7 Ways the US National Debt Impacts Your Daily Life

As we watch Donald Trump and Elon Musk decimate our federal government, fire thousands of government workers, and eliminate entire projects all while our elected representatives vote to reduce funding for Medicaid and welfare all in the name of reducing our government deficit and federal debt, it’s worth taking some time to look at […] The post 7 Ways the US National Debt Impacts Your Daily Life appeared first on 24/7 Wall St..

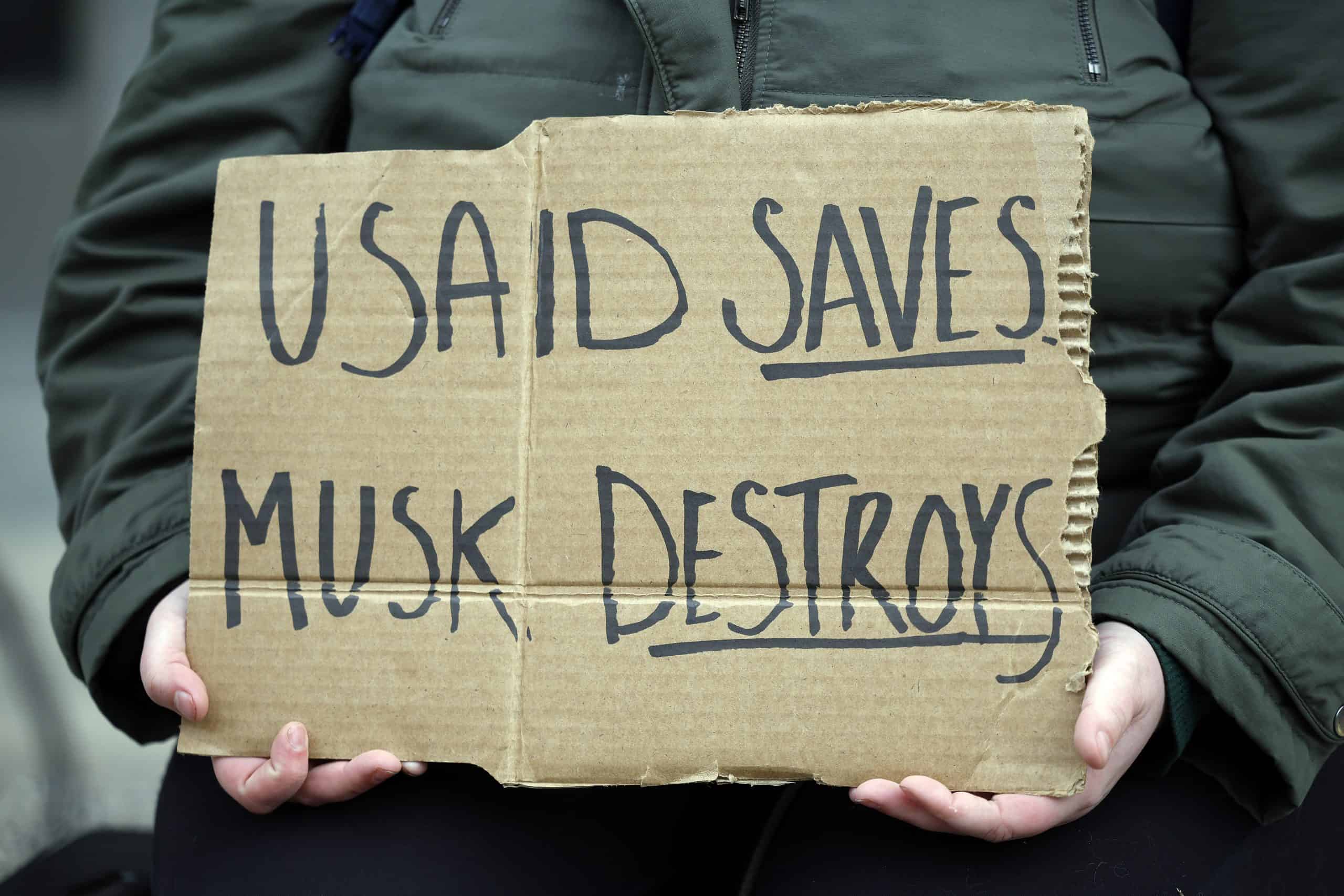

As we watch Donald Trump and Elon Musk decimate our federal government, fire thousands of government workers, and eliminate entire projects all while our elected representatives vote to reduce funding for Medicaid and welfare all in the name of reducing our government deficit and federal debt, it’s worth taking some time to look at the real effects of government debt, and what we are trying to avoid.

