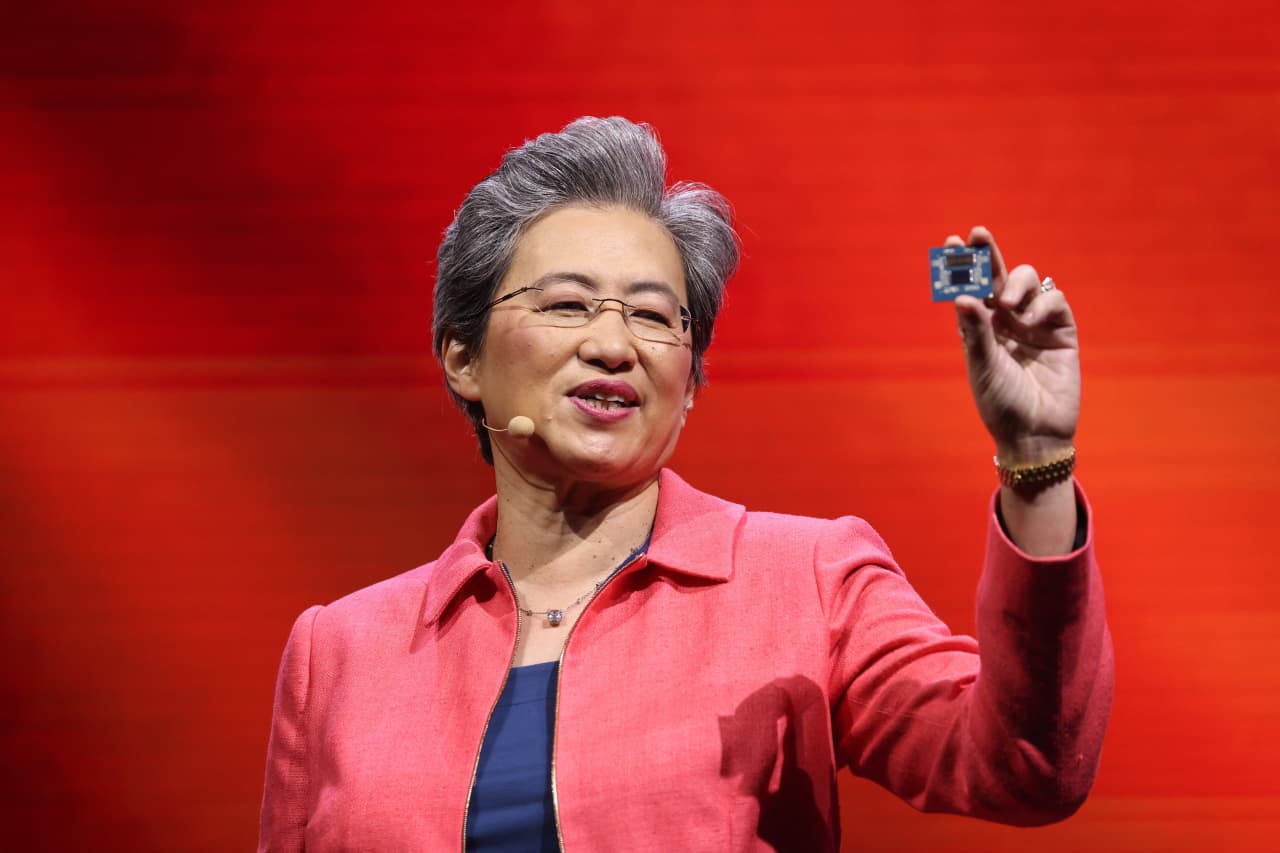

2 Top Artificial Intelligence Stocks to Buy Right Now

Artificial intelligence (AI) continues to be the topic of discussion these days. It seems that every week, there's a new development happening in the space. This further drives excitement from industry participants and observers. It's becoming more difficult to argue that AI is just hype. Businesses are investing billions of dollars to position themselves to become AI leaders. Users are finding the various apps to be valuable tools to boost productivity and efficiency.From an investing perspective, it's time to put money to work. Here are two top AI stocks to buy right now.Continue reading

Artificial intelligence (AI) continues to be the topic of discussion these days. It seems that every week, there's a new development happening in the space. This further drives excitement from industry participants and observers.

It's becoming more difficult to argue that AI is just hype. Businesses are investing billions of dollars to position themselves to become AI leaders. Users are finding the various apps to be valuable tools to boost productivity and efficiency.

From an investing perspective, it's time to put money to work. Here are two top AI stocks to buy right now.