An Exceptionally Rare Event for Stocks -- the 6th Occurrence in 35 Years -- Has Historically Led to Supercharged Returns for the S&P 500

This trusted Wall Street metric has a flawless track record of forecasting future stock returns.

When examined over multiple decades, Wall Street's major stock indexes -- the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and innovation-propelled Nasdaq Composite (NASDAQINDEX: ^IXIC) -- are highly predictable and fully capable of hitting new all-time highs with regularity. But when narrowing things down to the span of a few weeks, months, or even years, it's a different story.

Through the first five months and change of 2025, we've witnessed the broad-based S&P 500 achieve a fresh record-closing high, as well as observed the Dow Jones and S&P 500 dip into correction territory, with the Nasdaq Composite entering its first bear market in three years.

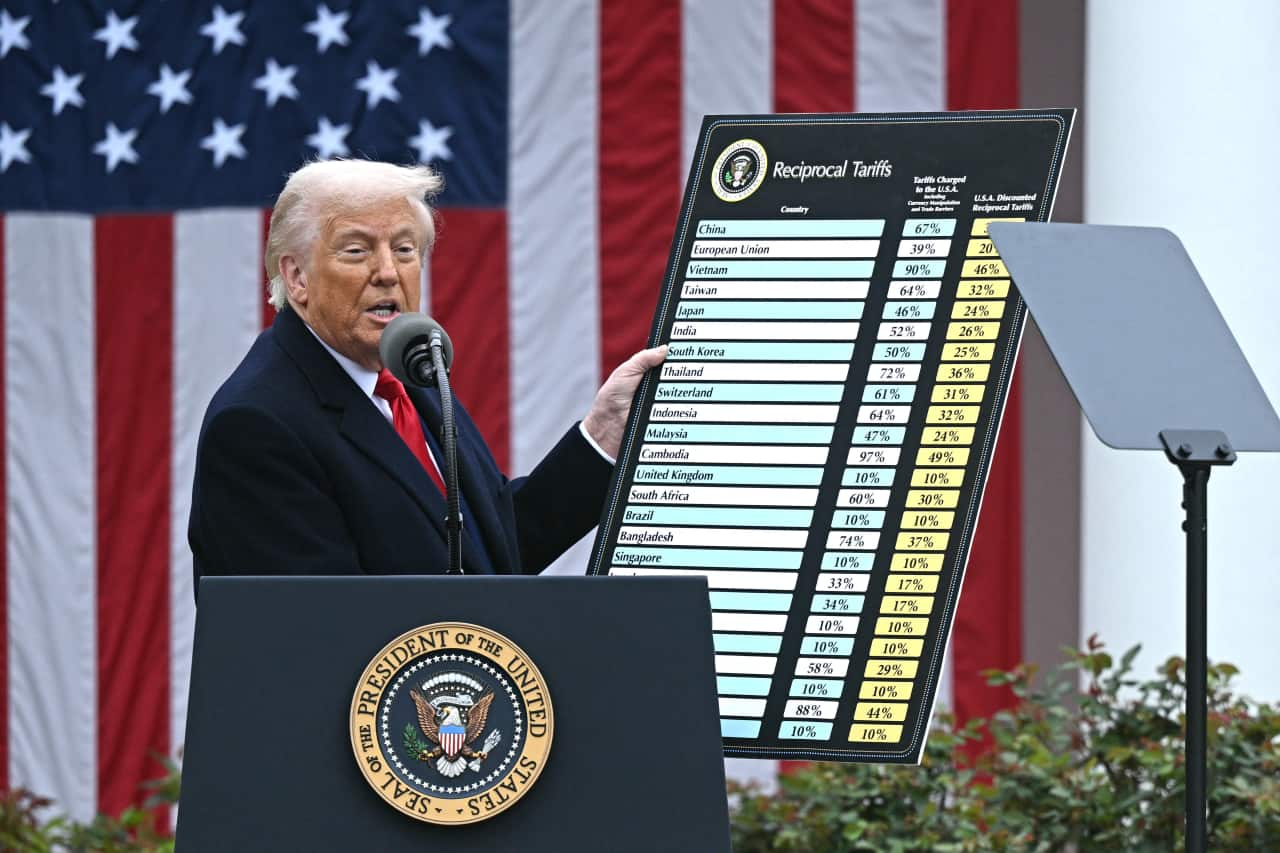

Stocks were particularly volatile during a one-week stretch from April 2 through 9. The widely followed S&P 500 endured its fifth-largest two-day percentage decline in 75 years from the close on April 2 through 4, then delivered its largest single-day nominal point increase in its storied history on April 9.