Billionaire Bill Ackman may get big payday from White House

This is what could happen next.

Shares of Fannie Mae and Freddie Mac surged after U.S. President Donald Trump said he is working on taking the two government-controlled mortgage giants public, a move that many shareholders hailed.

In a post on his Truth Social platform on May 27, Trump praised the two companies' "vital service" to the American dream of homeownership. The two entities help provide stability and affordability to the U.S. housing market by backing trillions of dollars in home loans.

"I am working on TAKING THESE AMAZING COMPANIES PUBLIC, but I want to be clear, the U.S. Government will keep its implicit GUARANTEES, and I will stay strong in my position on overseeing them as President,” Trump wrote.

Fannie Mae and Freddie Mac are government-sponsored enterprises that have been under federal conservatorship since the 2008 financial crisis. The official names of the two enterprises are the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation, respectively.

Trump unsuccessfully attempted to remove Fannie and Freddie from U.S. government control in 2019 during his first administration.

Despite being government-controlled, their shares are still traded on over-the-counter markets and have drawn strong interest from hedge funds and institutional investors.

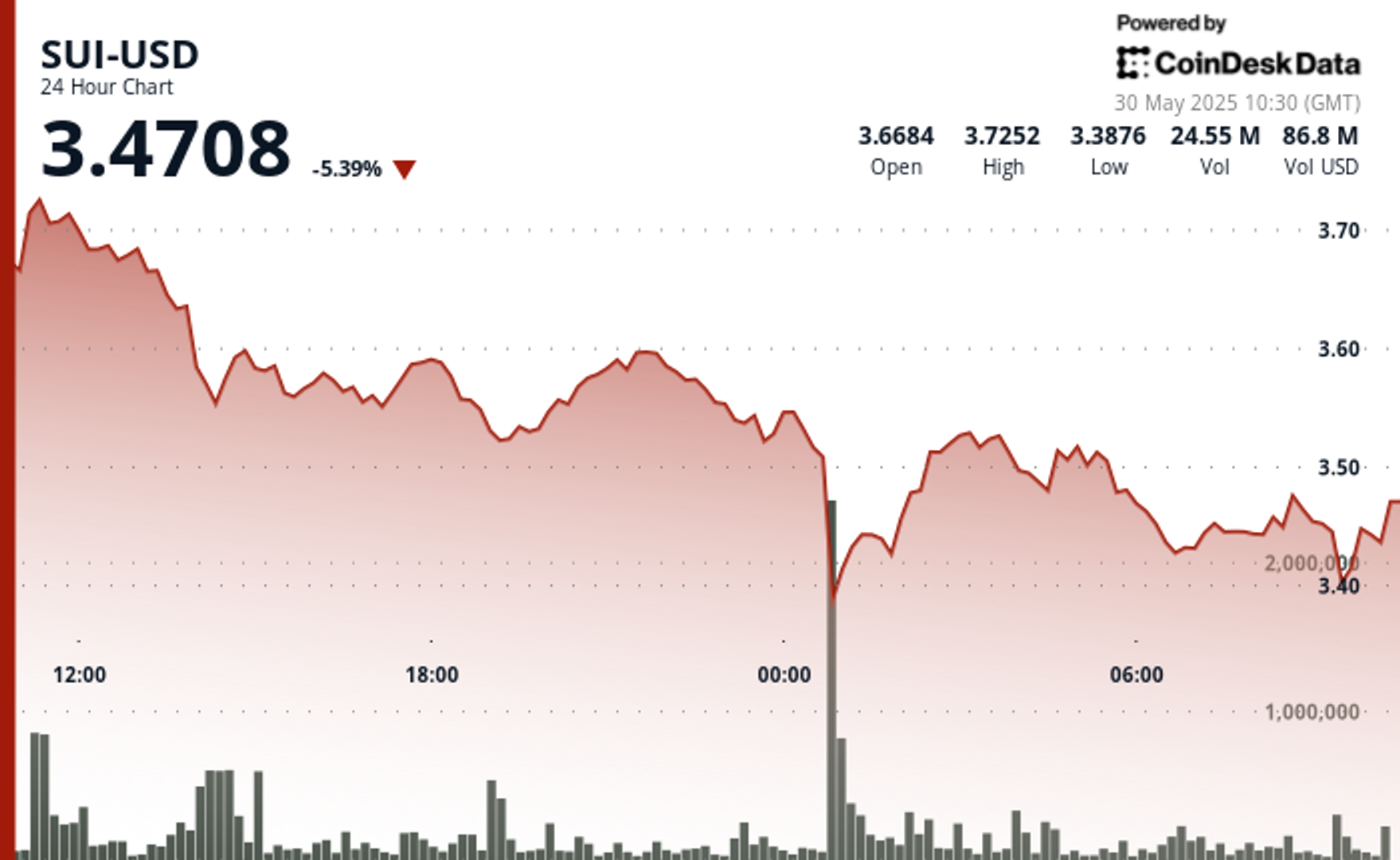

Earlier this month, Trump said he was giving “very serious consideration to bringing Fannie Mae and Freddie Mac public,” noting they are “doing very well, throwing off a lot of CASH.” Following the statement, the shares just hit their highest since 2008.

Fannie shares (FNMA) rose 2.2% to $10.78, while Freddie (FMCC) gained 5.3% to $8 at the market close on May 28.

Bill Ackman stands to gain a big windfall

Among the investors cheering the announcement is billionaire fund manager Bill Ackman. In a recent X post, he responded to Trump with two thumbs up.

Through his firm, Pershing Square Capital Management, Ackman has invested in both mortgage giants and has repeatedly pushed for their release from conservatorship.

He called it the “biggest deal in history” and estimated that the government could make $300 billion if the companies are restructured and released, according to Bloomberg.

"Fannie and Freddie represent a royalty on first mortgages secured by the U.S. housing market, which is a low-risk, high risk-adjusted return investment that will generate large and growing dividends that can be invested in other sovereign fund assets," Ackman said in a March post on X.

Related: Billionaire Bill Ackman buys $2.8 billion of popular tech stock

"The long-term returns on F2 [Fannie Mae and Freddie Mac] will significantly exceed the cost of U.S. Treasurys enabling our country to deleverage over time," he added.

Ackman’s interest in real estate extends beyond the mortgage agencies. Earlier this month, Pershing Square announced a $900 million deal to acquire 9 million newly issued shares of Howard Hughes Holdings (HHH) , a real estate company focused on developing large-scale communities and commercial districts.

Ackman plans to turn Howard Hughes into a "modern-day version of Berkshire."

More Real Estate:

- SALT income tax deduction takes critical step forward

- Buffett's Berkshire predicts major housing market shift soon

- Homeownership trend surges among Gen Z and Millennials

In 1965, legendary investor Warren Buffett bought control of Berkshire Hathaway, then a struggling textile manufacturer. He gradually sold off the textile businesses and invested heavily in insurance, utilities, retailing, and other businesses.

"Fortunately, our starting base of assets won't be a dying textile company, but a very good business," Ackman said. "We will adopt similar, long-term, shareholder-oriented principles to Berkshire, and we intend to hold the stock forever."

Related: Veteran fund manager unveils eye-popping S&P 500 forecast