Key Points

-

The national debt can lead to high inflation, high interest rates, and financial crises.

-

Politicians often use the national debt as a threat to cut federal programs, even though economists don’t actually know how much debt the U.S. can handle.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

But why is government debt so bad, if it is bad at all? If the United States has carried significant debt for most of its history, why is it so important to reduce it now? Will we ever face serious consequences, or are they already being felt? Here we rank seven of the ways that national debt impacts your daily life.

#1 Regular Debt Ceiling Conflict

The federal government actually has controls on how much it is allowed to borrow to fund its programs (believe it or not). Recently, this limit, known as the debt ceiling, is what causes our government to shut down for a period of time every few years.

Regular Debt Ceiling Conflict

In order to continue paying for things, the government has to increase its debt ceiling to allow it to borrow more money. This means that opposition parties can prevent raising the debt ceiling as a way to punish the ruling party for not compromising on certain issues or programs. This can impact the employment of thousands of people, the efficiency of some programs, and the smooth operation of entire industries.

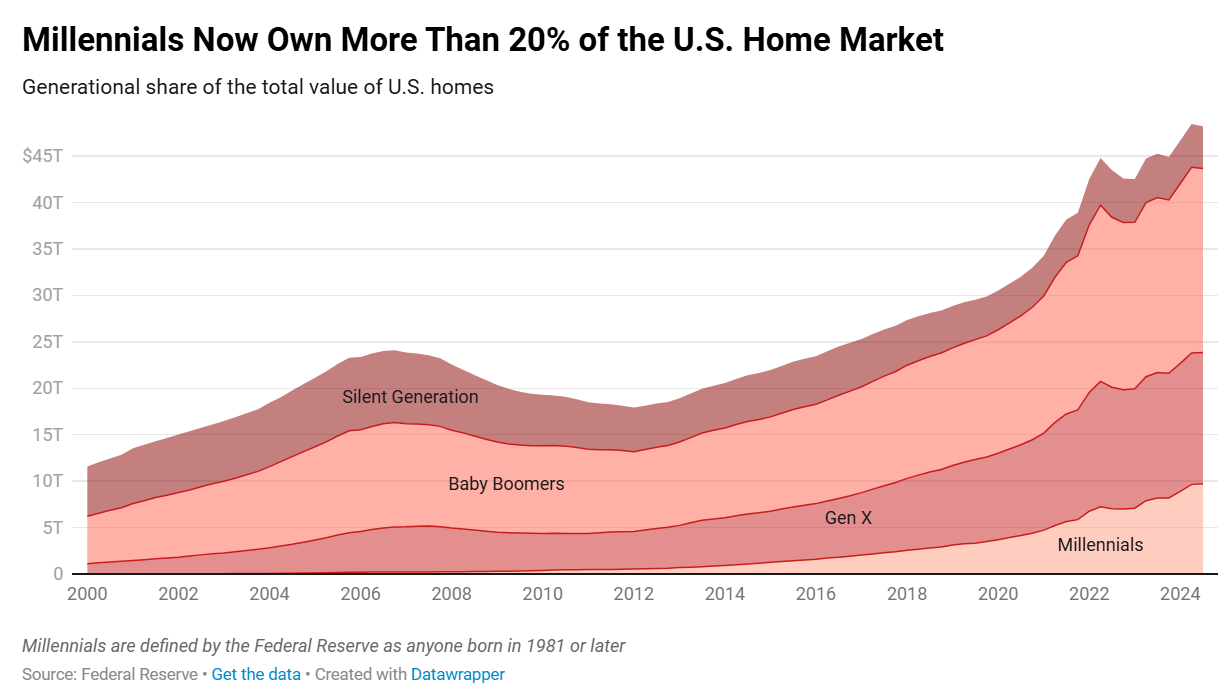

#2 Lagging Intergenerational Equity

The projects and programs that are funded by government debt are often separated from the payment of that debt by decades if it is ever paid off at all. This leads to something known as lagging intergenerational equity, which is the system of later generations paying the bill for the benefits of yesterday’s generation.

Lagging Intergenerational Equity

As the government debt increases, this means that future generations will end up paying more and more just to service the debt while seeing fewer and fewer benefits and new government programs. If the government is unable to pay for anything besides the interest on its debt, it can lead to instability and civil unrest. If you feel like the government isn’t doing as much for you as it did for previous generations, you’d be right.

#3 Higher Inflation

In order to pay its debts, a government can choose to simply print more money. This is a short-term solution that will lead to more problems down the road if the government doesn’t actually take steps to reduce its spending or reduce its deficit.

Higher Inflation

Inflation, along with corporate greed, has led to record-high prices for consumer goods and has made modern life unaffordable for millions of Americans. The largest military budget in the world, the COVID-19 pandemic, and other factors continue to force prices up for groceries, homes, and other things.

#4 Possible Debt Crisis

Not only does significant amounts of debt make a country more vulnerable to any financial crisis, but it can also create one by itself. If a government is unable to make payments on its existing debt, lenders will be unlikely to let it borrow more. This can lead to the government defaulting on its debts, and in a financial world, panic can spread quickly.

Possible Debt Crisis

Even the possibility of the United States defaulting on its debts keeps politicians and bankers on their toes. Ever since the debt surpassed the total value of the U.S. GDP and continued to grow, talk about what might happen in the event the U.S. defaults has become more urgent and real. However, it doesn’t have to take a default to cause an issue. If the United States faces another significant recession, there is a very real possibility that it can cause the United States to fall into a financial hole from which it could never recover. Politicians love to use this threat to cut social spending and fearmonger their way into office.

#5 Slower Economic Growth

The World Bank Group reported that government debt above 77% of GDP results in noticeable economic growth, with the slowdown increasing the higher the debt is. This means that businesses make less money, people are less likely to move from poor to middle class, people earn less money, inflation may increase, and the real wages of workers increase at a slower rate.

Slower Economic Growth

This economic slowing can cause a downward spiral, as the economy generates less taxes, so the government is forced to either increase taxes, or lower taxes in the hope that the economy will speed up again. Either option can make it harder for the government to pay its debts, leading to more economic slowdown. Suffice it to say, if you’re already feeling the slowdown in your own life (through slower wage growth or high inflation) it is unlikely it will get better anytime soon.

#6 Higher Interest Rates

Interest rates rise for a number of reasons, one of which is the lender uncertainty of the borrower to repay their debts. As the U.S. government takes on more and more debt, lenders will begin to doubt the ability of the U.S. economy to generate enough tax income to service that debt, leading to higher inflation which spreads through the economy.

Higher Interest Rates

As the amount of investment funds dwindles in the face of higher inflation, the government begins competing with private firms to secure more debt for itself. This crowds out private and foreign investment, which means there is less money being put into the local economies and weakening the borrowing power and currency value in local markets. You can see mortgage rates, loan rates, and other borrowing fees increase as a result.

#7 Cuts to Government Programs

Naturally, as the government deficit and the overall debt increase, far-right extremists intensify their calls for cutting government programs, with welfare programs being their most popular target. Far-right politicians and their supporters see poverty as a moral and spiritual failing, and helping those in need is immoral.

Cuts to Government Programs

Despite overwhelming evidence that government welfare programs help the economy grow, help people escape poverty, and increase the overall health, well-being, and happiness of all citizens, right-aligned politicians continue to cut welfare programs. This is making healthcare, housing, groceries, and most other things more expensive.

The post 7 Ways the US National Debt Impacts Your Daily Life appeared first on 24/7 Wall St..