Car buyers should shop these brands for the best tariff deal

These carmakers are offering the best incentives for motivated car buyers.

So far, 2025 has been a great year for car buyers.

Because of the uncertainty surrounding President Donald Trump's trade war, car buyers are flocking to dealers to take advantage of current prices before vehicles imported after Liberation Day hit dealer lots.

Those vehicles will be subject to the 25% tariffs Trump has placed on foreign car imports. This, plus the 25% additional tariff on auto parts, has motivated potential car buyers.

Related: Car buyers notice a disturbing trend at the car lot

U.S. car inventory rose during the pandemic, reversing a decades-long decline. Inventory had remained elevated, until this year.

Car buyers looking to take advantage of dealers who were also motivated to sell off inventory before the tariffs hit snatched up as much inventory as they could.

“Dealers have a front-line view of the U.S. auto market, which appears to be at an inflection point,” said Cox Automotive Chief Economist Jonathan Smoke last month. “The recent sales pace has been a positive, lifting current market sentiment higher for franchised dealers.“

Auto dealers' customer traffic index rose to 37 from 33 in Q1 last year. Franchised dealers reported a 10-point increase in in-person visits, the largest increase since the metric was introduced in Q3 2022, according to Cox.

“People are buying cars because they think tariffs are coming,” one Mazda dealer said.

Now, a new report from Kelley Blue Book suggests the buyers' market will last a while.

New vehicle prices steady in May as car buyers take advantage of deals

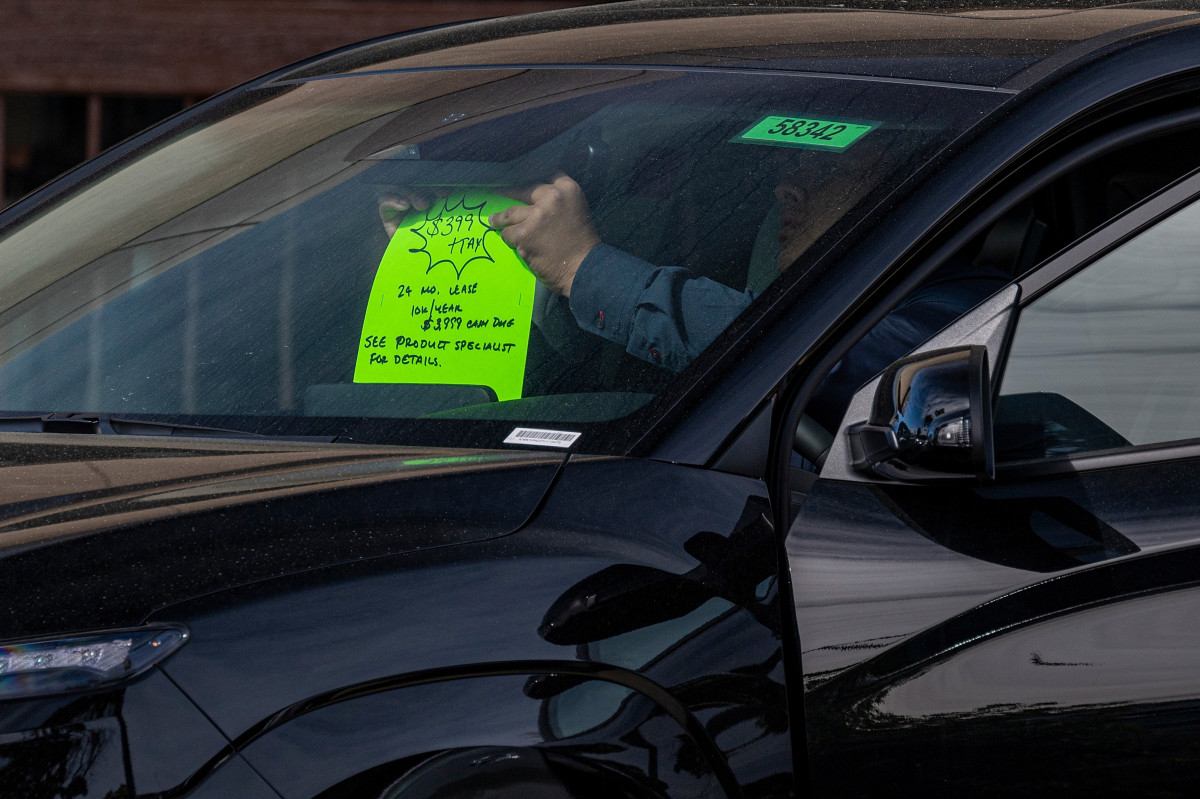

To get customers through the door, car dealers offered nearly every incentive under the sun while also keeping base prices steady.

The average transaction price of a new vehicle (ATP) remained steady at $48,799 in May. Last May, ATp rose 1%, according to Cox Automotive's KBB.

However, new vehicle sales did slow in the month. Dealers were on pace to sell 15.6 million vehicles at an annualized rate in May; that number is down from 17.3 million in April.

Some dealers offered incentives to combat declining demand. KBB estimates that new vehicle incentives increased slightly to 6.8% in May ($3,297).

However, the majority of automakers reported reducing incentive spending in May. Dealers like Volkswagen, Mazda, Land Rover, Volvo, and BMW all reduced incentive spending by more than 10%.

Incentives were also notably lower month over month for Stellantis.

However, other car companies ramped up their incentive programs.

Tesla, Toyota, and Nissan all significantly increased incentive spending in May. Toyota increased its incentive spending by over 20%, but its 4.1% May reading is still well below the industry average.

Meanwhile, Tesla's average transaction prices fell 1.5% in May to $55,277. Year over year, Tesla prices are down nearly 3%. Two models did buck that trend, as the Model 3 and Cybertruck both saw price increases during the month.

Related: New car prices are rising; here's where to get the best deal

EV incentives were especially generous last month, jumping to 14.2% ($8,225) from 11.6% in April.

“While tariff policy is adding uncertainty to the new-vehicle market, prices are holding remarkably steady, a reminder that auto industry change is often slow,“ said Cox Automotive Executive Analyst Erin Keating.

“We are still expecting prices to move higher through the summer, as the inflationary impact of tariffs begins to hit.“

The auto industry starts showing cracks

Cooler-than-expected inflation data has some economists scratching their heads.

It has been over two months since Trump rolled out his tariffs, but the inflation expected from the import taxes hasn't hit yet.

The consumer price index rose to 2.4% this week, short of analyst expectations of a 2.5% increase.

If consumers aren't feeling the pain, producers must be.

”Right now, we believe dealer profitability is being squeezed, as costs on many products are going up, but raising retail prices in this environment is a real challenge,” Keating said.

So consumers can enjoy the buyers' market for now, but shouldn't expect producers to bite the bullet for much longer.

Related: Car dealers are worried, and it could be great news for car buyers