A personal finance expert's blunt advice on how to pay down debt fast

Credit card and other personal debt can be a barrier to retirement savings, but there is a way to clear debt.

The average American has nearly $100,000 in personal debt. That number includes mortgages and credit cards, student loans and car loans, but no matter the source, paying those bills every month can make it difficult to put money into an emergency savings fund, let alone into an IRS or 401(k).

Overall, the national average card debt among cardholders with unpaid balances in Q3 2024 was $7,236, up from $7,130 in Q2. That includes debt from bank cards and retail credit cards, according to Lending Tree.

Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter

Related: Retire at 40? Here's how it can be done with IRAs, other major tips

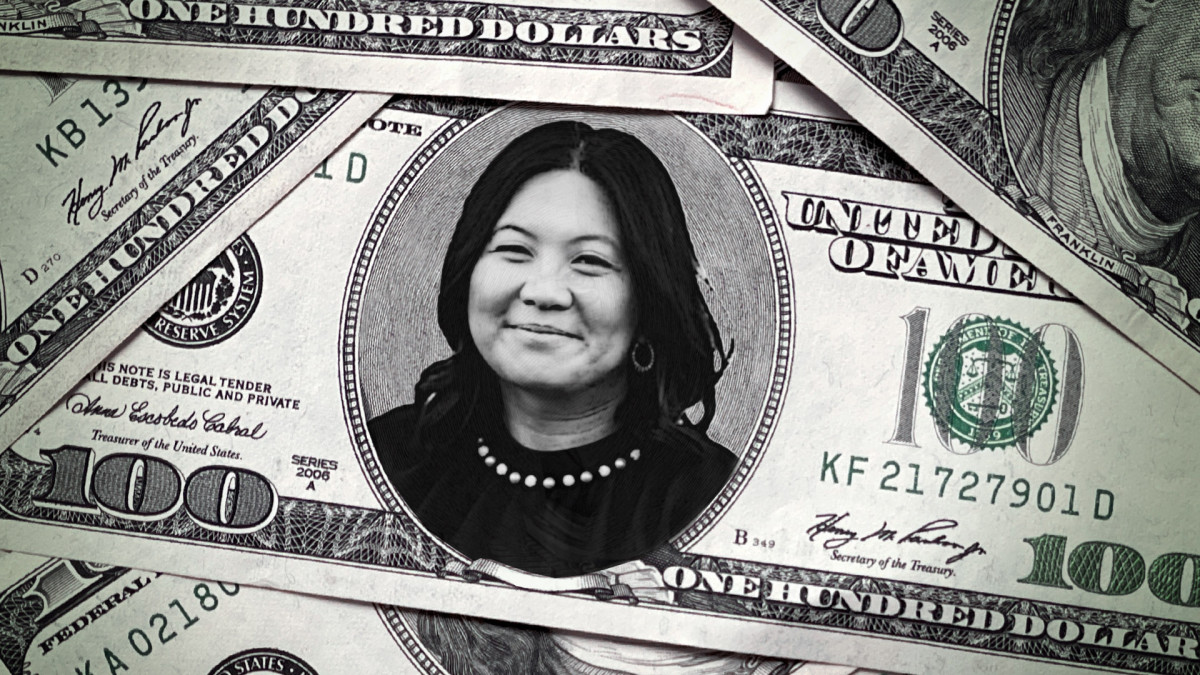

If all the current economic uncertainty is making you reconsider how you spend and save, Bernadette Joy, a personal finance coach and author of "CRUSH Your Money Goals," has some advice. Image source: Shutterstock

What do you waste money on?

A recent poll from Ladder showed that the average adult in the U.S. spends $1,497 a month on nonessential items. That adds up to $18,000 a year — and more than a million dollars over the course of a lifetime.

Yet the same poll showed 38% of Americans don't believe they have enough money to put into a retirement account or pay off their credit cards (28%).

More on personal finance:

- Tony Robbins has blunt words on IRAs, 401(k)s and a tax fact

- Scott Galloway warns U.S. workers on Social Security, retirement flaw

- Dave Ramsey explains a Roth IRA, 401(k) blunt truth

So what are the nonessentials Americans are spending money on? Restaurant meals, drinks out with friends, takeout, using rideshare for nonessential trips, fitness classes, streaming series...and the list goes on.

If spending on non-essential is preventing you from prioritizing retirement planning, read on.

Related: The one-dollar rule: How a personal finance expert justifies any purchase

How the "snowball method" helps reduce debt

One of the habits she found helpful is paying off credit card bills every week instead of every month. "It makes a big difference," she told TheStreet exclusively, "especially since interest rates are so high."

If paying bills entirely every week, or even every month, isn't feasible now, try her other recommendation: the debt snowball method.

Joy managed to pay off six figures in debt — mostly student loans and a mortgage — in less than two years using the debt snowball method. Basically you you focus on paying off your smallest debts first while making minimum payments on larger debts

"Then, once the smallest debt is paid off, you roll the amount you were paying on into the next smallest debt, creating a snowball effect until all debts are paid off," she says. Joy describes the "dopamine rush I got from tackling my debt snowball" as the same satisfaction she got from de-cluttering her house.

"You start off small; you build up your snowball over the course of a month, and without even realizing it, you've cleared out some space."

She also points out how the two types of clearing space complement each other. When you realize you spent money on something that's going into a "donate" piles, you become determined to not by more junk that will only become clutter later.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast