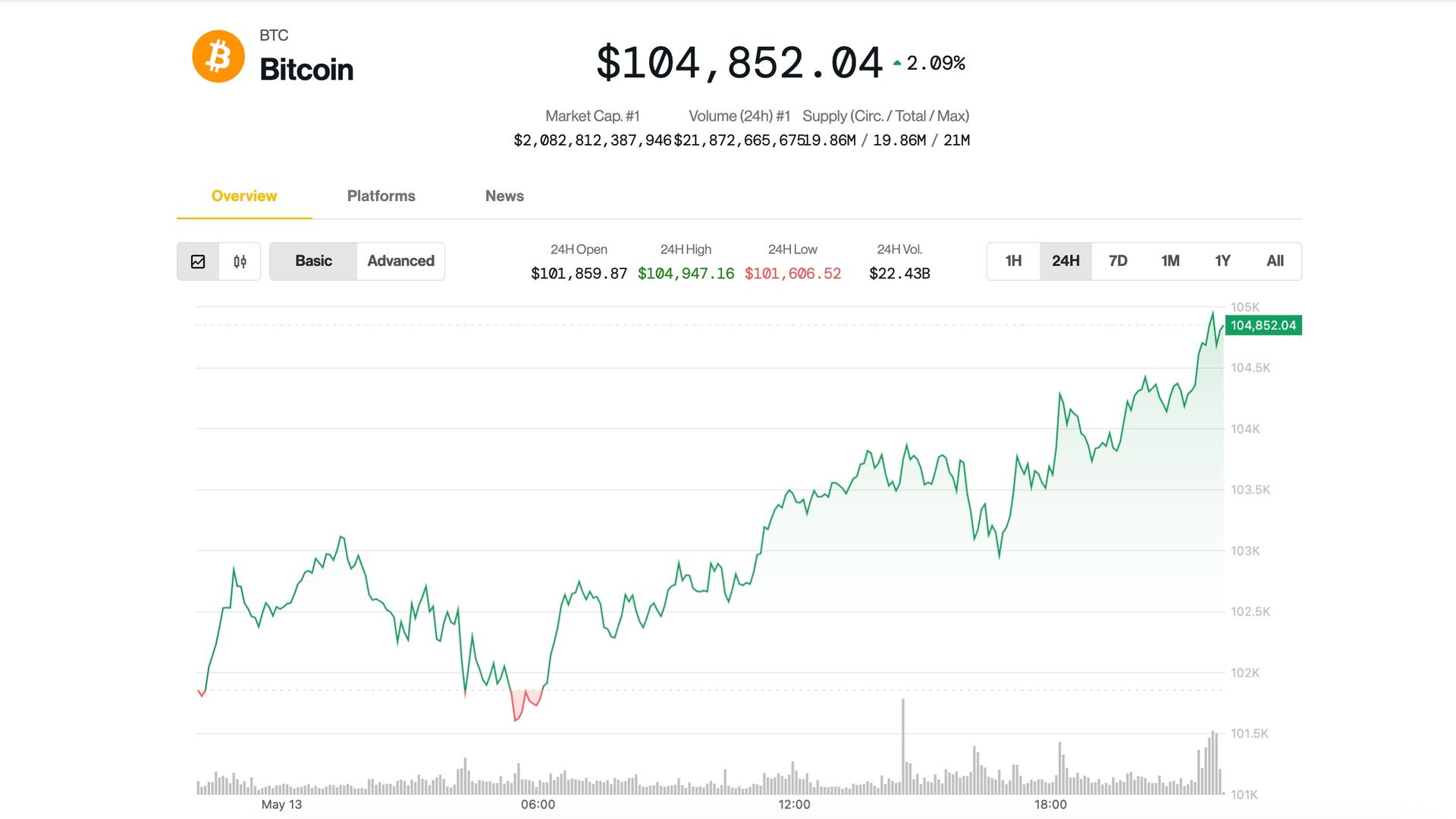

U.S. consumer price inflation eased again last month, suggesting little impact from President Donald Trump's tariff regime heading into the second quarter.

The Commerce Department pegged its headline Consumer Price Index for April at an annual rate of 2.3%, down from the 2.4% pace recorded in March and the consensus forecast from analysts on Wall Street.

On a monthly basis, price pressures rose 0.2%, quickening from the 0.1% decline recorded in March, as domestic gasoline prices rose 2.36% to an average of $3.30 per gallon, according to Energy Department data.

So-called core inflation, which strips out volatile components like food and energy, held at an annual rate of 2.8%, matching both the Wall Street forecast and March's 2.8% pace.

