Billionaire Philippe Laffont Has Cumulatively Sold 83% of Coatue's Nvidia Stake and Is Piling Into Wall Street's Hottest Artificial Intelligence (AI) IPO

Coatue Management's billionaire chief is swapping out the brains of AI-powered data centers for a newly public AI stock with scorching-hot growth potential.

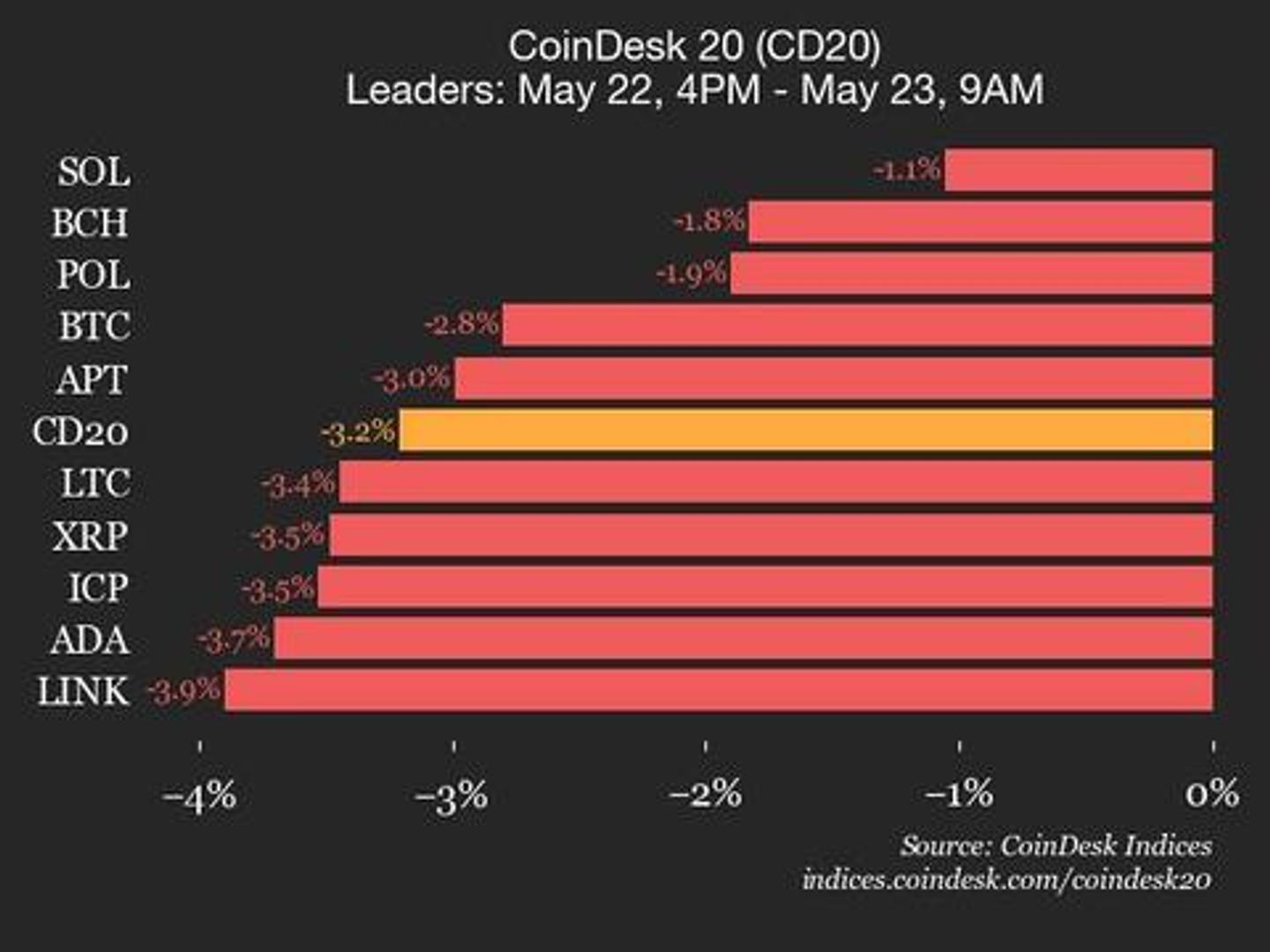

May has been a data-packed month for investors. Between earnings season, a steady flow of economic data releases from the government, and the Federal Open Market Committee's federal funds rate decision, there's been a lot to unpack.

But arguably the most important data release of the quarter occurred one week ago, on May 15. This was the deadline for institutional investors with at least $100 million in assets under management (AUM) to file Form 13F with the Securities and Exchange Commission. A 13F provides investors with a way to track which stocks and exchange-traded funds (ETFs) Wall Street's most prominent money managers have been buying and selling.

Though Berkshire Hathaway's Warren Buffett is the most followed of all asset managers, he's far from the only billionaire investor known to deliver outsized returns and move markets. For instance, billionaire fund manager Philippe Laffont of Coatue Management, who's overseeing $22.7 billion in AUM, has a rich track record of outperformance.