The monthly core reading of 0.2% was also inside Wall Street's 0.3% forecast and the final March reading of 0.1%.

U.S. stocks pared declines following the data release, with futures contracts tied to the S&P 500 indicating an opening-bell gain of around 10 points and the Nasdaq priced for a 90-point gain.

The Dow was called 90 points lower, thanks in part to the 9% slump for index heavyweight UnitedHealth Group (UNH) .

Benchmark 10-year Treasury note yields were modestly lower at 4.445% following the data release, while 2-year notes were pegged 2 basis points lower at 3.977%.

Related: Fed rate cut bets hammered by U.S.-China tariff truce

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 1.2% lower at 101.674.

Tariff impact still to come: Navellier

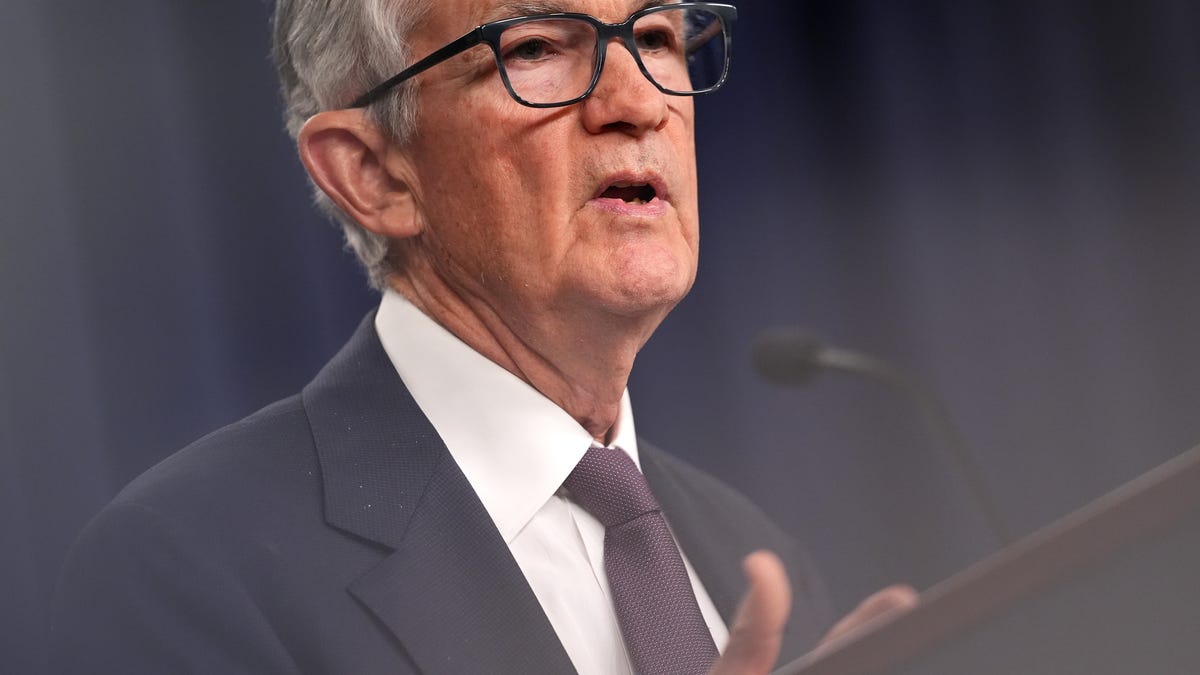

Earlier this month, the Federal Reserve's preferred inflation gauge, the PCE Price Index, showed a modest tick higher in March price pressures. That benchmark followed a weaker-than-expected first-quarter GDP reading that could stoke stagflation concerns in the world's biggest economy.

The Bureau of Economic Analysis's PCE Price Index report for March, which the Federal Reserve closely tracks for a clearer indication of inflation pressures, on Wednesday showed core prices rising at an annual rate of 2.6%, with the headline figure easing to 2.3%.

More Economic Analysis:

- Fed inflation gauge sets up stagflation risks as tariff policies bite

- U.S. recession risk leaps as GDP shrinks

- Like it or not, the bond market rules all

However, the broader impact of Trump's complicated tariff schedule is only partly evident in the April inflation readings, given the myriad exemptions, pauses and rollbacks his administration has announced.

A global baseline duty of 10% on all U.S. trading partners went into effect April 5, with 25% levies on some goods from Canada and Mexico kicking in at the start of the month.

"There is also a 25% tariff on steel, aluminum, and foreign-made vehicles," said Louis Navellier of Navellier Calculated Investing. "These will show up in inflation data, though it is hard to say how much. More carveouts will be agreed to, as we saw in the UK agreement."